FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

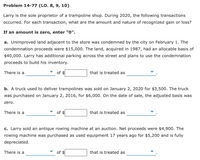

Transcribed Image Text:Problem 14-77 (LO. 8, 9, 10)

Larry is the sole proprietor of a trampoline shop. During 2020, the following transactions

occurred. For each transaction, what are the amount and nature of recognized gain or loss?

If an amount is zero, enter "0".

a. Unimproved land adjacent to the store was condemned by the city on February 1. The

condemnation proceeds were $15,000. The land, acquired in 1987, had an allocable basis of

$40,000. Larry has additional parking across the street and plans to use the condemnation

proceeds to build his inventory.

There is a

of

that is treated as

b. A truck used to deliver trampolines was sold on January 2, 2020 for $3,500. The truck

was purchased on January 2, 2016, for $6,000. On the date of sale, the adjusted basis was

zero.

There is a

of $

that is treated as

c. Larry sold an antique rowing machine at an auction. Net proceeds were $4,900. The

rowing machine was purchased as used equipment 17 years ago for $5,200 and is fully

depreciated.

There is a

of $

that is treated as

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1) Kristine sold one asset on March 20th of 2023. It was a computer with an original basis of $10,000, purchased in May of 2021 and depreciated under the half-year convention. What is Kristine's depreciation deduction for 2023? Note: Round final answer to the nearest whole number. Blank] Blank 1 Add your answerarrow_forwardOn February 8, 2020, Holly purchased a residential apartment building. The cost basis assigned to the building is $209,000. Holly also owns another residential apartment building that she purchased on July 15, 2020, with a cost basis of $384,200. a. Calculate Holly's total depreciation deduction for the apartments for 2020 using MACRS.arrow_forwardPlease dont provide solution image based thanksarrow_forward

- Nonearrow_forwarddan purchased machinery (7 yr. property) to use in her business on 9/1/18 at a cost of $ 40,000. This was the only property placed in service in 2018. On 3/1/20 dan sold this equipment for $ 44,000. Answer each part below as follows: How much depreciation (use MACRS 200DB method) will Gabby claim in the following years? 2018 2019arrow_forward5arrow_forward

- Daarrow_forwardM103.arrow_forwardProblem 7-34 (LO. 3, 4) Heather owns a two-story building. The building is used 40% for business use and 60% for personal use. During 2020, a fire caused major damage to the building and its contents. Heather purchased the building for $800,000 and has taken depreciation of $100,000 on the business portion. At the time of the fire, the building had a fair market value of $900,000. Immediately after the fire, the fair market value was $200,000. The insurance recovery on the building was $600,000. The contents of the building were insured for any loss at fair market value. The business assets had an adjusted basis of $220,000 and a fair market value of $175,000. These assets were totally destroyed. The personal use assets had an adjusted basis of $50,000 and a fair market value of $65,000. These assets were also totally destroyed. If an amount is zero, enter "0". a. Determine the business and personal gain or loss in regard to the building and its contents. Business Personal Total…arrow_forward

- dvubenarrow_forwardNonearrow_forwardJenny constructed a building for use as a residential rental property. The cost of the building was $164,976, and it was placed in service on August 1, 1998. The building has a 27.5-year MACRS life. What is the amount of depreciation on the building for 2020 for tax purposes? a.$6,547 b.$6,000 c.$3,000 d.$2,250 e.None of these choices are correct.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education