Principles of Economics 2e

2nd Edition

ISBN: 9781947172364

Author: Steven A. Greenlaw; David Shapiro

Publisher: OpenStax

expand_more

expand_more

format_list_bulleted

Question

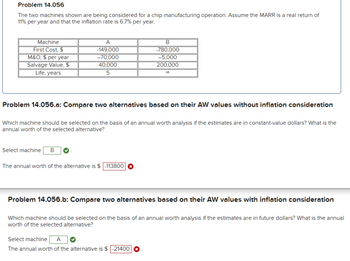

Transcribed Image Text:Problem 14.056

The two machines shown are being considered for a chip manufacturing operation. Assume the MARR is a real return of

11% per year and that the inflation rate is 6.7% per year.

Machine

First Cost, $

M&O, $ per year

Salvage Value, $

Life, years

A

-149,000

B

-780,000

-70,000

-5,000

40,000

200,000

5

00

Problem 14.056.a: Compare two alternatives based on their AW values without inflation consideration

Which machine should be selected on the basis of an annual worth analysis if the estimates are in constant-value dollars? What is the

annual worth of the selected alternative?

Select machine B

The annual worth of the alternative is $ -113800

Problem 14.056.b: Compare two alternatives based on their AW values with inflation consideration

Which machine should be selected on the basis of an annual worth analysis if the estimates are in future dollars? What is the annual

worth of the selected alternative?

Select machine

A

The annual worth of the alternative is $ -21400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rosalie the Retiree knows that when she retires in 16 years, her company will give her a one-time payment of 20,000. However, if the inflation rate is 6 per year, how much buying power will that 20,000 have when measured in todays dollars? Hint: Start by calculating the rise in the price level over the 16 years.arrow_forwardWith in 1 or 2 percentage points, what has the U.S. inflation rate been during the last 20 years? Draw a graph to show the data.arrow_forwardA fixed-rate mortgage has the same interest rate over the life of the loan, whether the mortgage is for 15 or 30 years. By contrast, an adjustable-rate mortgage changes with market interest rates over the life of the mortgage. If inflation falls unexpectedly by 3, what would likely happen to a homeowner with an adjustable-rate mortgage?arrow_forward

- The index number representing the price level changes from 110 to 115 in one year and then from 115 to 120 the next year. Since the index number increases by five each year, is five inflation rate each year? Is the inflation rate the same each year? Explain your answer.arrow_forwardWhat is deflation?arrow_forwardMetropolitan Hospital has estimated its average monthly bed needs as N=1,000+9X where X=timeperiod(months);January2002=0 N=monthlybedneeds Assume that no new hospital additions are expected in the area in the foreseeable future. The following monthly seasonal adjustment factors have been estimated, using data from the past five years: Forecast Metropolitans bed demand for January, April, July, November, and December 2007. If the following actual and forecast values for June bed demands have been recorded, what seasonal adjustment factor would you recommend be used in making future June forecasts?arrow_forward

- The total price of purchasing a basket of goods in the United Kingdom over four years is: year 1=940, year 2=970, year 3=1000, and year 4=1070. Calculate two price indices, one using year 1 as the base year (set equal to 100) and the other using year 4 as the base year (set equal to 100). Then, calculate the inflation rate based on the first price index. If you had used the other price index, would you get a different inflation rate? If you are unsure, do the calculation and find out.arrow_forwardWhat life cycle cost concept begins raising concerns by year 5 with any electric vehicle (EV)? If that issue affected resale value at year 5, would that affect perceived value-in-use? How exactly?arrow_forwardWhy do you mink the U.S. experience with inflation over the last 50 years has been so much milder than in many other countries?arrow_forward

- Inflation rates, like most statistics, are imperfect measures. Can you identify some ways that the inflation rate for fruit does not perfectly capture the rising price of fruit?arrow_forwardGo to this website (http://www.measuringworth.com/ppowerus/) for the Purchasing Power Calculator at measuringWorth.com. How much money would it take today to purchase what one dollar would have bought in the year of your birth?arrow_forwardAccording to Table 19.7, how often have recessions occurred since the end of World War II (1945)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning

Essentials of Economics (MindTap Course List)EconomicsISBN:9781337091992Author:N. Gregory MankiwPublisher:Cengage Learning Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...EconomicsISBN:9781337091985Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:9781337091992

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours...

Economics

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...

Economics

ISBN:9781285165875

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning