FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

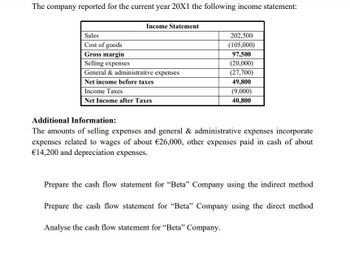

Transcribed Image Text:The company reported for the current year 20X1 the following income statement:

Sales

Cost of goods

Gross margin

Income Statement

Selling expenses

General & administrative expenses

Net income before taxes

Income Taxes

Net Income after Taxes

202,500

(105,000)

97,500

(20,000)

(27,700)

49,800

(9,000)

40,800

Additional Information:

The amounts of selling expenses and general & administrative expenses incorporate

expenses related to wages of about €26,000, other expenses paid in cash of about

€14,200 and depreciation expenses.

Prepare the cash flow statement for "Beta" Company using the indirect method

Prepare the cash flow statement for "Beta" Company using the direct method

Analyse the cash flow statement for "Beta" Company.

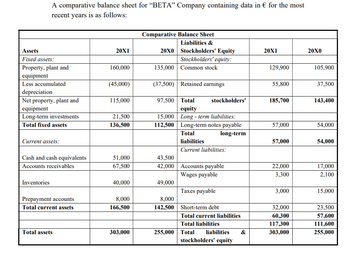

Transcribed Image Text:A comparative balance sheet for "BETA" Company containing data in € for the most

recent years is as follows:

Assets

Fixed assets:

Property, plant and

equipment

Less accumulated

depreciation

Net property, plant and

equipment

Long-term investments

Total fixed assets

Current assets:

Cash and cash equivalents

Accounts receivables

Inventories

Prepayment accounts

Total current assets

Total assets

20X1

160,000

(45,000)

115,000

21,500

136,500

51,000

67,500

40,000

8,000

166,500

303,000

Comparative Balance Sheet

Liabilities &

20X0

Stockholders' Equity

Stockholders' equity:

135,000 Common stock

(37,500) Retained earnings

97,500 Total

equity

15,000 Long-term liabilities:

112,500

Long-term notes payable

Total

long-term

liabilities

Current liabilities:

8,000

142,500

stockholders'

43,500

42,000 Accounts payable

Wages payable

49,000

Taxes payable

Short-term debt

Total current liabilities

Total liabilities

255,000 Total liabilities &

stockholders' equity

20X1

129,900

55,800

185,700

57,000

57,000

22,000

3,300

3,000

32,000

60,300

117,300

303,000

20X0

105,900

37,500

143,400

54,000

54,000

17,000

2,100

15,000

23,500

57,600

111,600

255,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following items are included in calculating Firm Free Cash Flow? I. Cost of goods sold II. Depreciation expense III. Interest expense IV. Capital expenditures A. I and II. B. I, II and IV. C. II, III and IV. D. I and III.arrow_forwardUsing the direct method of preparing the statement of cash flows, to determine the cash effects of operating activities, which of the following needs to be adjusted? a. Equity as reported in the balance sheet b. Long-term assets and liabilities from the balance sheet c. Net income d. Reported revenues and expensesarrow_forwardHow do I find what the net increase or decrease is in cash on a Statement of Cash Flow?arrow_forward

- Prepare a statement of cash flows using the indirect methodarrow_forwardWhich of the following is not a purpose of cash flows statement. Select one: O a. They predict net income. O b. They help evaluate management decisions. c. The predict ability to pay debts or dividends. O d. They predict future flows.arrow_forwardAccounting Questionarrow_forward

- A measure that helps estimate the amount and timing of cash flows from operating activities is the cash flow on total assets ratio. True or False True Falsearrow_forwardUse ulate the cash flow from operating activities using the indirect method. AA. Statement of Cash Flows (Indirect Method) Use the following information regarding the Surpa Corporation to (a) prepare a statement of cash flows using the indirect method and (b) compute Surpa's operating-cash-flow -to-current-liabilities ratio. Accounts payable increase. . Accounts receivable increase. . . Accrued liabilities decrease . .. Amortization expense. . Cash balance, January 1.. . Cash balance, December 31.. Cash paid as dividends ... Cash paid to purchase land . .. Cash paid to retire bonds payable at par. . Cash received from issuance of common stock... Cash received from sale of equipment . .. Depreciation expense. .. Gain on sale of equipment . . .. Inventory decrease. . . Net income. . .. am . . . $ 13,000 .. 4,000 6,000 7,000 21,000 17,000 31,000 90,000 60,000 40,000 17,000 29,000 7,000 13,000 78,000 3,000 140,000 Prepaid expenses increase ... Average current liabilities. .. A. Cash Flow…arrow_forwardPlease explain how to prepare a statement of cash flows (indirect method) including analyzing tables? Please provide an example. Thank you,arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education