Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

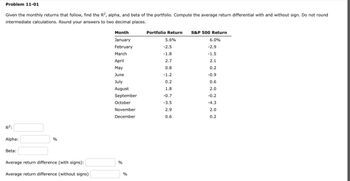

Transcribed Image Text:Problem 11-01

Given the monthly returns that follow, find the R2, alpha, and beta of the portfolio. Compute the average return differential with and without sign. Do not round

intermediate calculations. Round your answers to two decimal places.

Month

R²:

Alpha:

%

Beta:

Average return difference (with signs):

Average return difference (without signs)

Portfolio Return S&P 500 Return

January

5.6%

6.0%

February

-2.5

-2.9

March

-1.8

-1.5

April

2.7

2.1

May

0.8

0.2

June

-1.2

-0.9

July

0.2

0.6

August

1.8

2.0

September

-0.7

-0.2

October

-3.5

-4.3

November

2.9

2.0

December

0.6

0.2

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- 14. John Lewis of Hungerford plc may have returns next year as follows: Return probability 10% 30% 20% 20% -10% 30% -20% 20% What is the standard deviation of returns for John Lewis? A. 24.65% B. 15.86% C. 14.83% D. 22.25%arrow_forwardProblem 9-21 Risk, Return, and Their Relationship (LG9-3, LG9-4)Consider the following annual returns of Estee Lauder and Lowes Companies: Estee LauderLowes CompaniesYear 123.9%6.0%Year 224.016.6Year 318.14.7Year 450.444.0Year 517.314.0Compute each stocks average return, standard deviation, and coefficient of variation.Note: Round your answers to 2 decimal places.arrow_forwardQUESTION 11 A 30 year 1/1 ARM has an initial rate of 3.75%. In the future, the rate will reset to 325 basis points above the LIBOR index with no rate caps or floors. In 1 year, at the time of the first reset, the LIBOR is 1%. What will be the fully indexed rate at the first reset? OA. 7.00% O B. 1.00% O C. 4.75% O D.4.25%arrow_forward

- QUESTION 12 Use the table below to answer questions 12 through 15. What is the portfolio tracking error? O A. 81.35 basis points OB. 86.35 basis points O C. 83.35 basis points D. 80.35 basis points Month January February March April May June July August September October November December Portfolio A's Return (%) 2.15 0.89 1.15 -0.47 1.71 0.10 1.04 2.70 0.66 2.15 -1.38 -0.59 Benchmark Index Return (%) 1.65 -0.10 0.52 -0.60 0.65 0.33 2.31 1.10 1.23 2.02 -0.61 -1.20arrow_forwardProblem 8-14 Suppose that the index model for stocks A and B is estimated from excess returns with the following results: RA = 4.0% +0.50RM + eA RB = -1.2% + 0.70RM + eB OM 17%; R-squareд = 0.26; R-squareg = 0.18 Assume you create a portfolio Q, with investment proportions of 0.40 in a risky portfolio P, 0.35 in the market index, and 0.25 in T-bill. Portfolio Pis composed of 70% Stock A and 30% Stock B. a. What is the standard deviation of portfolio Q? (Calculate using numbers in decimal form, not percentages. Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Standard deviation 10.98 c. What is the "firm-specific" risk of portfolio Q? (Calculate using numbers in decimal form, not percentages. Do not round intermediate calculations. Round your answer to 4 decimal places.) Firm-specific % Answer is complete but not entirely correct. 0.0025 xarrow_forwardDigital Executive Cheese Fruit January +14 +7 February -3 +1 March +5 +4 April +7 +13 May -4 +2 June +3 +5 July -2 -3 August -8 -2 Required: a-1. Calculate the variance and standard deviation of each stock. a-2. Which stock is riskier if held on its own? b. Now calculate the returns in each month of a portfolio that invests an equal amount each month in the two stocks. c. Is the variance more or less than halfway between the variance of the two individual stocks? Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B Req C Now calculate the returns in each month of a portfolio that invests an equal amount each month in the two stocks. Note: Negative amounts should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to 2 decimal places. Month January February March April May June July August Portfolio Returnarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education