ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

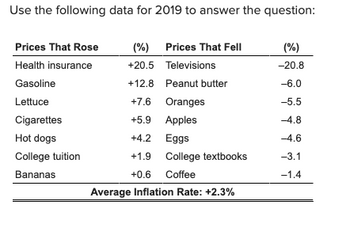

![**How did the pace of college tuition hikes compare to the 2019 rate of inflation?**

College tuition [Dropdown menu: (Click to select)] , and it differed from the 2019 rate of inflation by [Text box].](https://content.bartleby.com/qna-images/question/0763f7f4-03c2-40ab-868a-e517bf0d23d8/eff92673-5fe2-40e6-82bd-205bc2fa50f3/w4w8rhs_thumbnail.png)

Transcribed Image Text:**How did the pace of college tuition hikes compare to the 2019 rate of inflation?**

College tuition [Dropdown menu: (Click to select)] , and it differed from the 2019 rate of inflation by [Text box].

Transcribed Image Text:### Analysis of Price Changes in 2019

#### Price Increases

- **Health Insurance**: +20.5%

- **Gasoline**: +12.8%

- **Lettuce**: +7.6%

- **Cigarettes**: +5.9%

- **Hot Dogs**: +4.2%

- **College Tuition**: +1.9%

- **Bananas**: +0.6%

#### Price Decreases

- **Televisions**: -20.8%

- **Peanut Butter**: -6.0%

- **Oranges**: -5.5%

- **Apples**: -4.8%

- **Eggs**: -4.6%

- **College Textbooks**: -3.1%

- **Coffee**: -1.4%

#### Overview

The average inflation rate for 2019 was +2.3%. This reflects a general rise in prices, with notable increases in sectors such as health insurance and gasoline. Conversely, prices for electronics like televisions saw significant reductions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Assume that the economy has an annual inflation rate of 5 percent. Are the followinginvestments profitable in real terms? (d) The spot price of silver is $31 per ounce. You purchase 50 ounces of silver for $1,600,in order to compensate the merchant. Over the year, the spot price of silver rises to $34per ounce, and you are able to sell the silver you have at the spot price. (e) You purchase a Non-Fungible Token (NFT) for $98 million. The following year, you are able to sell it for $102.5 million.arrow_forwardIf the market interest rate is 16% per year when the inflation rate is 9% per year, the real interest rate is closest to:a. 6.4%b. 7.3%c. 9.4%d. 16.1%arrow_forwardis ver ne ordine Annual expenses for two alternatives have been estimated on different bases as follows. Alt. A Alt. B End of Year Annual Expenses Estimated in Future Annual Expenses Estimated in Real $ with base=0 1 2 3 4 Between $300,000-387,000 If the average general price inflation rate is expected to be 6% per year and the real rate of interest is 9% per year, what is the PW of Alt. A.? (use positive sign for expenses) Hint: Purchasing power remains the same in year 1 with respect to b=0. Between $387,000-388.000 120,000 132,000 148,000 168,000 Between $388,000-390,000 O Higher than $390,000 100,000 110,000 120,000 130,000arrow_forward

- Don’t use excel Use formulas or factorsarrow_forwardRequired information As indicated, some of the cash flows are expressed in future (then-current) dollars and others in current-value (today's) dollars. Use a real interest rate of 10% per year and an inflation rate of 6% per year. Year 10 3 4 Cash Flow, $ 19,000 38,500 22,000 28,500 Then-current Then-current Today's NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. 17 Expressed As Today's Find the present worth of the estimated cash flows. The present worth of the estimated cash flows is $arrow_forwardPrice per Unit in Units Purchased 2008 2009 2010 Good A 5 $1.00 $1.50 $1.50 Good B 10 $2.00 $2.50 $3.00 Good C 4 $4.00 $4.50 $5.00 If 2009 is the base year, the inflation rate between 2008 and 2009 is Select one: Oa. 20.4% Ob. 14.1% Oc 23.2% Od. 18.8% here to searcharrow_forward

- Calculate the inflation rate experienced in 2014 and 2015 based on the CPI for each year below: Year CPI (as of December 31 of the year) Inflation rate (%) 2013 124.5 Not applicable for 2013 2014 125.2 ? 2015 127.5 ?arrow_forwardCalculate the inflation-adjusted interest rate when the annualized inflation rate is 7% per yar and the real interest rate is 4% per year..arrow_forwardA couple wants to save for their daughter’s college expenses. The daughter will enter college eight years from now and will need $40,000, $41,000, $42,000 and $43,000 in actual dollars over four college years. Assume that these college payments will be made at the beginning of the school year. The future general inflation rate is estimated to be 6% per year and the annual inflation-free interest rate is 5%. What is the equal amount, in actual dollars, the couple must save each year until their daughter goes to college? A. $11,945 B. $12,142 C. $12,538 D. $11,838arrow_forward

- Assume that the economy has an annual inflation rate of 5 percent. Are the following investments profitable in real terms? You do not need to explain your answer. (a) A$1,000 face-value bond, which you purchase at a 30% discount, that pays a monthly coupon of$4. (b) A$1 million house the increases in price by$45,000 per year. You do not rent out the house, nor do you undertake renovations. (c) A$1 million house that you renovate for$45,000 over the course of a year, causing the price to increase to$1.1 million. (d) The spot price of silver is$31 per ounce. You purchase 50 ounces of silver for$1,600, in order to compensate the merchant. Over the year, the spot price of silver rises to$34per ounce, and you are able to sell the silver you have at the spot price. (e) You purchase a Non-Fungible Token (NFT) for$98 million. The following year, you are able to sell it for$102.5 millionarrow_forwardHenrique is a baseball fan and attends several games per season. His expenses per season are listed in the table below: |Year 1 |Year 2 5 Baseball Tickets Jersey Food Transport $500 $600 |$100 $150 $50 |$120 $150 $80 Calculate the inflation rate for Henrique's baseball season between year 1 and 2. 18.5% O0.18% 15.8% O1.6%arrow_forwardA series of five constant-dollar (or real-dollar)payments (beginning with $5,000 at the end of thefirst year) are increasing at the rate of 7% per year.Assume that the average general inflation rate is 5%and the market interest rate is 12% during this inflationary period. What is the equivalent present worthof the series?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education