FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

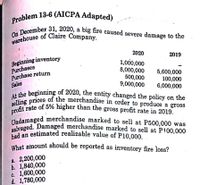

Transcribed Image Text:Problem 13-6 (AICPA Adapted)

On December 31, 2020, a big fire caused severe damage to the

What amount should be reported as inventory fire loss?

At the beginning of 2020, the entity changed the policy on the

salvaged. Damaged merchandise marked to sell at P100,000

profit rate of 5% higher than the gross profit rate in 2019.

had an estimated realizable value of P10,000.

warehouse of Claire Company.

Undamaged merchandise marked to sell at P500,000 was

selling prices of the merchandise in order to produce a gross

2020

2019

Beginning inventory

Purchases

Purchase return

Sales

1,000,000

8,000,000

500,000

9,000,000

5,600,000

100,000

6,000,000

on

se St rate of 5% higher than the gross profit rate in 2019.

Uadamaged merchandise marked to sell at P500,000 was

salve estimated realizable value of P10,000.

a. 2,200,000

b. 1,840,000

c. 1,600,000

d. 1,780,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- E 7-8 Sales returns ⒸLO7-4 Halifax Manufacturing allows its customers to return merchandise for any reason up to 90 days after delivery and receive a credit to their accounts. All of Halifax's sales are for credit (no cash is collected at the time of sale). The company began 2024 with a refund liability of $300,000. During 2024, Halifax sold merchandise on account for $11,500,000. Halifax's merchandise costs are 65% of merchandise selling price. Also during the year, customers returned $450,000 in sales for credit, with $250,000 of those being returns of merchandise sold prior to 2024, and the rest being merchandise sold during 2024. Sales returns, estimated to be 4% of sales, are recorded as an adjusting entry at the end of the year. Required: 1. Prepare entries to (a) record actual returns in 2024 of merchandise that was sold prior to 2024; (b) record actual returns in 2024 of merchandise that was sold during 2024; and (c) adjust the refund liability to its appropriate balance at…arrow_forwardSh4arrow_forwardCurrent Attempt in Progress Cullumber Company began operations on January 1, 2024, adopting the conventional retail inventory system. None of the company's merchandise was marked down in 2024 and, because there was no beginning inventory, its ending inventory for 2024 of $31,248 would have been the same under either the conventional retail system or the LIFO retail system. On December 31, 2025, the store management considers adopting the LIFO retail system and desires to know how the December 31, 2025, inventory would appear under both systems. All pertinent data regarding purchases, sales, markups, and markdowns are shown below. There has been no change in the price level. Cost Retail Inventory, Jan. 1, 2025 $31,248 $50,400 Markdowns (net) 10,920 Markups (net) 18,480 Purchases (net) 109,960 149,520 Sales (net) 140,280 Determine the cost of the 2025 ending inventory under both (a) the conventional retail method and (b) the LIFO retail method. (Round ratios for computational purposes to…arrow_forward

- Current Attempt in Progress Nash Company began operations on January 1, 2024, adopting the conventional retail inventory system. None of the company's merchandise was marked down in 2024 and, because there was no beginning inventory, its ending inventory for 2024 of $46,080 would have been the same under either the conventional retail system or the LIFO retail system. On December 31, 2025, the store management considers adopting the LIFO retail system and desires to know how the December 31, 2025, inventory would appear under both systems. All pertinent data regarding purchases, sales, markups, and markdowns are shown below. There has been no change in the price level. Inventory, Jan. 1, 2025 Markdowns (net) Markups (net) Purchases (net) Sales (net) Cost $46,080 167,600 Retail $76,800 16,640 28,160 227,840 213,760 Determine the cost of the 2025 ending inventory under both (a) the conventional retail method and (b) the LIFO retail method. (Round ratios for computational purposes to 2…arrow_forwardPlease do not give solution in image format thankuarrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education