FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Prepare

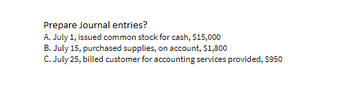

Transcribed Image Text:Prepare Journal entries?

A. July 1, issued common stock for cash, $15,000

B. July 15, purchased supplies, on account, $1,800

C. July 25, billed customer for accounting services provided, $950

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 8arrow_forwarde File Edit View History Bookmarks Profiles Tab Window Help Week 4 Home X Short Exercis X G Dalton Hair St X C For each acco X plus.pearson.com/products/658729f2-cb81-45ee-babb-bf032e847a35/pages/urn:pearso... ☆ 5 6 32 Total 33 Net (b) 34 Total 35 A partial worksheet for Ramey Law Firm is presented below. Solve for the missing information. A 6 32 Total 33 Net (c) 34 Total 35 End of Chapter: Completing the Accounting Cycle A J Income Statement Debit (a) 8,375 (d) Credit $ 24,850 (e) $ 24,850 JA 23 Income Statement Debit $ 22,400 K Credit (a) F4-34 S-F:4-8. Determining net loss using a worksheet (Learning Objective 2) A partial worksheet for Aaron Adjusters is presented below. Solve for the missing information. 5,300 (f) L ▶ M Balance Sheet Debit $ 211,325 C For each acce X (e) L Debit (b) (d) (g) Credit $ 202,950 tv (c) (f) Balance Sheet M Credit $61,400 + $ 61,400 AA ⠀arrow_forwardChart of Accounts Common Stock Cash Accounts Receivable Retained Earnings Supplies Dividends Prepaid Rent Office Equipment Accounts Payable Notes Payable Unearned Fees Fees Earned Salary Expense Rent Expense Supplies Expense Interest Expense Utility Expense During the month of June, Acme Inc. entered into the following transactions: 1 Transferred cash from a personal bank account in exchange for stock, $100,000 3 Recorded services provided on account, $9,100 5 Received cash from clients as an advance payment for services to be provided in July, $12,500 7 Purchased Office Equipment for $5,000, paying $500 cash and signing a Note for the remainder. 9 Receive cash for services provided: $5,000 10 Paid part-time receptionist for two weeks' salary $1,750 12 Purchased office supplies from Staples on account, $1,200 14 Billed clients for fees earned; $2,500 16 Paid $1,000 for 3 months rent for the months of July - September 18 Paid Staples, $600 24 Received cash from clients on account,…arrow_forward

- A seller uses a perpetual inventory system, and on April 17, a customer returns $1,000 of merchandise previously purchased on credit on April 13. The seller's cost of the merchandise returned was $480. The merchandise is not defective and is restored to inventory. The seller has not yet received any cash from the customer.arrow_forwardQuestion 4 of 20: Select the best answer for the question 4. The process of entering journal page numbers of transactions in the ledger and then entering the account numbers in the journal is referred to as OA. balancing OB. journalizing OC. cross-adding. D. cross-referencing Mark for review (Will be highlighted on the review page) Previous Question Next Questionarrow_forwardRequirements Sheet in Workbook Requirement 1—Prepare the Journal Entries in the General Journal Journal Entries Requirement 2—Post Journal Entries to the General Ledger General Ledger Requirement 3—Prepare a Trial Balance Trial Balance Requirement 4—Prepare the Adjusting Entries Adjusting Entries Requirement 5—Post Adjusting Entries to the General Ledger General Ledger Requirement 6—Prepare an Adjusted Trial Balance Adjusted Trial Balance Requirement 7—Prepare the Financial Statements Financial Statements Requirement 8—Prepare the Closing Entries Closing Entries Requirement 9—Post Closing Entries to the General Ledger General Ledger Requirement 10—Prepare the Post Closing Trial Balance Post-Closing Trial Balance During its first month of operation, the Quick Tax Corporation, which specializes in tax preparation, completed the following transactions. July 1 Began business by making a deposit in a company…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education