Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

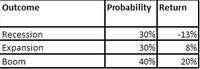

Probabilities and possible returns of share X have been projected as below based on different statutes of an economy.

Required:

a) Calculate the expected return if you buy this share.

b) Calculate the variance and standard deviation.

Transcribed Image Text:Outcome

Probability Return

30%

30%

Recession

-13%

Expansion

8%

Boom

40%

20%

Expert Solution

arrow_forward

Step 1

a) Calculation of expected return

| Probability | Return | Expected return |

| X | Y | Z=X*Y |

| 30% | -13% | -3.90% |

| 30% | 8% | 2.40% |

| 40% | 20% | 8.00% |

| Expected return | 6.50% | |

Hence

Expected return = 6.50%

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Capital Asset Pricing Model (CAPM) describes a relationship between the expected return of,,, a)An individual share and its variance risk b)An individual share and its standard deviation risk c)An individual share and its undiversifiable risk d)An individual share and its diversifiable riskarrow_forwardRemember, the expected value of a probability distribution is a statistical measure of the average (mean) value expected to occur during all possible circumstances. To compute an asset’s expected return under a range of possible circumstances (or states of nature), multiply the anticipated return expected to result during each state of nature by its probability of occurrence. Consider the following case: James owns a two-stock portfolio that invests in Blue Llama Mining Company (BLM) and Hungry Whale Electronics (HWE). Three-quarters of James’s portfolio value consists of BLM’s shares, and the balance consists of HWE’s shares. Each stock’s expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in different market conditions are detailed in the following table: Market Condition Probability of Occurrence Blue Llama Mining Hungry Whale Electronics Strong 0.25 27.5% 38.5% Normal 0.45 16.5% 22% Weak 0.30 -22%…arrow_forwardExplain the meaning and differences between the correlation coefficients “p” in the traditional portfolio and the beta “B” coefficients in the capital asset pricing model (CMPL) approacharrow_forward

- a. What are the expected return and standard deviation of your client's portfolio?arrow_forwardOn the expected return (Y-axis) vs. variance (X-axis) graph, investors will prefer portfolios that lie to the: 1) Southeast 2) Northeast 3) Northwest 4) Southwestarrow_forwardFundamental analysis is a method of______________________________to determine intrinsic value of the stock.a. Measuring the intrinsic value of a security using the market indexb. Using qualitative and quantitative factorsc. Using statistical analysis such as standard deviation, coefficients and probabilitiesd. Using historical price movementse. B and C onlyarrow_forward

- The standard deviation of a portfolio is simply the weighted average of the standard deviations for the individual assets within the portfolio. Group of answer choices True Falsearrow_forwardcan you draw a profit diagram of the portfolio above and state any assumptions that must be made. Also, is the cost of the portfolio positive?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education