FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:12

34567

20

8 Additional paid-in capital-common

9 Additional paid-in capital-preferred

10 Accounts payable

11 Accounts receivable

12 Common stock, $2 par

13 Preferred stock, $10 par

22225

21

A

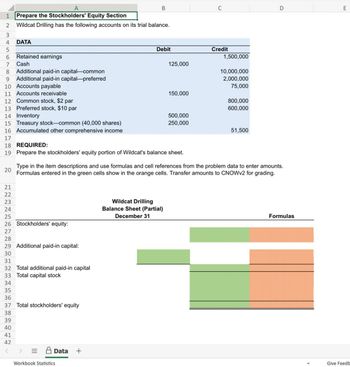

Prepare the Stockholders' Equity Section

Wildcat Drilling has the following accounts on its trial balance.

23

DATA

24

Retained earnings

Cash

14 Inventory

15 Treasury stock-common (40,000 shares)

16 Accumulated other comprehensive income

17

18 REQUIRED:

19 Prepare the stockholders' equity portion of Wildcat's balance sheet.

B

25

26 Stockholders' equity:

27

28

29 Additional paid-in capital:

30

31

32 Total additional paid-in capital

33 Total capital stock

34

35

36

37 Total stockholders' equity

38

39

40

41

42

<

Data +

Debit

Workbook Statistics

125,000

150,000

Wildcat Drilling

Balance Sheet (Partial)

December 31

500,000

250,000

C

Credit

1,500,000

10,000,000

2,000,000

75,000

Type in the item descriptions and use formulas and cell references from the problem data to enter amounts.

Formulas entered in the green cells show in the orange cells. Transfer amounts to CNOWV2 for grading.

800,000

600,000

51,500

D

Formulas

E

Give Feedb

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- yby external tool Using the information below, compute ending retained earnings. Additional Paid-in Capital, Common $ 9,000 Accounts Payable 1,100 Total Expenses 7,800 Preferred Stock, at par 1,750 Common Stock, at par 400 Sales 10,000 Treasury Stock 250 Dividends 700 Retained Earnings (beginning) 1,000 Additional Paid-in Capital, Prefeered 50 O $2.500 $2.750 O$11.250 O$2.250 O$11.500 On what date does a declared cash dividend become a liability to be recordearrow_forwardContributed capital: Western Grass, Inc. Equity Section of Balance Sheet December 31, 2823 Preferred shares, $3 cumulative, 10,000 shares authorized, issued and outstanding Common shares, 100,000 shares authorized; 65,000 shares issued and outstanding Total contributed capital Retained earnings Total equity 75,000 552,500 627 500 581 000 $1,208,500 Required: Using the Information provided, calculate book value per common share assuming: (Round the final answers to 2 decimal places.) a. There are no dividends in arrears. b. There are three years of dividends in arrears. Book Value of Common Sharesarrow_forwardPlease help me jn this sir accounting questionarrow_forward

- Required: Prepare the stockholders' equity section of the balance sheet for For Feet's Sake as of December 31, 2024. (Amounts to be deducted should be indicated by a minus sign.) FOR FEET'S SAKE Balance Sheet (Stockholders' Equity Section) December 31, 2024 Stockholders' equity: Retained earnings Common stock Additional paid-in capital Total paid-in capital Total stockholders' equity S 0arrow_forwardView Policies Current Attempt in Progress The following information is available for Metlock Hill Corporation: Beginning common stockholders equity $790,000 Dividends paid to common stockholders 60,000 Dividends paid to preferred stockholders 32,000 Ending common stockholders'equity 1,000,000 Net income 219,950 Based on the preceding information, calculate return on common stockholders'equity. Return on common stockholders' equity eTextbook and Media Attempts: 0 of 3 used Submit Answer Save for Laterarrow_forwardEquity method journal entries (price equals book value) Prepare journal entries for the transactions below relating to an Equity Investment accounted for using the equity method. a. An investor purchases 14,400 common shares of an investee at $16 per share; the shares represent 25% ownership in the investee and the investor concludes that it can exert significant influence over the investee. b. The investee reports net income of $172,800. c. The investor receives a cash dividend of $1.50 per common share from the investee. d. The investor sells all 14,400 common shares of the investee for $260,280. General Journal Ref. Description Debit Credit a. b. C. d. Equity investmentarrow_forward

- Please Complete all requirement And do not Give image formatarrow_forwardPlease help me with show all calculation thankuarrow_forwardReporting Paid-In Capital The following accounts and their balances were selected from the adjusted trial balance of Block Ayala Group Inc., a freight forwarder, at October 31, the end of the current fiscal year: Common Stock, no par, $14 stated value $700,000 Paid-In Capital from Sale of Treasury Stock 404,900 Paid-In Capital in Excess of Par-Preferred Stock 106,560 Paid-In Capital in Excess of Stated Value-Common Stock 1,680,000 Preferred 2% Stock, $120 par 888,000 Retained Earnings 4,989,000 Prepare the Paid-In Capital portion of the Stockholders' Equity section of the balance sheet using Method 1 of Exhibit 8. There are 160,000 shares of common stock authorized and 20,000 shares of preferred stock authorized. Block Ayala Group Inc., Stockholders' Equity October 31 Paid-In Capital: Total Paid-In Capitalarrow_forward

- Please answer in text form without imagearrow_forwardThe stockholders' equity section of The Seventies Shop is presented here THE SEVENTIES SHOP Balance Sheet (partial) ($ in thousands) Stockholders' equity: Preferred stock, $50 par value Common stock, $5 par value Additional paid-in capital Total paid-in capital Retained earnings Treasury stock Total stockholders' equity se 17,500 70,000 87,500 50,500 (3,200) $134,800 Based on the stockholders' equity section of The Seventies Shop, answer the following questions. Remember that all amounts are presented in thousands Dividends paid 4. If retained earnings at the beginning of the period was $42 million and net income during the year was $13.450,000, how much was paid in dividends for the year? (Enter your answer in dollars not in millions. (i.e., 5 should be entered as 5,000,000).)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education