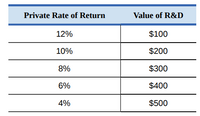

HighFlyer Airlines wants to build new airplanes with greatly increased cabin space. This will allow HighFlyer Airlines to give passengers more comfort and sell more tickets at a higher price. However, redesigning the cabin means rethinking many other elements of the airplane as well, like engine and luggage placement, and the most efficient shape of the plane for moving through the air. HighFlyer Airlines has developed a list of possible methods to increase cabin space, along with estimates of how these approaches would affect the plane's operating costs and ticket sales. Based on these estimates, Table shows the value of R&D projects that provide at least a certain private

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Polaris Industries wishes to purchase a multiple-use in-plan ”road test” simulator that can be used for ATVs, motorcycles, and snowmobiles. It takes digital data from relatively short drives on a desired surface - from smooth to exceptionally harsh - and simulates the ride over and over while the vehicle is mounted to a test stand under load. It can run continuously if desired and provides opportunities to redesign in areas of poor reliability. It costs $128,000 and its market value decreases 30% each year. Operating costs are modest; however, maintenance costs can be significant due to the rugged use. O&M in the first year is expected to be 10,000, increasing 25% each subsequent year. MARR is 15%. What is the optimum replacement interval? Show screen shots of any formulas used in Excel.arrow_forwardCheck each of the following that are sunk costs. Group of answer choices A machine then was used to research a new product that can be used in the production process if we go forward with the project, or sold if we do not The market value of the land on which we plan to build a factory The original cost of the land on which we plan to build a factory The amount we paid our research scientists to determine the feasibility of a product we are now considering. The cost to construct a factory we will build if we launch the a new productarrow_forwardThe owner of Barb’s Burgers has suggested the firm should invest in more moderntechnology and created a list of potential changes she thinks may be helpful as aninvestment. She has asked you to analyze the four potential choices and comment onwhat this would change in terms of cost: Allow Barb’s Burgers to be delivered via the pre-existing food delivery systems.For example, allow people from Doordash/Uber Eats to pick-up orders and deliverthem. This would require the firm to make some minor changes and result in fewerparking spaces for customers dining at the restaurant. • Question: Argue how each of these is likely to change the cost of the firm once implemented (i.e. are any of these a fixed cost or a variable cost). How this adjust the amount of labour and/or capital currently necessary for the firm? Would the technology be a general technology, labour-saving, or capital-saving? Also mention the parking space.arrow_forward

- The Tuff Wheels was getting ready to start its development project for a new product to be added to its small, motorized vehicle line for children. The new product is called the Kiddy Dozer. It will look like a miniature bulldozer, complete with caterpillar tracks and a blade. Tuff Wheels has forecasted the demand and the cost to develop and produce the new Kiddy Dozer. The following table contains the relevant information for this project. Development cost $900,000; Estimated development time 9 months; Pilot testing $200,000; Ramp-up cost $400,000; Marketing and support cost $150,000 per year; Sales and production volume 60,000 per year; Unit production cost $100; Unit price $170; Interest rate 8% Tuff Wheels also has provided the project plan shown as follows. As can be seen in the project plan, the company thinks that the product life will be three years until a new product must be created. Assume all cash flows occur at the end of each period. What is the net present value…arrow_forwardYou are considering adding a new software title to those published by your highly successful software company. If you add the new product, it will use capacity on your disk duplicating machines that you had planned on using for your flagship product, “Battlin’ Bobby.” You had planned on using the unused capacity to start selling “BB” on the West coast in two years. You would eventually have had to purchase additional duplicating machines 10 years from today, but using the capacity for your new product will require moving this purchase up to 2 years from today. If the new machines will cost $113,000 and can be expensed under Section 179, your marginal tax rate is 21 percent, and your cost of capital is 14 percent, what is the opportunity cost associated with using the unused capacity for the new product? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardClarke, Inc. manufactures door panels. Suppose Clarke, Inc. is considering spending the following amounts on a new total quality management (TQM) program: View the spending amounts. Clarke, Inc. expects the new program would save costs through the following: View the savings amounts. Requirements 1. Classify each cost as a prevention cost, an appraisal cost, an internal failure cost, or an external failure cost. 2. Should Clarke, Inc. implement the new quality program? Give your reason. Requirement 1. Classify each cost as a prevention cost, an appraisal cost, an internal failure cost, or an external failure cost. Type of Cost Strength-testing one item from each batch of panels Training employees in TQM Training suppliers in TQM Identifying suppliers who commit to on-time delivery of perfect-quality materials Lost profits from lost sales due to disappointed customers Rework and spoilage Inspection of raw materials Warranty costs Savings Avoid lost profits from lost sales due to…arrow_forward

- Break into teams and identify costs that an airline such as Delta Air Lines would incur on a flight from Green Bay to Minneapolis. (1) Identify the individual costs as variable or fixed. (2) Assume that Delta is trying to decide whether to drop this flight because it seems to be unprofitable. Determine which costs are likely to be saved if the flight is dropped.arrow_forwardMohave Corp. is considering eliminating a product from its Sand Trap line of beach umbrellas. This collection is aimed at people who spend time on the beach or have an outdoor patio near the beach. Two products, the Indigo and Verde umbrellas, have impressive sales. However, sales for the Azul model have been dismal. Mohave’s information related to the Sand Trap line is shown below. Segmented Income Statement for Mohave’s Sand Trap Beach Umbrella Products Indigo Verde Azul Total Sales revenue $ 60,000 $ 60,000 $ 30,000 $ 150,000 Variable costs 34,000 31,000 26,000 91,000 Contribution margin $ 26,000 $ 29,000 $ 4,000 $ 59,000 Less: Direct fixed costs 1,900 2,500 2,000 6,400 Segment margin $ 24,100 $ 26,500 $ 2,000 $ 52,600 Common fixed costs* 17,840 17,840 8,920 44,600 Net operating income (loss) $ 6,260 $ 8,660 $ (6,920 ) $ 8,000 *Allocated based on total…arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education