ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Refer to the provided supply-and-

Multiple Choice

a. external benefits from producing and consuming the product.

b. external benefits from producing and external costs from consuming the product.

c. external costs from producing and consuming the product.

d. external costs from producing and external benefits from consuming the product.

Transcribed Image Text:Price

HG

F

E

O

A B C

Quantity

Multiple Choice

S₁

52

D2

·D₁

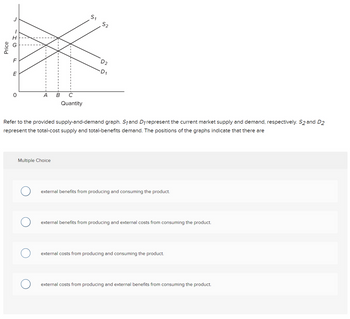

Refer to the provided supply-and-demand graph. S₁ and D₁ represent the current market supply and demand, respectively. S2 and D2

represent the total-cost supply and total-benefits demand. The positions of the graphs indicate that there are

external benefits from producing and consuming the product.

external benefits from producing and external costs from consuming the product.

external costs from producing and consuming the product.

external costs from producing and external benefits from consuming the product.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Determine whether the actions below correct positive, negative externalities or neither: A. Correct positive externalities B. Correct negative externalities C. Correct neither 1. government control of the prices in the market 2. Subsidize production in the market ? ✓ 3. Increase the cost of production in the market ? ?arrow_forward(a) Explain the difference between a positive externality and a negative externality and why each result in an equilibrium point that is not optimal for society. (b) which externality results in an equilibrium quantity that is higher than the optimal social quantity of a good? (c) how can the impact of the externality in part b be corrected?arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Only typed answer You are an industry analyst that specializes in an industry where the market inverse demand is P = 100 - 3Q. The external marginal cost of producing the product is MCExternal = 6Q, and the internal cost is MCInternal = 14Q. Instruction: Round your answers to the nearest two decimal places. a. What is the socially efficient level of output? units b. Given these costs and market demand, how much output would a competitive industry produce? units c. Given these costs and market demand, how much output would a monopolist produce? units d. Which of the following are actions the government could take to induce firms in this industry to produce the socially efficient level of output. Instructions: You may select more than one answer. Click the box with a check mark for the correct answers and click twice to empty the box for the wrong answers. You must click to select or deselect each option in order to receive full credit. Pollution taxes…arrow_forwardThe market for perfume is characterized by: MPB=200-Q and MPC= 3Q with a marginal social benefit of -$12 caused by the others smelling the perfume. The externality is ______ and on the _____ side of the market. The inefficient quantity is ______ and the price is _____. The allocatively efficient quantity in the market is ______. If the government were to correct the externality, it would _______ the market by $______ per unit of perfume. Word Bank: negative, demand, 50, 150, 47, tax, 12, positive, supply, subsidyarrow_forwardQuesrion 11 Hello can you please help awnsering question 11 a and b thank youarrow_forward

- B. Let’s consider the market for flour in a different town. Assume that it is efficient (i.e. that there are not external costs to producing flour, and no external benefits from consuming it). Price ($/lb) Quantity Supplied (thousands of lbs per day) Quantity Demanded (thousands of lbs per day) 1.5 8 14 2 9 13 2.5 10 12 3 11 11 3.5 12 10 4 13 9 What is the price and quantity of flour sold without government intervention. Graph this equilibrium. XXXX 2. Suppose that, alarmed by the inability of many poorer consumers to buy flour, the government institutes a $2/lb price ceiling. How much flour will suppliers wish to sell, and how much will buyers demand? How much flour will actually be sold? Show this outcome on the same graph you drew for question 1. XXXX 3. Describe, in one sentence each, three problems that this policy might create? Please do not simply copy down phrases from the textbook, but instead describe ways that…arrow_forwardWhen producing a good generates external costs, the producing firm's supply curve will Multiple Choicea. be vertical.b. overstate the total cost of production.c. be above (to the left of) the total-cost supply curve.d. understate the total cost of production.arrow_forwardRefer to Figure. Which of the following statements is correct? Price 22 24 22 81 18 16 Social cost (private cost and external cost) Supply (private cost) Demand (private value) 120 160 Quantity a. The private cost of producing the 160th unit of output is $16 b. The social cost of producing the 160th unit of output is $22. c. d. The external cost of producing the 160th unit of output is $6. All of the above are correct.arrow_forward

- A gas tax that a government enacts to fight climate change works by: O externalizing the internal cost of climate change. internalizing the external cost of climate change. O raising funds that the government can use to fight climate change. raising funds to finance social safety net programs needed to cushion the downturn caused by the transition to a green economy.arrow_forwardQuestion 29arrow_forwardMichigan SUGAR BEET processing center creates waste ponds that smell terrible interfering with the quality of life of nearby residents. Below are the dollar valued benefits and costs of producing a ton of sugar. Quantity in Tons Private Benefit Private Cost External Cost 1 $140 $100 $20 2 $130 $110 $20 3 $120 $120 $20 4 $110 $130 $20 5 $100 $140 $20 6 $90 $150 $20 7 $80 $160 $20 Describe the quantity of tons of Sugar that would be produced in a pure Describe the society optimal quantity tons of sugar that should be Describe two ways that the business can be incentivized to internalize the socialcosts of sugararrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education