FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2025. (If no entry is required, select "No

entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not

indent manually. List debit entry before credit entry.)

Date Account Titles and Explanation

Dec. 31

Debit

Credit

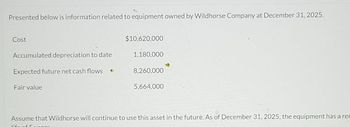

Transcribed Image Text:Presented below is information related to equipment owned by Wildhorse Company at December 31, 2025.

Cost

Accumulated depreciation to date

Expected future net cash flows

Fair value

$10,620,000

1,180,000

8,260,000

5,664,000

Assume that Wildhorse will continue to use this asset in the future. As of December 31, 2025, the equipment has a rer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- (Recording and Amortization of Intangibles) Parrish Company, organized in 2019, has set up a single account for all intangible assets. The following summary discloses the debit entries that have been recorded during 2020: 1/2/20 Purchased patent (8-year life) $ 625,000 4/1/20 Purchased goodwill (indefinite life) 540,000 7/1/20 Purchased franchise with 10-year life; expiration date 7/1/30 675,000 8/1/20 Payment for copyright (5-year life) 246,000 9/1/20 Research and development costs 342,500 $2,428,500 Instructions Prepare the necessary entries to clear the Intangible Assets account and to set up separate accounts for distinct types of intangibles. Make the entries as of December 31, 2020, recording any necessary amortization and reflecting all balances accurately as of that date. (Use straight-line amortization.)arrow_forwardplease help, i cant figure out the last partarrow_forwardAt December 31, Year 5, Aaron Co. had the following property, plant, and equipment: Asset Fair Value Cost to Sell Present Value of All Cash Flows Expected from the Asset Sum of All Undiscounted Cash Flows Expected from the Asset Useful Life from the Acquisition Date (Depreciation Method) Residual Value Equipment $220,000 $5,000 $230,000 $255,000 6 years (Straight Line) $0 Machine set 310,000 8,000 320,000 335,000 4 years (SYD) 0 Land 660,000 9,000 600,000 640,000 Determine the impairment losses recognized for Year 5 under U.S. GAAP and IFRS. Enter the appropriate amounts in the designated cells below. Enter all amounts as positive numbers. If the correct answer is zero, enter a zero (0). Purchase Receipt 3 - Land Purchase Date: 1/1/Year 3 Purchase Amount: $650,000 Purchase Receipt 2 - Machine Set Purchase Date: 1/1/Year 5 Purchase Amount: $600,000 Purchase Receipt 1 - Equipment Purchase Date: 7/1/Year 2 Purchase…arrow_forward

- The property, plant, and equipment section of the Jasper Company's December 31, 2023, balance sheet contained the following: Property, plant, and equipment: Land Building Less: Accumulated depreciation Equipment Less: Accumulated depreciation Total property, plant, and equipment Machine 101 102 103 Cost $ 48,400 79,000 20,000 Date Acquired 1/1/2021 6/30/2022 9/1/2023 $ 780,000 (150,000) 147,400 Residual Value $ 6,000 7,000 2,000 ? The land and building were purchased at the beginning of 2019. Straight-line depreciation is used and a residual value of $30,000 for the building is anticipated. The equipment is comprised of the following three machines: $ 110,000 Life (in Years) 8 9 8 630,000 ? ? The straight-line method is used to determine depreciation on the equipment. On March 31, 2024, Machine 102 was sold for $54,000. Early in 2024, the useful life of machine 101 was revised to five years in total, and the residual value was revised to zero. Required: 1. Calculate the accumulated…arrow_forwardDuring 2021, ABC Co. purchased intangible assets and debited them all to "Intangible assets". $250,000 $66,000 $50,000 1-Jan Patent 7-Year Life 1-Jun Goodwill Indefinite Life 1-Oct Research and development costs (a). Prepare a journal entry to reclassify them to an intangible asset account and/or expense account. (b). Prepare a journal entry to record amortization expense as of December 31, 2021.arrow_forwardPresented below is information related to equipment owned by Marigold Company at December 31, 2025. Cost $9,360,000 Accumulated depreciation to date 1,040,000 Expected future net cash flows 7,280,000 Fair value 4,992,000 Assume that Marigold will continue to use this asset in the future. As of December 31, 2025, the equipment has a remaining useful life of 5 years. (a) Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2025. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List debit entry before credit entry.) Date Account Titles and Explanation Dec. 31 Debit Credit eTextbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit Answerarrow_forward

- Do not give answer in imagearrow_forwardMarigold Company uses IFRS and owns property, plant and equipment with a historical cost of 5170000 euros. At December 31, 2019, the company reported a valuation reserve of 8640000 euros. At December 31, 2020, the property, plant and equipment was appraised at 5520000 euros.The property, plant and equipment will be reported on the December 31, 2020 statement of financial position at 5520000 euros. 8990000 euros. 5170000 euros. 8640000 euros.arrow_forwardvd subject-Accountingarrow_forward

- The intangible assets section of Ayayai Company at December 31, 2022, is presented here. Patents ($83,000 cost less $8,300 amortization) $74,700 Franchises ($54,600 cost less $21,840 amortization) 32,760 Total $107,460 The patent was acquired in January 2022 and has a useful life of 10 years. The franchise was acquired in January 2019 and also has a useful life of 10 years. The following cash transactions may have affected intangible assets during 2023. Jan. 2 Paid $35,100 legal costs to successfully defend the patent against infringement by another company. Sept. 1 Paid $50,000 to an extremely large defensive lineman to appear in commercials advertising the company’s products. The commercials aired in September and October. Oct. 1 Acquired a franchise for $141,400. The franchise has a useful life of 50 years. Nov.–Dec. Developed a new product, incurring $135,000 in research and development costs during December. A patent was granted for…arrow_forwardPresented below is information related to equipment owned by Swifty Company at December 31, 2020. Cost Accumulated depreciation to date Expected future net cash flows Fair value $6,370,000 750,000 5,100,000 3,630,000 Assume that Swifty will continue to use this asset in the future. As of December 31, 2020, the equipment has a remaining useful life of 4 years and no salvage value.arrow_forward! Required information [The following information applies to the questions displayed below.] The following information relates to the intangible assets of Lettuce Express: a. On January 1, 2021, Lettuce Express completed the purchase of Farmers Produce, Ic., for $1,590,000 in cash. The fair value of the identifiable net assets of Farmers Produce was $1,431,000. b. Included in the assets purchased from Farmers Produce was a patent for a method of processing lettuce valued at $54,000. The original legal life of the patent was 20 years. There are still 17 years left on the patent, but Lettuce Express estimates the patent will be useful for only 10 more years. c. Lettuce Express acquired a franchise on July 1, 2021, by paying an initial franchise fee of $187,600. The contractual life of the franchise is seven years. 2. Prepare the intangible asset section of the December 31, 2021, balance sheet. LETTUCE EXPRESS Balance Sheet December 31, 2021 (Intangible Assets Section) Intangible Assets…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education