FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

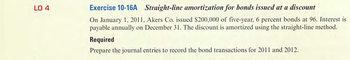

Transcribed Image Text:LO 4

Exercise 10-16A Straight-line amortization for bonds issued at a discount

On January 1, 2011, Akers Co. issued $200,000 of five-year, 6 percent bonds at 96. Interest is

payable annually on December 31. The discount is amortized using the straight-line method.

Required

Prepare the journal entries to record the bond transactions for 2011 and 2012.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For a standard U.S. Treasury bond, when are the following characteristics of the bond determined? The amounts of any interest payments. The dates of any interest payments. The bond's market yield. The bond's market price. The amount that the Treasury returns to the bondholder, when the bond matures. The price that the bondholder pays to the Treasury to acquire the bond. The maturity date. 1. 2. Fixed before the bonds are sold and does not change. Fixed when the bonds are sold and does not change. 3. Fluctuates continually.arrow_forwardDemonstrate how to identify and account for debt investments classified for reporting purposes as available-for-sale securities.arrow_forwardHow are the bonds issued, what is the appropriate journal entry? Provide example for issuing bonds. How do we determine the present value of a bond when market rate differs from its contract rate? How do we record the interest payment (provide examples for both premium and discount amortization), using the effective interest method? What is the difference between the effective interest method and the straight line method when amortizing either a discount or a premium? Cite and give credit to the author that you are citing.arrow_forward

- Write a short note on Securities and Exchange Commission.arrow_forwardI'm trying to figure out what dates I need to use for my journal entries. I have already put July 1 and december 31 in my 2019 journal section and then june 30 for my 2020 section and it keeps telling me I'm wrong I don't get it. My numbers are right just not my dates. Effective Interest Premium Amortization Ex. 14.08 " Prepare the journal entries to record the issue of the bonds on July 1, 2019, and the interest payments on December 31, 2019, and June 30, 2020." Polk Incorporated issued $200,000 of 13% bonds on July 1, 2019, for $206,801.60. The bonds were dated January 1, 2019, pay interest on each June 30 and December 31, are due December 31, 2020, and were issued to yield 12%. Polk uses the effective interest method of amortization. Required: Prepare the journal entries to record the issue of the bonds on July 1, 2019, and the interest payments on December 31, 2019, and June 30, 2020. In addition, prepare a bond interest expense and premium amortization schedule for the bonds…arrow_forwardHow to record the inteest on a bond in journal entry form.arrow_forward

- Please see below. Need help with this.arrow_forwardHow is the retirement of bonds recorded?arrow_forwardEntity A has an incentive compensation plan under which the sales manager receives a bonus equal to 10percent of the company's income after deductions for bonus and income taxes. Income before bonus and incometaxes is P500,000. The effective income tax rate is 30 percent. How much is the amount of bonus (rounded to the nearest peso)?a. 32,710 b. 60,748 c. 30,974 d. 37,210 How much is the amount of income tax?a. 131,776 b. 140,708 c. 138,837 d. 140,187arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education