FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

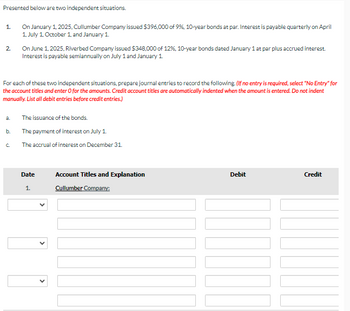

Transcribed Image Text:Presented below are two independent situations.

1. On January 1, 2025, Cullumber Company issued $396,000 of 9%, 10-year bonds at par. Interest is payable quarterly on April 1, July 1, October 1, and January 1.

2. On June 1, 2025, Riverbed Company issued $348,000 of 12%, 10-year bonds dated January 1 at par plus accrued interest. Interest is payable semiannually on July 1 and January 1.

For each of these two independent situations, prepare journal entries to record the following. *(If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.)*

a. The issuance of the bonds.

b. The payment of interest on July 1.

c. The accrual of interest on December 31.

| Date | Account Titles and Explanation | Debit | Credit |

|------|---------------------------------|-------|--------|

| 1. | Cullumber Company: | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

*(Note: The table is shown without specific entries, intended for educational demonstration of how journal entries can be prepared.)*

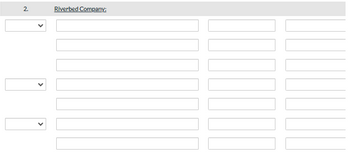

Transcribed Image Text:The image appears to be a tabular form, likely part of a data entry interface related to "Riverbed Company." It includes multiple rows with drop-down menus and text input fields for entering or selecting data.

### Table Structure

1. **Top Header:**

- Numbered "2."

- Title: "Riverbed Company:"

2. **Rows:**

- Each row includes a drop-down menu on the left followed by two text input fields.

- There are five rows in total, suggesting space for entering data or selecting options for multiple items or categories.

### Functionality

This format is typical for websites where specific data needs to be entered in an organized manner, such as inventory systems, report generators, or customer databases. Each row might represent a different entry or aspect related to the Riverbed Company.

No graphs or diagrams are present in the image.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2025, Concord Corporation issued $500,000 of 7% bonds, due in 10 years. The bonds were issued for $537.196, and pay interest each July 1 and January 1. The effective-interest rate is 6%. Prepare the company's journal entries for (a) the January 1 issuance. (b) the July 1 interest payment, and (c) the December 31 adjusting entry. Concord uses the effective interest method. (Round answers to 0 decimal places, eg, 38,548. If no entry is required, select "No Entry for the account titles and enter O for the amounts Credit account titles are automatically indented when the amount is entered. Do not indent manually List all debit entries before credit entries) No. (4) Date Account Titles and Explanation Debit Credarrow_forwardGreat Lake Glassware Company issues $1,050,000 of its 16%, 10-year bonds at 94 on February 28, 2024. The bonds pay interest on February 28 and August 31. Assume that Great Lake uses the straight-line method for amortization The journal entry to record the first interest payment on August 31, 2024 includes a OA. debit to Interest Expense for $87,150. OB. debit to Cash for $84,000. OC. debit to Discount on Bonds Payable for $3,150 OD. debit to Interest Expense for $80,850arrow_forwardCoronado Inc. issued $920,000 of 10%, 10-year bonds on June 30, 2025, for $814,472. This price provided a yield of 12% on the bonds. Interest is payable semiannually on December 31 and June 30. If Coronado uses the effective-interest method, determine the amount of interest expense to record if financial statements are issued on October 31, 2025. (Round intermediate calculations to 6 decimal places, e.g. 1.251247 and final answer to 0 decimal places, e.g. 38,548.) Interest expense to be recordedarrow_forward

- On June 30, Jamison Company issued $2,500,000 of 10-year, 9% bonds, dated June 30, for $2,580,000. Present entries to record the following transactions. Issuance of bonds. (a) Payment of first semiannual interest on December 31 (record separate entry from premium (b) amortization). (C) Amortization by straight-line method of bond premium on December 31.arrow_forward1. On January 1, 2025, Waterway Company issued $408,000 of 9%, 10-year bonds at par. Interest is payable quarterly on April 1. July 1, October 1, and January 1. 2. On June 1, 2025, Wildhorse Company issued $360,000 of 11%, 10-year bonds dated January 1 at par plus accrued interest. Interest is payable semiannually on July 1 and January 1. For each of these two independent situations, prepare journal entries to record the following. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) a. The issuance of the bonds. b. The payment of interest on July 1. с The accrual of interest on December 31. Date Account Titles and Explanation Debit Credit 1. Waterway Company: 2. Wildhorse Company:arrow_forwardBurris Corporation is authorized to issue $940,000 of 6% bonds. Interest on the bonds is payable semiannually; the bonds are dated January 1, Year 1, and are due December 31, Year 5. Required: Prepare the journal entries to record the following: a. April 1, Year 1 Sold the bonds at par plus accrued interest b. June 30, Year 1 First interest payment c. December 31, Year 1 Second interest paymentarrow_forward

- On January 1, $980,000, 5-year, 10% bonds were issued for $950,600. Interest is paid semiannually on January 1 and July 1. If the issuing company uses the straight-line method to amortize a discount on bonds payable, the semiannual amortization amount isarrow_forwardOn January 1, $954,000, 5-year, 10% bonds, were issued for $925,380. Interest is paid semiannually on January 1 and July 1. If the issuing corporation uses the straight-line method to amortize discount on bonds payable, what is the semiannual amortization amount? Select the correct answer. $47,700 $5,724 $28,620 $2,862arrow_forwardLincoln Company issued $110,000 of 10-year, 8% bonds payable on January 1, 2025. Lincoln Company pays interest each January 1 and July 1 and amortizes discount or premium by the straight-line amortization method. The company can issue its bonds payable under various conditions. Read the requirements. Requirement 1. Journalize Lincoln Company's issuance of the bonds and first semiannual interest payment assuming the bonds were issued at face value. Explanations are not required. (Record debits first, then credits. Exclude explanations from any journal entries.) Journalize the issuance of the bond payable at face value. Date Jan. 1, 2025 Accounts Debit Creditarrow_forward

- Riverbed Company issued $2,690,000, 9%, 20-year bonds on January 1, 2020, at 105. Interest is payable annually on January 1. Riverbed uses straight-line amortization for bond premium or discount. Prepare the journal entries to record the following events. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) (a) The issuance of the bonds. (b) The accrual of interest and the premium amortization on December 31, 2020. (c) The payment of interest on January 1, 2021. (d) The redemption of the bonds at maturity, assuming interest for the last interest period has been paid and recorded. Date Account Titles and Explanation Debit Credit > >arrow_forwardMarigold Corporation issued $660,000 of 6% bonds on May 1,2025 . The bonds were dated January 1,2025 , and mature January 1 , 2028 , with interest payable July 1 and January 1 . The bonds were issued at face value plus accrued interest. Prepare Marigold's journal entries for (a) the May 1 issuance, (b) the July 1 interest payment, and (c) the December 31 adjusting entry.arrow_forwardOn February 1, Clayton Co. issued $1,300,000 of 20-year, 9% bonds for $1,225,000. Interest is payable semiannually on February 1 and August 1. Present the entries to record the following transactions:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education