FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

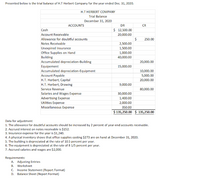

Transcribed Image Text:Presented below is the trial balance of H.T Herbert Company for the year ended Dec. 31, 2020.

H.T HERBERT COMPANY

Trial Balance

December 31, 2020

ACCOUNTS

DR

CR

Cash

$ 12,500.00

Account Receivable

20,000.00

Allowance for doubtful accounts

$

250.00

Notes Receivable

2,500.00

Unexpired Insurance

1,500.00

Office Supplies on Hand

Building

Accumulated depreciation-Building

Equipement

1,000.00

40,000.00

20,000.00

15,000.00

10,000,00

Accumulated depreciation-Equipment

Account Payable

5,000,00

H.T. Herbert, Capital

20,000.00

H.T. Herbert, Drawing

Service Revenue

9,000.00

80,000,00

Salaries and Wages Expense

30,000.00

Advertising Expense

Utilities Expense

1,400.00

2,000.00

Miscellaneous Expense

350.00

$ 135,250.00 $ 135,250.00

Data for adjustment

1. The allowance for doubtful accounts should be increased by 2 percent of year-end accounts receivable.

2. Accrued interest on notes receivable is $152.

3. Insurance expense for the year is $1,240.

4. A physical inventory shows that office supplies costing $273 are on hand at December 31, 2020.

5. The building is depreciated at the rate of 10.5 percent per year.

6. The equipment is depreciated at the rate of 8 1/5 percent per year.

7. Accrued salaries and wages are $2,000.

Requirements:

A. Adjusting Entries

B. Worksheet

c. Income Statement (Report Format)

D. Balane

heet (Report Format)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Trial Balance as at June 30, 2020 Dr $ Cr $ Cash 127,000 Accounts Receivable 151,000 Allowance for Bad-Debts 12,500 Merchandise Inventory 187,500 Store Supplies 58,000 Prepaid Insurance 72,000 Prepaid Rent 56,000 Furniture & Fixtures 800,000 Accumulated Depreciation: Furniture & Fixtures 256,000 Computer Equipment 450,000 Accumulated Depreciation: Computer Equipment Accounts Payable 133,500 Salaries Payable Interest Payable 27,000 Unearned Sales Revenue 82,000 Long-Term Loan 360,000 Eva Ready, Capital 898,500 Eva Ready, Withdrawals 104,000 Sales Revenue 1,043,000 Sales Discount 7,000 Sales Returns & Allowances 5,500 Cost of Goods Sold 403,000 Salaries Expense 165,000 Insurance Expense Utilities Expense…arrow_forwardPrepare income Statementarrow_forwardSelected accounts from Han Corporation’s trial balance are as follows. Prepare a partial balance sheet listing only the Fixed Assets section. Han Corporation Abbreviated Trial Balance December 31, 2020 Account Name (Acct. #) Debit Balances Credit Balances Cash 150,000 Short-term Marketable Securities 145,000 Accounts Receivable 26,000 Inventories 90,000 Other Current Assets 10,000 Land 350,000 Buildings 300,000 Accumulated Depreciation: Buildings 40,000 Equipment 145,000 Accumulated Depreciation: Equipment 150,000 Goodwill 40,000 Other Intangible Assets 20,000arrow_forward

- 25arrow_forwardJanuary 2020 the following trial balance was extracted from the books of Yusiti Credit RM Particulars Debit RM Capital 1 February 2019 Vehicles at cost 101,430 Equipment at cost Purchases and sales 35,000 80,000 284,680 503,520 Provision for depreciation at 1 February 2019: Vehicles 21,000 35,000 650 Equipment Return inward and return outwards 1,340 Finance expenses Stock at 1 February 2019 Vehicles expenses Rent, rates and insurance Office expenses Drawings Petty cash Wages and salaries Bad debts Debtors and creditors Cash at bank 1,220 25,570 4,930 7,420 21,940 23,550 200 95,370 1,240 83,210 14,880 680,550 680,550 18,950 ТОTAL dditional information as at 31 January 2020: RM No. Particulars i. Stock valued at Insurance prepaid iii. Goods taken from stock for own use iv. Wages due Provision for doubtful debt required vj. Provision for depreciation is to be provided as follows: 29,750 C 340 i. 420 2,4009 620 C V. 30% straight line method reducing balance method Vehicles 25% Equipmentarrow_forwardBayley Company has the following trial balance below at December 31, 2020. All accounts have normal balances. Account Balance Cash $460,000 Accounts receivable (net of the Allowance for Doubtful Accounts) 352,000 Inventory at the lower of FIFO cost and net realizable value 451,000 Trading Investments 230,000 Buildings (net of accumulated depreciation) 740,000 Equipment (net of accumulated depreciation) 240,000 Land held for Future Use 305,000 Goodwill 89,000 Notes Receivable (due 2025) 91,000 Prepaid Insurance 16,000 Accounts Payable 345,000 Guaranteed Investment Certificates 50,000 Notes Payable (due in 2021) 235,000 Bonds Payable at net carrying value (due February 1, 2021) 83,000 Rent Payable 55,000 Bonds Payable at net carrying value (due December 31, 2028) 746,000 Common shares, unlimited number of shares authorized 400,000 Contributed surplus 190,000 Retained…arrow_forward

- FDN Company reported Accounts Receivable of P10,000,000 on December 31, 2021. Allowance for Doubtful Accounts was P1,000,000 on January 1, 2021. The following information is provided pertaining to the company's aging analysis. Time outstanding Accounts receivable Percent uncollectible Under 90 days P7,200,000 5% 91 180 days 1,800,000 7% 181 360 days 1,000,000 50% How much should be reported as Allowance for Doubtful Accounts as of December 31, 2021?arrow_forward2021 Dec 31 Recorded Bad Debt Expense of $15,500 2022 Apr 1 Wrote off J.Salazar account of $3500 as uncollectible 2022 June 4 Wrote off T.Savvy account of $4000 as uncollectible 2022 August 10 Recovered $1500 from T. Savvy Required Journalize the transactions using the income statement approach to estimate bad debts. Journalize how Sloan Company would record the T Savvy bad debt situation if the direct write-off method had been used. Assume the bad debt was recovered on August 10, 2023.arrow_forwardJournal adjusting entry for Office supplies on hand at 30 Sept is $6,050 incl. GST.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education