FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

tuejejjeh3h

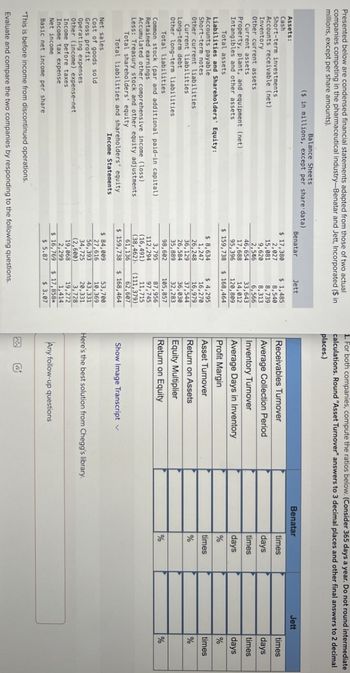

Transcribed Image Text:Presented below are condensed financial statements adapted from those of two actual

companies competing in the pharmaceutical industry-Benatar and Jett, Incorporated ($ in

millions, except per share amounts).

Balance Sheets

($ in millions, except per share data)

1. For both companies, compute the ratios below. (Consider 365 days a year. Do not round intermediate

calculations. Round "Asset Turnover" answers to 3 decimal places and other final answers to 2 decimal

places.)

Assets:

Cash

Short-term investments

Accounts receivable (net)

Inventory

Other current assets

Current assets

Property, plant, and equipment (net)

Intangibles and other assets

Total assets

Liabilities and Shareholders' Equity:

Accounts payable

Short-term notes

Other current liabilities

Current liabilities

Long-term debt

Other long-term liabilities

Total liabilities

Benatar

Jett

Benatar

Jett

$ 17,380

$ 1,485

Receivables Turnover

times

2,027

8,540

times

15,081

8,739

9,620

8,313

Average Collection Period

days

days

2,546

6,566

46,654

33,643

Inventory Turnover

times

times

17,688

14,012

95,396

120,809

$ 159,738

$ 168,464

Average Days in Inventory

Profit Margin

days

days

%

%

$ 8,634

1,247

26,248

$ 4,295

16,270

16,979

Asset Turnover

times

times

Return on Assets

36,129

37,544

%

%

26,584

36,030

35,889

32,283

Equity Multiplier

98,602

105,857

Return on Equity

%

%

3,795

87,956

97,745

11,715

Common stock (par and additional paid-in capital)

Retained earnings

Accumulated other comprehensive income (loss)

Less: Treasury stock and other equity adjustments

Total shareholders' equity

112,294

(16,491)

(38,462).

61,136

(111,379)

62,607

$ 168,464

Show Image Transcript

Total liabilities and shareholders' equity

$ 159,738

Income Statements

Gross profit

Operating expenses

Net sales

Cost of goods sold

Other (income) expense-net

Income before taxes

$ 84,009

53,700

27,616

10,369

56,393

43,331

34,725

20,331

Here's the best solution from Chegg's library.

(2,600)

3,728

19,068

19,272

Income tax expense

2,299

1,414

Net income

Basic net income per share

$ 16,769

$ 17,858*

$ 5.87

$ 3.07

Any follow-up questions

*This is before income from discontinued operations.

Evaluate and compare the two companies by responding to the following questions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- hi im looking at the solution above and have a quuestion-im a littlepuzzled on exactly how i should be plugging in the numbersfor example, the chart liists Time (ln2/(ln(1+r)) but how exactly should i type this in my calculatorto get =l3/J3? maybe im overthinking itarrow_forwardmyedio.com Question 12 Listen Use the function f(x)=2x-5 • Find the inverse of f(x). . . Graph f(x) and f(x) and state the domain of each function. Prove that f(x) and f¹(x) are inverses, both graphically and algebraically. ATTACHMENTS W Algebra2 U9 UnitTest_Q17 docx 146.32 KBarrow_forwardReq1-Req2 were incorrect. Can you try the problem again ?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education