FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

SHOW THE

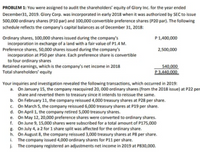

Transcribed Image Text:PROBLEM 1: You were assigned to audit the shareholders' equity of Glory Inc. for the year ended

December31, 2019. Glory Corp. was incorporated in early 2018 when it was authorized by SEC to issue

500,000 ordinary shares (P10 par) and 100,000 convertible preference shares (P20 par). The following

schedule reflects the company's capital balances as of December 31, 2018:

Ordinary shares, 100,000 shares issued during the company's

incorporation in exchange of a land with a fair value of P1.4 M.

Preference shares, 50,000 shares issued during the company's

incorporation at PS0 per share. Each preference share is convertible

to four ordinary shares

Retained earnings, which is the company's net income in 2018

Total shareholders' equity

P1,400,000

2,500,000

540,000

P 3,440.000.

Your inquiries and investigation revealed the following transactions, which occurred in 2019:

a. On January 15, the company reacquired 20, 000 ordinary shares (from the 2018 issue) at P22 per

share and reverted them to treasury since it intends to reissue the same.

b. On February 11, the company reissued 4,000 treasury shares at P28 per share.

c. On March 5, the company reissued 6,000 treasury shares at P19 per share.

d. On April 1, the company retired 5,000 treasury shares.

e. On May 12, 20,000 preference shares were converted to ordinary shares.

f. On June 9, 15,000 shares were subscribed for a total amount of P175,000

8. On July 4, a 2 for 1 share split was affected for the ordinary share.

h. On August 8, the company reissued 3,000 treasury shares at P8 per share.

. The company issued 4,000 ordinary shares for P11 per share.

j. The company registered an adjustments net income in 2019 at P830,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Why are transactions recorded in the journal? Group of answer choices To ensure that total debit equal total credits To help prepare the financial statements To ensure that all transactions are posted to the ledger To have a chronological record of all transactionsarrow_forwardThe General Ledger How does posting journal entries work in a computerized accounting system? What does it mean when posting is done automatically? Explain.arrow_forwarddo all business transactions require journal entries?arrow_forward

- The answer given is in journal entry form, the question is asking for tabular summary form. Could this please be provided?arrow_forwardWhat is the process of recording a transaction in the journal called? Group of answer choices journalizing posting charting ledgeringarrow_forwardAn optional step in the account cycle is the preparation of:arrow_forward

- The Ledger Where are the opening balances located when posting the journal entries? When are they used? Explain and provide example please.arrow_forwardWhat would the general journals (adjusting/closing/revising) look like?What about the general ledger?arrow_forwardWhat is the purpose of the adjusting journal entries?arrow_forward

- Describe the “Chart of Accounts” and discuss the importance of this list when using Quick Books.arrow_forwardWhat is the purpose of posting J.F numbers that are entered in the journal at the time entries are posted to the accounts.arrow_forwardGive the journal entry for the following transaction. Received a promisory note in payment of an accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education