FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

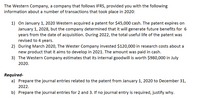

Transcribed Image Text:The Western Company, a company that follows IFRS, provided you with the following

information about a number of transactions that took place in 2020:

1) On January 1, 2020 Western acquired a patent for $45,000 cash. The patent expires on

January 1, 2028, but the company determined that it will generate future benefits for 6

years from the date of acquisition. During 2022, the total useful life of the patent was

revised to 4 years.

2) During March 2020, The Wester Company invested $120,000 in research costs about a

new product that it aims to develop in 2021. The amount was paid in cash.

3) The Western Company estimates that its internal goodwill is worth $980,000 in July

2020.

Required-

a) Prepare the journal entries related to the patent from January 1, 2020 to December 31,

2022.

b) Prepare the journal entries for 2 and 3. If no journal entry is required, justify why.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: accountingarrow_forwardWildhorse Company, a machinery dealer, leased a machine to Dexter Corporation on January 1, 2020. The lease is for an 8-year period and requires equal annual payments of $30,384 at the beginning of each year. The first payment is received on January 1, 2020. Wildhorse had purchased the machine during 2019 for $130,000. Collectibility of lease payments by Wildhorse is probable. Wildhorse set the annual rental to ensure a 6% rate of return. The machine has an economic life of 10 years with no residual value and reverts to Wildhorse at the termination of the lease.arrow_forwardWhat does interim testing mean? Give some examples of substantive tests that can be done before the end of the year?arrow_forward

- Prepare all of the journal entries for the lessor for 2020 and 2021 to record the lease agreement, the receipt of lease payments, and the recognition of revenue. Assume the lessor's annual accounting period ends on December 31, and it does not use reversing entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Account Titles and Explanation Date 1/1/20 /1/20 2/31/20 /1/21 2/31/21 Lease Receivable Cost of Goods Sold Sales Revenue (To record the lease) Cash Lease Receivable (To record the receipt of lease payment) Lease Receivable Interest Revenue Cash Lease Receivable Lease Receivable Interest Revenue Debit 451,000.00 I Credit 451,000.00arrow_forwardRecorded an adjusting journal entry for the portion of insurance coveragearrow_forwardQw.142arrow_forward

- The Claims Made Policy Form will pay for looses that occur at which of the following times? After the expiration date of the policy Before the retroactive date, and reported during the policy term During the policy term, and presented after the policy term After the expiration date, and reported during the policy termarrow_forward990.arrow_forwardPrepare the journal entry for the salaries and wages paid.arrow_forward

- I need help on the arrows where I am pointing at.arrow_forwardPrepare all of Blossom's journal entries for 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)arrow_forwardOn May 14, a prospect completes an applicalion for insurance. The producer collects the initial premium and issues a conditional receipt. The insurance company determines that the prospedt is insurable and issues a standard policy on May 26. If the producer delivers the policy to the insured on June 1, the effective date of coverage is A. May 14 B. May 24 C. May 26 D. June 1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education