FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

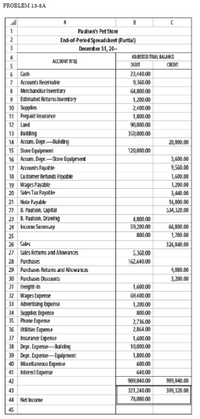

INCOME STATEMENT, STATEMENT OF OWNER'S EQUITY, AND

Balance on page 600 for the year ended December 31, 20--. Owner's

equity as of January 1, 20--, was $504,320. The current portion of Note

Payable is $2,000.

REQUIRED

1. Prepare a multiple-step income statement.

2. Prepare a statement of owner's equity.

3. Prepare a balance sheet.

Transcribed Image Text:PROBLEM 15-8A

A

Paulson's Pet Stone

End-of-Parlod Spreadshoet (Partial)

December 31, 20–

4

ADJUSTED TRAL BALANCE

ACCOUNT E

5

DEBIT

CREDIT

6 Cash

7 Accounts Recelvable

8 Merchandise Invertory

9 Estimated ReturnsInventory

23,440.00

9,360.00

64,800.00

1,200.00

10 Supplies

11 Prepaid Insurance

2,400.00

1,800.00

12 Land

90,000.00

13 Building

14 Accum. Depr-Bulding

15 Slore Equipment

16 Accum. Depr.–Rtore Equipment

17 Accounts Payable

350,000.00

20,000.00

120,000.00

3,600.00

9,560.00

18 Customer Retunds Fayable

19 Wages Payable

20 Sales Tax Payable

1,600.00

1,200.00

21 Nole Payable

22 B. Paulson, Capital

3,440.00

16,000.00

534,320.00

23 B. Paulson, Drawing

24 KUne Summary

4800 00

59,200.00

64,800.00

1,200.00

25

800 00

26 Sales

326,040.00

27 Sales Retums and Alowances

5,360.00

28 Purchases

162,640.00

4,080.00

3,200.00

29 Purchases Retums and Alcwance

30 Purchases Discunis

1,600.00

31 freight-in

32 Wages Expense

33 Advertising Eperse

34 Supples Expense

35 Phone Expense

36 Utities Expense

37 Insurance Expense

38 Depr. Expense-Bui dng

9,400.00

1,200.00

800.00

2,736.00

2,864.00

1,600.00

10,000.00

39 Depr. Expense-Equipment.

40 Mixellaneous Expense

41 Interest Expense

1,800.00

600.00

640.00

42

989,040.00

989,040.00

43

321,240.00

399,320.00

44 Net Income

78,080.00

45

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Percent of sales method At the end of the current year, Accounts Receivable has a balance of $745,000; Allowance for Doubtful Accounts has a credit balance of $6,500; and sales for the year total $3,350,000. Bad debt expense is estimated at 1/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts. $ X b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $ X Allowance for Doubtful Accounts $ X Bad Debt Expense $ X c. Determine the net realizable value of accounts receivable. < $ Xarrow_forwardAccounting for uncollectible accounts (aging-of-receivables method), notes receivable, and accrued interest revenue Sleepy Recliner Chairs completed the following selected transactions: Record the transactions in the journal of Sleepy Recliner Chairs. Explanations are not required. (Round to the nearest dollar.)arrow_forwardPlease help mearrow_forward

- Provide the answer is correct optionarrow_forwardRecord journal entries for the following purchase transactions of Flower Company. Oct. 13 Purchased 81 bushels of flowers with cash for $1,300. Oct. 20 Purchased 220 bushels of flowers for $30 per bushel on credit. Terms of the purchase are 5/10, n/30, invoice dated October 20. Oct. 30 Paid account in full from the October 20 purchase. If an amount box does not require an entry, leave it blank. Assume the perpetual inventory system is used. Oct. 13 Oct. 20 Oct. 30 Accounts Receivable Accounts Payable Cost of Goods Sold Cash Sales Returns and Allowances II III II IIarrow_forwardAnalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $835,000; Allowance for Doubtful Accounts has a credit balance of $7,500; and sales for the year total $3,760,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $32,300. a. Determine the amount of the adjusting entry for uncollectible accounts.$fill in the blank 1 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $fill in the blank 2 Allowance for Doubtful Accounts $fill in the blank 3 Bad Debt Expense $fill in the blank 4 c. Determine the net realizable value of accounts receivable.$fill in the blank 5arrow_forward

- Please helparrow_forwardAnalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $545,000; Allowance for Doubtful Accounts has a credit balance of $5,000; and sales for the year total $2,450,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $22,500. a. Determine the amount of the adjusting entry for uncollectible accounts.$ b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $ Allowance for Doubtful Accounts $ Bad Debt Expense $ c. Determine the net realizable value of accounts receivable.$arrow_forwardOn June 1, Nicholson Company purchased inventory on account with a cost of $1,200. Credit terms were 2/10, net 30. On June 2, Nicholson Company returned 60 percent of the inventory. Nicholson Company uses the perpetual inventory system. What journal entry did Nicholson Company prepare on June 2? A. debit Accounts Payable for $720 and credit Inventory for $720 B. debit Purchase Returns for $1,200 and credit Accounts Payable for $1,200 C. debit Purchase Returns for $720 and credit Accounts Payable for $720 D. debit Cash for $1,200 and credit Accounts Payable forarrow_forward

- On December 31 of last year, the balance sheet of Union Company had accounts receivable of $74,5000 and a credit balance in Allowance for Uncollectible Accounts of $5,075. During the current year, Union's financial records included the following selected activities: Sales on accounts $298,750 Sales returns and allowances, $18,250 Collections from customers, $287,500 Accounts written off as worthless, $4,000 1) Prepare T accounts for Accounts receivable and Allowance for uncollectible accounts. Enter the beginning balances and show the effects on these accounts of the items listed above. Determine the ending balance of each account.arrow_forwardThe following data were selected from the records of Sykes Company for the year ended December 31, current year. Balances January 1, current year Accounts receivable (various customers) Allowance for doubtful accounts $121,000 5,000 In the following order, except for cash sales, the company sold merchandise and made collections on credit terms 5/10, n/30 (assume a unit sales price of $600 in all transactions). Transactions during current year: a. Sold merchandise for cash, $260,000. b. Sold merchandise to R. Smith; invoice price, $8,500. c. Sold merchandise to K. Miller; invoice price, $40,000. d. Two days after purchase date, R. Smith returned one of the units purchased in (b) and received account credit. e. Sold merchandise to B. Sears; invoice price, $22,000. f. R. Smith paid his account in full within the discount period. g. Collected $90,000 cash from customer sales on credit in prior year, all within the discount periods. h. K. Miller paid the invoice in (c) within the discount…arrow_forwardCalculate the average daily balance (in $) for October for a revolving credit account with a previous month's balance of $110 and the following activity. (Round your answer to the nearest cent.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education