Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

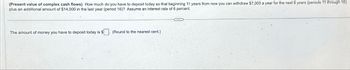

Transcribed Image Text:(Present value of complex cash flows) How much do you have to deposit today so that beginning 11 years from now you can withdraw $7,000 a year for the next 6 years (periods 11 through 16)

plus an additional amount of $14,000 in the last year (period 16)? Assume an interest rate of 6 percent.

The amount of money you have to deposit today is $ ☐ (Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Investment X offers to pay you $4,700 per year for 9 years, whereas Investment Y offers to pay you $6,400 per year for 5 years. a. If the discount rate is 8 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. If the discount rate is 20 percent, what is the present value of these cash flows?arrow_forwardWhat is the present value of a perpetual stream of cash flows that pays $80,000 at the end of year one and then grows at a rate of 6% per year indefinitely? The rate of interest used to discount the cash flows is 10%. The present value of the growing perpetuity is $enter your response here. (Round to the nearest cent.)arrow_forwardIn saving for a future major purchace, Oksana has been making uniform deposits of $5,000 per year in an account that has earned variable annual interest rates of i1 = 12 = i3 = 5% and i4 = i5 = 7% (see cash flow diagram below). How much does she have in the account immediately after making the last deposit? The account will have $ i₁ i₂ m i3 (Round to the nearest dollar.) i5arrow_forward

- Calculate the present values at t = 0 (now) of the following cash flows: j. The first cash flow at t = 1 is $100. Every year thereafter, the payment increases by 3% over the previous year’s payment. This continues for 9 years past the first payment (for a total of 10 payments). What is the present value of this growing annuity if the effective annual discount rate is .02 (2%)? k. $50 every year and a half forever, with the first payment after 1.5 years, where the effective annual rate is .05 (i.e., 5%).arrow_forwardPlease advise on these time value of money practice problems. How would you solve these using a financial calculator? What values would you enter for N, I/YR, PV, PMT, and FV ? a) Calculate the PV when you plan to receive $5,000 in 5 years with a 10% discount rate. b) Calculate the FV of a $10,000 deposit today for 10 years @ 5%. c) What is the PV of receiving $2,500 for each of the next 5 years with a 10% discount rate?arrow_forwardA sum of $10,000 now (time 0) is equivalent to the following cash flow diagram. What is the value of $B if the annual interest rate is 3%? Ⓡ $1,200 The value of $B is $ (Round to the nearest dollar.) $10,000 1 2 $1,200 3 Click the icon to view the interest and annuity table for discrete compounding when i = 3% per year. $2,000 $B 5 End of Year 6 37arrow_forward

- You have an opportunity to make an investment that will pay $ 300 at the end of the first year, $ 100 at the end of the second year, $ 200 at the end of the third year, $ 400 at the end of the fourth year, and $500 at the end of the fifth year. a. Find the present value if the interest rate is 9 percent. (Hint: You can simply bring each cash flow back to the present and then add them up. Another way to work this problem is to either use the =NPV function in Excel or to use your CF key on a financial calculator —but you'll want to check your calculator's manual before you use this key. Keep in mind that with the =NPV function in Excel, there is no initial outlay. That is, all this function does is bring all the future cash flows back to the present. With a financial calculator, you should keep in mind that CF0 is the initial outlay or cash flow at time 0, and, because there is no cash flow at time 0, CF0 =0.) b. What would happen to the…arrow_forwardA financial instrument just paid the investor $127 last year. The cash flow is expected to last forever and increase at a rate of 1.6 percent annually. If you use a 5.2 percent discount rate for investments like this, what should be the price you are willing to pay for this financial instrument? (Round to the nearest dollar.)arrow_forward1.You expect to receive AED 400,000 a year for the next 10 years and this amount will grow at a rate of 6% . What is the present value of the expected cash flows for the next 10 years if the interest rate is 8% per year?arrow_forward

- 1.arrow_forwardConsider a stream of cash flows, where you receive $2,000.00 per year for 20 yearsEXCEPT year 12 during which you receive only $1,000.00. If the current market rate ofinterest is 7.200% (compounded annually), then what is the present value of this stream ofuneven cash flows? Hint: there are several ways to solve this problem but see if you cansolve it using a single annuity formula.arrow_forwardIn saving for a future major purchace, Oksana has been making uniform deposits of $4,000 per year in an account that has earned variable annual interest rates of i1 = 12 = 13= 8% and i4 = 15 = 10% (see cash flow diagram below). How much does she have in the account immediately after making the last deposit? i₁ 1₂ 12 The account will have $ 13 i4 is *** (Round to the nearest dollar.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education