ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Please help with question 20 and the reasoning on why it is $625

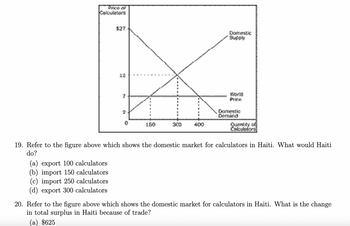

Transcribed Image Text:Price of

Calculators

(a) export 100 calculators

(b) import 150 calculators.

$27

(c) import 250 calculators.

(d) export 300 calculators

12

0

150

300 400

Domestic

Supply

World

Price

Domestic

Demand

19. Refer to the figure above which shows the domestic market for calculators in Haiti. What would Haiti

do?

Quantity of

Calculators

20. Refer to the figure above which shows the domestic market for calculators in Haiti. What is the change

in total surplus in Haiti because of trade?

(a) $625

Transcribed Image Text:20. Refer to the figure above which shows the domestic market for calculators in Haiti. What is the change

in total surplus in Haiti because of trade?

(a) $625

(b) $865

(c) $1500

(d) $2800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- You want to borrow $1500 at 8% and you are willing to pay $210 in simple interest.How long can you keep the moneyarrow_forwardWhich of the following is a cash outflow? Current year Last year Question 6 options: bank loan 2,000 1,000 mortgage payable 30,000 25,000 car 30,000 5,000 house 140,000 150,000arrow_forwardTim invested in a 3-year bond paying 4.7% simple interest. Upon maturity the bond was worth $2700. How much money did Tom invest?arrow_forward

- Distinguish between Loan and Project Cash Flows?arrow_forwardCalculate the simple interest due on a 58-day loan of $1300 if the interest rate is 5%. (Round your answer to the nearest cent.)$arrow_forwardMary paid back a total of $3500 on an original loan of $900 that charged a simple interest of 8%. How many years was the loan taken out? Round to two decimal placesarrow_forward

- So what really happens if we don't raise the debit limit? Hmmmm? Good question we have never not done that before... Verbatum question formulated by Eric Kortenhoven. Comment on the question then reply to a fellow student this will be an extra credit and points can be used wherever you would like just let me know where to apply themarrow_forwardJill bought a $680 rocking chair. The terms of her revolving charge are 1.5% on the unpaid balance from the previous month. If she pays $100 per month, complete a schedule for the first 3 months. Be sure to use the U.S. Rule. (Round your final answers to the nearest cent.) Monthly payment number Outstanding 1.5% interest Amount of Reduction in Outstanding balance due balance due payment monthly payment balance due 2 3 Mc Graw Hill A Prev 2 of 15 Next > MacBook Air 44 DII V10 18 F7 F6 F10 F4 FG 19 F3 27 F2 * & @ #3 %24 4. 6. 1 T Y Q W J K F G S C V com < CO A.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education