ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

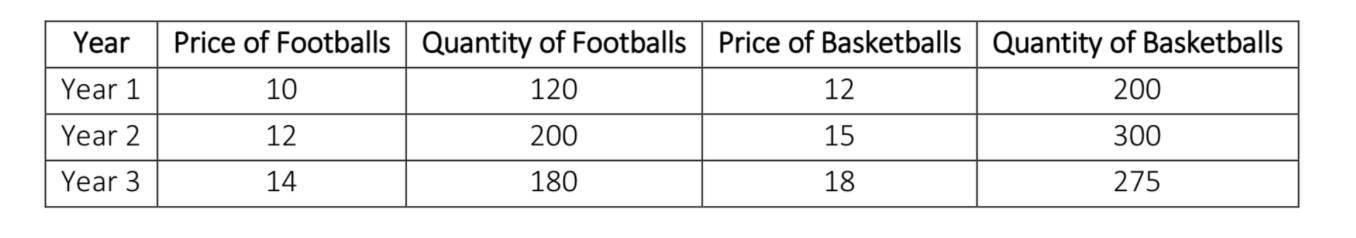

1. Calculate the inflation rate.

2. Re-do parts b)-d), but use year 2 as the base year. How do your answers differ?

Transcribed Image Text:Price of Basketballs Quantity of Basketballs

Price of Footballs

Quantity of Footballs

Year

Year 1

10

120

12

200

Year 2

12

200

15

300

180

Year 3

14

18

275

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose the economy’s nominal GDP constantly grows at 9%, and real GDP constantly grows at 4%What is the inflation rate? How long does it take for an item that costs $1 today to cost $4?arrow_forwardConsider the following: Price Index in 2017 86 Price Index in 2018 100 Price Index in 2019 108 Price Index in 2020 120 Price Index in 2021 146 a. The base year is 2018 b. Calculate the inflation rate from 2018 to 2019. 8 % (Enter your response as a percentage rounded to two decimal places.) c. Calculate the inflation rate from 2019 to 2020. 11.11 % (Enter your response as a percentage rounded to two decimal places.) d. Assume the cost of a market basket in 2018 is $2,137.0. (Enter your responses rounded to one decimal place.) Calculate the cost of the same basket of goods and services in 2017. Calculate the cost of the same basket of goods and services in 2021.arrow_forwardif inflation is running at 8% and you want to negotiate a 2% raise in your salary, how large a raise should you ask for? 2% 6% 8% 10%arrow_forward

- 3. An economist has predicted that for the next 5 years, the U.S. will have a 2.5% annual inflation rate, followed by 5 years at a 3.5% inflation rate. This is equivalent to what average price change per year for the entire 10-year period?arrow_forwardThe table below shows the index numbers for the cost of a basket of goods and services in each period. Use this information to calculate the inflation rate for each period. Round to two decimal places. Period 1 Period 2 Period 3 Period 4 Index Number 112 120 124 130 Provide your answer below: Inflation Rate Period 2 = %; Period 3 = %; Period 4 = [arrow_forwardSuppose you took out 20,000 in student loans at a fixed interest rate of 5%. Assume that after you graduate, inflation rises significantly as you are paying back your loans. Does this rise in inflation benefit you in paying back your student loans? Who is hurt more from unexpected higher inflation, a borrower or a lender ?arrow_forward

- Calculate inflation when nominal interest rate is 8% and the real interest rate is 2% Help!arrow_forwardAssume the economy is experiencing low and stable inflation, averaging 2% a year. Nadia loans her good friend Brett $12,000 to buy a car. Nadia and Brett agreed that he would repay the loan over the next 5 years at a 5% fixed interest rate. How would Nadia and Brett be affected if next year the inflation rate unexpectedly rises to 6%?arrow_forwardSuppose you have $150,000 in a bank term account. You earn 5% interest per annum from this account. You anticipate that the inflation rate will be 3% during the year. However, the actual inflation rate for the year is 6%. Calculate the impact of inflation on the bank term deposit you have. ii. Examine the effects of inflation in your city of residence with attention to food and accommodation expenses. iii. The Australian Bureau of Statistics (ABS) reported in May 2016 that the civilian population in Australia over 15 years of age was 19.8 million. Of this population of 19.8 million Australians, 12.5 million were employed and 0.7 million were unemployed. Calculate Australia’s labor force and the number of people in the civilian population who were not in the labor force?arrow_forward

- Use the information in the table to calculate the inflation rate. The base year is 1989. Market basket Frozen peas Wool slacks Cellular car phone 1989 Prices 1990 Quantity 0.60 26 1990 Prices 0.80 1991 Quantity 1991 Prices 29 0.70 20.00 16 25.00 25 35.00 な 325.00 2 300.00 16 450.00 What is the annual inflation rate for 1991? Enter your answer as a percent rounded to two places after the decimal. 1991 annual inflation rate:arrow_forwardBy adjusting the interest rate and changing the quarterly deposits required, can we adjust annual inflation?arrow_forwardA price index for a basket of goods over four years was calculated to be: 2014 = 92, • 2015 =97, • 2016=100, • 2017=107. Calculate the inflation rate for each year so that you will enter: Blank #1 = Inflation Rate for 2015 Blank #2 = Inflation Rate for 2016 • Blank #3 = Inflation Rate for 2017 What is the base year in this scenario? • Blank #4 = Base year for this basket %3D Round to two decimal places Blank # 1 Blank # 2 Blank # 3 Blank # 4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education