FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Sh8

Please help me

Solution

Thankyou

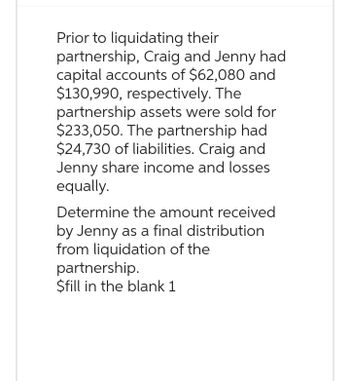

Transcribed Image Text:Prior to liquidating their

partnership, Craig and Jenny had

capital accounts of $62,080 and

$130,990, respectively. The

partnership assets were sold for

$233,050. The partnership had

$24,730 of liabilities. Craig and

Jenny share income and losses

equally.

Determine the amount received

by Jenny as a final distribution

from liquidation of the

partnership.

$fill in the blank 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- F8'Ch X Book 4 xlsx Bb Signature E UTF-8Lece x Connect 9 Question 2 E Chapter 7E x 8 BUS 214 14 X Question 6 neducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fperustatecollege.blackboard.com%252Fwebapps%252Fportal%252Ffra pters 7-9) 6 Saved Help Misu Sheet, owner of the Bedspread Shop, knows his customers will pay no more than $140 for a comforter. Misu wants a 50% markup on selling price. What is the most that Misu can pay for a comforter? Misu's payment Ac Graw DII & %23 %24 96 2. 4. y. e NEIARDarrow_forwardPlease do not give solution in image format thankuarrow_forwardx M Question 1-QUIZ - CH 17 - CX Chapter 5: Customers and Sal x o.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.tulsacc.edu%2... H 17 i Saved 山☆ Help Exercise 17-42 (Algo) Taguchi Quality Loss Function (QLF) Analysis [LO 17-4] Flextronchip, an OEM manufacturer, has a fifth-generation chip for cell phones, with chip specification of 0.2 ± 0.0002 mm for the distance between two adjacent pins. The loss due to a defective chip has been estimated as $20. Required: 1. Compute the value of k, the cost coefficient in the Taguchi quality loss function (QLF), L(x) = K(x-772. 2. Assume that the quality control manager takes a sample of 100 chips from the production process. The results are as follows: Measurement 0.1996 Frequency 3 0.2004 5 3 a. & b. Use the appropriate Taguchi quality loss function, L(x), to calculate the estimated quality loss for each of the observed measurements. Additionally, calculate the expected (i.e., average) loss per…arrow_forward

- q15arrow_forwardI Session 6 L Dashboard x Question 9 X G What is the X Login | bar x M (Alen A ezto.mheducation.com/ext/map/index.html?_con%3con&external_browser%3D0&launchUrl=https%253A%2521 - Z. M MKT 100 (Section 2. H QuickLaunchSSO : Homework Saved Asset W has an expected return of 13.6 percent and a beta of 1.37. If the risk-free rate is 4.62 percent, complete the following table for portfolios of Asset W and a risk-free asset. (Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Enter your portfolio expected return answers as a percent rounded to 2 decimal places, e.g.., 32.16. Enter your portfolio beta answers rounded to 3 decimal places, e.g., 32.161.) Portfolio Expected Percentage of Portfolio in Asset W Portfolio Beta Return 0 % % 25 % 50 75 % 100 % 125 % 150 % ......Tarrow_forwardUTF 8 Ch x Book 4 xisx Bb Signature E UTF-8Lece Connect p.mheducation.com/ext/map/indexhtml?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fperustatecollege.blackboard.com%252Fwebapps%252Fportal%2= Question 2 B Chapter 7E x 8 BUS 214 14 x Ques Chapters 7-9) 6 Saved Help Brian May, quitarist for Queen, does not know how to price his signature Antique Cherry Special that cost him £290 to make, He knows he wants 80% markup on cost. What price should Brian May ask for the guitar? Price aw -> %23 %24 4. 5 6. 2. 3. t y. e r karrow_forward

- 1arrow_forwardQuestion list O Question 1 O Question 2 O Question 3 O Question 4 More Info N 1 2 3 4 5 6 7 8 9 10 To Find F Given P FIP 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 2.2107 2.4760 2.7731 3.1058 K 0.8929 0,7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 Most likely estimates for a project are as follows. 0.3606 0.3220 To Find P Given F PIF Choose the correct choice below. Determine whether the statement "This project (based upon the most likely estimates) is profitable." is true or false. ✔Click the icon to view the relationship between the PW and the percent change in parameter. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year False O True To Find F Given A FIA 1.0000 2.1200 3.3744 4.7793 6.3528 8.1152 10.0890 12.2997 14.7757 17.5487 To Find P Given A PIA 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 To Find A Given F AIF 1.0000 04717 0.2963 0.2092 0.1574 0.1232 0.0991 0.0813 0.0877 0.0570 To Find A Given P…arrow_forwardPlz answer fast i give up vote without plagiarism pleasearrow_forward

- M Question 1-QUIZ- CH 17-C X Chapter 5: Customers and Sal x + o.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.tulsacc.edu%2... H17 2 S Saved Exercise 17-42 (Algo) Taguchi Quality Loss Function (QLF) Analysis [LO 17-4] Flextronchip, an OEM manufacturer, has a fifth-generation chip for cell phones, with chip specification of 0.2 ± 0.0002 mm for the distance between two adjacent pins. The loss due to a defective chip has been estimated as $20. Required: 1. Compute the value of k, the cost coefficient in the Taguchi quality loss function (QLF), L(x) = (x-7)². 2. Assume that the quality control manager takes a sample of 100 chips from the production process. The results are as follows: Measurement Frequency 3 0.1996 0.1997 5 0.1998 15 0.1999 14 0.2000 35 0.2001 14 0.2002 6 0.2003 5 0.2004 3 a. & b. Use the appropriate Taguchi quality loss function, L(x), to calculate the estimated quality loss for each of the observed measurements.…arrow_forwardWCS Inc. owns some common stock of Palmer Inc. and it just received $1,800 of dividend. If WCS Inc. is subject to a tax rate of 21%, what is the tax on this investment income? A. $148 OB. $164 OC. $189 OD. $226 OE. $282 OF. $324 G. $378 H. None of the abovearrow_forwardent II - Chapter 5 Saved Help Save & E 13 1.46853 0.68095 14 1.51259 0.66112 15 1.55797 0.64186 16 1.60471 0.62317 15.6178 10.63496 16.0863 10.95400 17.0863 11.29607 18.5989 11.93794 17.5989 11.63496 19.1569 12.29607 20.1569 12.56110 20.7616 12.93794 Monica wants to sell her share of an investment to Barney for $140,000 in 4 years. If money is wOrth 6% compounded semiannually, what would Monica accept today? Multiple Choice 110,517 $ 109.263 ( Prev 7 of 15 Next>arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education