FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

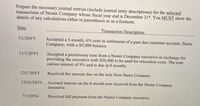

Transcribed Image Text:Prepare the necessary journal entries (include journal entry descriptions) for the selected

transactions of Nester Company whose fiscal year end is December 31, You MUST show the

details of any calculations either in parenthesis or as a footnote.

Date

Transaction Description

7/1/20Y5

Accepted a 5-month, 6% note in settlement of a past due customer account, Barns

Company, with a $9,000 balance.

11/1/20Y5

Accepted a promissory note from a Nester Company executive in exchange for

providing the executive with S20,000 to be used for relocation costs. The note

carries interest of 9% and is due in 8 months.

12/1/20Y5

Received the amount due on the note from Barns Company.

12/31/20Y5 Accrued interest on the 8-month note received from the Nester Company

executive.

7/1/20Y6

Received full payment from the Nester Company executive.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Paper Company receives a $6,000, 3-month, 6% promissory note from Dame Company in settlement of an open accounts receivable. What entry will Paper Company make upon receiving the note?arrow_forwardJournal Entries for Accounts and Notes ReceivableLancaster, Inc., began business on January 1. Certain transactions for the year follow: Jun.8 Received a $18,000, 60 day, eight percent note on account from R. Elliot. Aug.7 Received payment from R. Elliot on her note (principal plus interest). Sep.1 Received a $21,000, 120 day, nine percent note from B. Shore Company on account. Dec.16 Received a $17,000, 45 day, ten percent note from C. Judd on account. Dec.30 B. Shore Company failed to pay its note. Dec.31 Wrote off B. Shore's account as uncollectible. Lancaster, Inc., uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $25,600. An analysis of aged receivables indicates that the desired balance of the allowance account should be $22,500. Dec.31 Made the…arrow_forwardOn April 12, Hong Company agrees to accept a 60-day, 10%, $5,200 note from Indigo Company to extend the due date on an overdue account payable. What is the journal entry made by Indigo Company to record the transaction? Multiple Choicearrow_forward

- On May 22, Jarrett Company borrows $8,800, signing a 90-day, 8%, $8,800 note. What is the journal entry made by Jarrett Company to record the transaction? Multiple Choice Debit Cash $8,800; credit Accounts Payable $8,800. Debit Accounts Payable $8,800; credit Notes Payable $8,800. Debit Cash $8,976; credit Notes Payable $8,976. Debit Cash $8,800; credit Notes Payable $8,800. Debit Notes Receivable $8,800; credit Cash $8,800.arrow_forwardHelp me to entry particulararrow_forwardPlease help mearrow_forward

- Entries for notes payable A business issued a 60-day, 15% note for $85,000 to a creditor on account. Journalize the entries to record (a) the issuance of the note and (b) the payment of the note at maturity, including interest. Assume a 360 days in a year. If an amount box does not require an entry, leave it blank. If required, round yours answers to whole dollar.arrow_forwardJournalize the following transactions of Upton Drugs: Transactions: July 8 Received a $180,000, 90-day, 8% note dated July 8 from Miracle Chemical on account. Oct. 6 The note is dishonored by Miracle Chemical. Nov. 5 Received the amount due on the dishonored note plus interest for 30 days at 10% on the total amount charged to Miracle Chemical on Oct. 6. Required: Journalize the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Assume a 360-day year when calculating interest. CHART OF ACCOUNTSUpton DrugsGeneral Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Batson Co. 122 Accounts Receivable-Bynum Co. 123 Accounts Receivable-Calahan Inc. 124 Accounts Receivable-Dodger Co. 125 Accounts Receivable-Fronk Co. 126 Accounts Receivable-Miracle Chemical 127 Accounts Receivable-Solo Co. 128 Accounts Receivable-Watson Co. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132…arrow_forwardDanali Corporation borrowed $400,000 on October 1. The note carried a 13 percent interest rate with the principal and interest payable on May 1 of next year. Prepare the following journal entries. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheetarrow_forward

- On August 1, 2021, Avonette, Inc., sold equipment and accepted a six-month, 9%, $50,000 note receivable. Avonette's year-end is December 31. Which of the following accounts will Avonette credit in the journal entry at maturity on February 1, 2022, assuming collection in full? O A. Interest Receivable B. Cash OC. Interest Payable O D. Note Payablearrow_forwardJournalize the following transactions for the Scott Company. Assume 360 days per year. November 4: Received a $6,500, 90-day, 6% note from Tim's Co.in payment of the account. If an amount box does not require an entry, leave it blank. Nov. 4 December 31: Accrued interest on the Tim's Co. note. If an amount box does not require an entry, leave it blank. Round your answers to two decimal places. Dec. 31 February 2: Received the amount due from Tim's Co. on the note. If an amount box does not require an entry, leave it blank. Round your answers to two decimal places. Feb. 2arrow_forwardOn October 1, Dutta Incorporated borrowed $82 million and issued a nine-month promissory note. Interest was discounted at issuance at a 13% discount rate. Prepare the journal entry for the issuance of the note and the appropriate adjusting entry for the note at December 31, the end of the reporting period. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education