ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text::

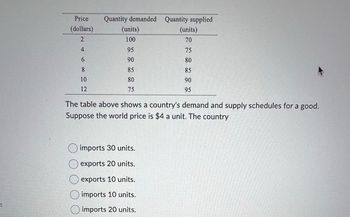

Price

(dollars)

Quantity demanded Quantity supplied

2

(units)

100

(units)

70

4

95

75

6

90

80

8

85

85

10

80

90

12

75

95

The table above shows a country's demand and supply schedules for a good.

Suppose the world price is $4 a unit. The country

imports 30 units.

exports 20 units.

☐ exports 10 units.

imports 10 units.

imports 20 units.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A 5 peso import tariff would raise how much government revenue? a) $3,000 b) 9,500 c) $12,500 d) $6,500arrow_forwardAccording to the foreign trade effect, when the price of American-made cars falls, U.S. consumers are likely to buy: More American-made cars. More foreign-made cars. Fewer total cars. More foreign-made carsarrow_forwardFind the revised import expenditure given increased excess demand for manufactures in Figure 1.8. Suppose the international price rises to $6.25 and quantity traded rises to 300. Find the BOT using the export revenue in Figure 1.11.arrow_forward

- i will 10 upvotes urgent.arrow_forwardA small country imports T-shirts. With free trade at a world price of $10, domestic production is 10 million T-shirts and domestic consumption is 42 million T-shirts. The country's government now decides to impose a quota to limit T-shirt imports to 20 million per year. With the import quota in place, the domestic price rises to $12 per T- shirt and domestic production rises to 15 million T-shirts per year. The quota on T- shirts causes domestic consumers to A) gain $7 million. B) lose $7 million. C) lose $70 million. D) lose $77 millionarrow_forwardTariffs and quotas are costly to consumers because О Multiple Choice consumers have to switch to higher-priced domestic goods. the price of the imported good falls. the supply of the imported good increases. import competition increases for domestic goods.arrow_forward

- [India is the world’s largest consumer of sugar. Assume the world price for sugar is $750 per ton.] [Assume India currently has a tariff of $50 per ton on sugar and imports 7 million tons of sugar. Show this situation in a graph. Label the quantity demanded and the quantity supplied domestically and imports clearly on a graph. Explain your graph in 3-4 sentences. How to draw the graph?arrow_forwardJiz What are the effects on U.S. imports and exports when the U.S. experiences economic growth stronger than its major trading partners? Multiple Choice There will be no effect on US imports and exports. U.S. exports will increase more than U.S. imports. US imports will decrease, but U.S. exports will increase. Saved US imports will increase more than U.S. exports. Note: don't use chat bot.arrow_forward12. If the free trade price is lIP and this country imposes a trade tariff of $3, what will be the resulting net welfare loss to the economy? a)$3 b)$27 C)$13.5 d)$40.5 e)$9 13. if the free trade price is IP and this country imposes an import quota of 6 units, what will be the welfare loss to this economy? a)$3 b)$27 c)$13.5 d)$40.5 e)$18arrow_forward

- Consider the following information pertaining to a country's imports, consumption, and production of t-shirts following the removal of Multi Fiber Agreement (MFA) quotas: Under After МFA МFA World Price ($/shirt) Domestic Price (S/shirt) Domestic Consumption (millions of shirts) Domestic Production (millions of shirts) 2.00 2.00 2.50 2.00 100 125 75 50 a. Use the information in the table above to graph the effects of the quota removal on domestic consumption and production. Include a companion graph for the world market like that shown in class. b. The deadweight loss associated with the quota is: c. The quota rents that were earned under the quota are: d. The gain in consumer surplus associated with quota removal is: e. The loss in producer surplus from the removal of the quota is: f. Assuming that the foreign government assigned the quota licenses, the amount the home country gained from removal of the quota is: 4.arrow_forwardDomestic Demand supply Domestic supply + imports $8 C $4 Qs Q Qd International Trade Two trading partners expand a previous free trade agreement to include sugar. What is the new domestic price of sugar? Provide your answer below:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education