FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

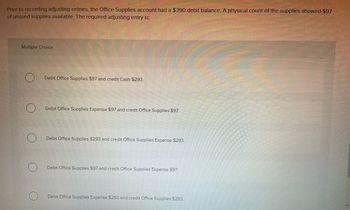

Transcribed Image Text:Prior to recording adjusting entries, the Office Supplies account had a $390 debit balance. A physical count of the supplies showed $97

of unused supplies available. The required adjusting entry is:

Multiple Choice

Debit Office Supplies $97 and credit Cash $293.

Debit Office Supplies Expense $97 and credit Office Supplies $97.

Debit Office Supplies $293 and credit Office Supplies Expense $293.

Debit Office Supplies $97 and credit Office Supplies Expense $97

Debit Office Supplies Expense $293 and credit Office Supplies $293.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. The following entry was made to record the purchase of $700 in supplies on account: 142 Supplies Cash 101 2. The following entry was made to record the payment of $450 in wages: Rent Expense Cash 3. The following entry was made to record a $400 payment to a supplier on account: Supplies 142 200 Cash 101 1 2 3 4 2 5 DATE 6 7 3. 8 Required: Assuming that all entries have been posted, prepare correcting entries for each of the errors. If an amount box does not require an entry, leave it blank. Page: 9 521 101 10 700 450 700 450 200 ACCOUNT TITLE To correct error in which a purchase of supplies on account was credited to Cash To correct error in which a payment of wages was debited to Rent Expense To correct error in which a $400 payment on account was recorded as a $200 cash purchase of supplies DOC. POST. NO. REF. DEBIT CREDIT 1 IN M+S 6 7 8 9 10arrow_forwardA book keeper recorded the purchase of office supplies on accounts as follows: Dr. Supplies expense 34000 Cr. Accounts receivable 34000 How much are total assets over or under stated? show workingsarrow_forwardPrior to recording adjusting entries, the Office Supplies account had a $359 debit balance. A physical count of the supplies showed $105 of unused supplies available. The required adjusting entry is: a. Debit Office Supplies $254 and credit Office Supplies Expense $254. b. Debit Office Supplies $105 and credit Office Supplies Expense $105. c. Debit Office Supplies Expense $254 and credit Office Supplies $254. d. Debit Office Supplies Expense $105 and credit Office Supplies $105.arrow_forward

- On June 30 of the current year, Rosemount Copy Center has completed the Trial Balance columns of the work sheet. Analyze the adjustment information given here into debit and credit parts. Record the adjustments on the work sheet. Total the Adjustments columns. Adjustment Information June 30 Supplies on hand $188.00 Value of prepaid insurance 540.00 WORK SHEET For Month Ended June 30, 20-- ACCOUNT TITLE TRIAL BALANCE ADJUSTMENTS INCOME STATEMENT BALANCE SHEET DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT 1 Cash 8,715.00 1 2 Petty Cash 75.00 2 3 Accounts Receivable-Raymond O’Neil 642.00 3 4 Supplies 518.00 4 5 Prepaid Insurance 675.00 5 6 Accounts Payable-Western Supply 268.00 6 7 Akbar…arrow_forwardJournalize the entries to correct the following errors (for each Journal Entry, omit the 4th journalizing step of providing an explanation): (a) An actual purchase of supplies for $300 on account was recorded and posted as a debit to Supplies for $600 and as a credit to Accounts Receivable for $500. (b) An actual receipt of $5,000 from Fees Earned was recorded and posted as a debit to Fees Earned for $3,000 and a credit to Cash for $3,000. JOURNAL Date Description Post. DR CR (a) (b)arrow_forwardThe Allowance balance is a $200 credit before adjustment. Uncollectible accounts are estimated to be $2,000. The adjusting entry to record uncollectible accounts is: GENERAL JOURNAL 1 2 1 2 Date Chapter 8-Receivables Now, the adjusting entry to record uncollectible accounts is: GENERAL JOURNAL Description a. Description If the Allowance balance started with a $200 DEBIT balance and uncollectible accounts are estimated to be $2,000. Date с. Post ref Debit Post ref Note: Bad Debt Expense estimate in the prior year was wrong, it was not an error. It was still a good faith estimate and the apparent violation of the matching principle is allowed under GAAP. Age Interval Not Past Due 1-30 days past due Debit At the end of the current year, the accounts receivable account has a debit balance of $1,400,000 and sales for the year total $15,350,000. Determine the amount of the adjustment needed. Page Credit The allowance account before adjustment has a debit balance of $23,000. Bad debt expense…arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. amount due for employee salaries, $4,800 actual count of supplies inventory, $ 2,300 depreciation on equipment, $3,000arrow_forwardI need to make adjustments on the end-of-period worksheet using the adjusting journal entries.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education