FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

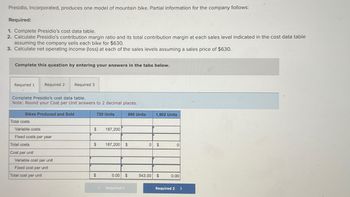

Transcribed Image Text:Presidio, Incorporated, produces one model of mountain bike. Partial information for the company follows:

Required:

1. Complete Presidio's cost data table.

2. Calculate Presidio's contribution margin ratio and its total contribution margin at each sales level indicated in the cost data table

assuming the company sells each bike for $630.

3. Calculate net operating income (loss) at each of the sales levels assuming a sales price of $630.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Required 3

Complete Presidio's cost data table.

Note: Round your Cost per Unit' answers to 2 decimal places.

Bikes Produced and Sold

Total costs

Variable costs

Fixed costs per year

Total costs

Cost per unit

Variable cost per unit

Fixed cost per unit

Total cost per unit

720 Units

890 Units

1,902 Units

$

187,200

187,200 $

0 $

0

$

0.00

Required 1

543.00

$

0.00

Required 2

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ces Sandy Bank, Incorporated, makes one model of wooden canoe. Partial information is given below. Required: 1. Complete the following table. 2. Suppose Sandy Bank sells its canoes for $600 each. Calculate the contribution margin per canoe and the contribution margin ratio. 3. This year Sandy Bank expects to sell 830 canoes for $600 each. Prepare a contribution margin income statement for the company. 4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $600 each. 5. Suppose Sandy Bank wants to earn $84,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $600 each. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Number of Canoes Produced and Sold Total costs Complete the following table. Note: Round your "Cost per Unit" answers to 2 decimal places. Variable Costs Fixed Costs Total Costs Cost per Unit Variable…arrow_forwardPlease help mearrow_forwardHazlett & Family is organized into two geographic markets Northern and Southern. The company makes an off-road vehicle for recreation and agricultural use. The vehicle is sold in three models, depending on the power and options. The three models, from least expensive to most expensive, are the H-L, H-LX, and H-LXS. The company's financial staff has prepared the following forecasted income statement for the upcoming fiscal year (in thousands of dollars): Sales revenue Cost of goods sold Gross margin Marketing costs Administrative costs Total marketing and administrative Operating profits Management has expressed special concern with the Southern market because of the extremely poor return on sales. This market was entered a year ago because it seemed like the best opportunity for growth. Hazlett & Family knew that it would take some time to build profitability in the market, but there has been no noticeable change in the low returns over time. H-L H-LX H-LXS The financial staff has also…arrow_forward

- Using the information in the example we have been using, how much would net income be if the company sold 500 bikes? (Reminder: Sales Price = $500, Variable Costs = $300)arrow_forwardPlease do not give solution in image format thankuarrow_forwardSandy Bank, Incorporated, makes one model of wooden canoe. Partial information is given below. Required: 1. Complete the following table. 2. Suppose Sandy Bank sells its canoes for $560 each. Calculate the contribution margin per canoe and the contribution margin ratio. 3. This year Sandy Bank expects to sell 760 canoes for $560 each. Prepare a contribution margin income statement for the company. 4. Calculate Sandy Bank's break-even point in units and in sales dollars. Sandy Bank sells its canoes for $560 each. 5. Suppose Sandy Bank wants to earn $72,000 profit this year. Calculate the number of canoes that must be sold to achieve this target. Sandy Bank sells its canoes for $560 each. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete the following table. Note: Round your "Cost per Unit" answers to 2 decimal places. Number of Canoes Produced and Sold Total costs Variable Costs Fixed Costs Total Costs Cost per Unit Required 3 Required 4…arrow_forward

- Riverside Incorporated makes one model of wooden canoe. Partial information for Number of Canoes Produced and Sold Total costs Variable costs Fixed costs Unit contribution margin Contribution margin ratio Sales revenue Variable costs Contribution margin Fixed costs www Total costs Cost per unit Variable cost per unit $ 210.00 220.00 Fixed cost per unit) Total cost per unit $ 430.00 Riverside sells its canoes for $650 each. Next year Riverside expects to sell 1,000 canoes Required: Complete the Riverside's contribution margin income statement for each independent scenario. Assuming each scenario is a variation of Riverside's original data. Note: Round your unit contribution margin and contribution margin ratio to 2 decimal places (i.e. 0.1234 should be entered as 12.34 %) and all other answers to the nearest dollar amount. Net operating income Scenario 1 Raises Sales Price to $750 per Canoe 550 $ $ 115,500 198,000 $ 313,500 $ 210.00 360.00 $ 570.00 750 $ 157,500 198,000 $ 355,500 540.00…arrow_forwardJamison Company uses the total cost method of applying the cost-plus approach to product pricing. Jamison produces and sells Product X at a total cost of $800 per unit, of which $540 is product cost and $260 is selling and administrative expenses. In addition, the total cost of $800 is made up of $460 variable cost and $340 fixed cost. The desired profit is $168 per unit. Determine the markup percentage on total cost. %arrow_forwardSurf Company can sell all of the two surfboard models it produces, but it has only 412 direct labor hours available. The Glide model requires 2 direct labor hours per unit. The Ultra model requires 4 direct labor hours per unit. Contribution margin per unit is $212 for Glide and $324 for Ultra. (a) Compute the contribution margin per direct labor hour for each product. (b) Determine the best sales mix and the resulting contribution margin. Complete this question by entering your answers in the tabs below. Required A Required B Compute the contribution margin per direct labor hour for each product. Glide Ultra Contribution margin per direct labor hourarrow_forward

- Royal Lawncare Company produces and sells two packaged products - Weedban and Greengrow. Revenue and cost information relating to the products follow: \ table[[, Product], [, Weedban,Greengrow], [Selling price per unit,$8.00, $39.00arrow_forwardAdams, Inc. has the following cost data for Product X, and unit product cost using absorption costing when production is 2,000 units, 2,500 units, and 5,000 units. (Click on the icon to view the cost data.) (Click on the icon to view the unit product cost data.) Product X sells for $175 per unit. Assume no beginning inventories. Read the requirements. Data table Begin by selecting the labels and computing the gross profit for scenario a. and then compute the gross profit for scenario b. and c. Absorption costing a. b. C. Gross Profit Reference 2,000 units 2,500 units 5,000 units 42 $ 42 52 52 11 11 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total unit product cost Print $ $ 42 S 52 11 10 115 $ Done 8 113 $ 4 109 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Print Done $42 per unit 52 per unit 11 per unit 20,000 per yeararrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education