FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Tanner-UNF Corporation acquired as a long-term investment $240 million of 6% bonds, dated July 1, on July 1, 2024. Company

management has the positive intent and ability to hold the bonds until maturity. The market interest rate (yield) was 8% for bonds of

similar risk and maturity. Tanner-UNF paid $200 million for the bonds. The company will receive interest semiannually on June 30 and

December 31. As a result of changing market conditions, the fair value of the bonds at December 31, 2024, was $210 million.

Required:

1. & 2. Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1, 2024 and interest on December 31, 2024,

at the effective (market) rate.

3. At what amount will Tanner-UNF report its investment in the December 31, 2024, balance sheet?

4. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on

January 2, 2025, for $190 million. Prepare the journal entry to record the sale.

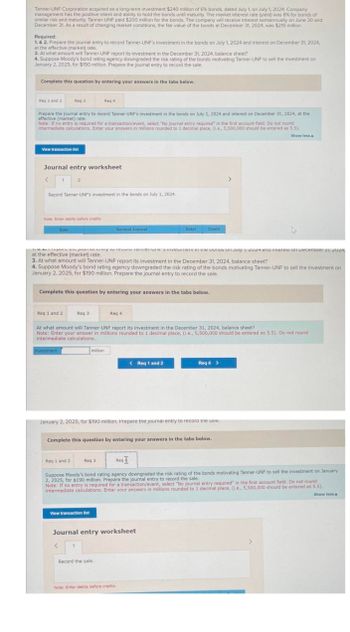

Complete this question by entering your answers in the tabs below.

Req 1 and 2

Prepare the journal entry to record Tanner-UNF's investment in the bonds on July 1, 2024 and interest on December 31, 2024, at the

effective (market) rate.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round

intermediate calculations. Enter your answers in millions rounded to 1 decimal place, (.e., 5,500,000 should be entered as 5.5).

Show less A

View transaction list

Req 3

Journal entry worksheet

1

Record Tanner-UNF's investment in the bonds on July 1, 2024.

Note: Enter debits before credits.

Date,

Req 1 and 2

vestment

2

Req 4

un journey wie erns vesunene onus on July 1, 2024 aru merest on December 31, 2024,

at the effective (market) rate.

3. At what amount will Tanner-UNF report its investment in the December 31, 2024, balance sheet?

4. Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on

January 2, 2025, for $190 million. Prepare the journal entry to record the sale.

Complete this question by entering your answers in the tabs below.

Req 3

Req 1 and 2

At what amount will Tanner-UNF report its investment in the December 31, 2024, balance sheet?

Note: Enter your answer in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5). Do not round

intermediate calculations.

million

< 1

General Journal

Reg 3

View transaction list

Req 4

January 2, 2025, for $190 million. Prepare the journal entry to record the sale.

Debit

Complete this question by entering your answers in the tabs below.

Record the sale.

Credit

< Req 1 and 2

Req

Suppose Moody's bond rating agency downgraded the risk rating of the bonds motivating Tanner-UNF to sell the investment on January

2, 2025, for $190 million. Prepare the journal entry to record the sale.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round

intermediate calculations. Enter your answers in millions rounded to 1 decimal place, (i.e., 5,500,000 should be entered as 5.5).

Show less A

Journal entry worksheet

Note: Enter debits before credits.

Reg 4 >

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Prepare any

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Prepare any

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fuzzy Monkey Technologies, Incorporated purchased as a long-term investment $150 million of 6% bonds, dated January 1, on January 1, 2024. Management has the positive intent and ability to hold the bonds until maturity. For bonds of similar risk and maturity the market yield was 8%. The price paid for the bonds was $133 million. Interest is received semiannually on June 30 and December 31. Due to changing market conditions, the fair value of the bonds at December 31, 2024, was $140 million. Required: 1. to 3. Prepare the relevant journal entries on the respective dates (record the interest at the effective rate). 4. At what amount will Fuzzy Monkey report its investment in the December 31, 2024 balance sheet? 5. How would Fuzzy Monkey's 2024 statement of cash flows be affected by this investment? (If more than one approach is possible, indicate the one that is most likely.)arrow_forwardOn February 1, 2021, Cromley Motor Products issued 10% bonds, dated February 1, with a face amount of $90 million. The bonds mature on January 31, 2025 (4 years). The market yield for bonds of similar risk and maturity was 12%. Interest is paid semiannually on July 31 and January 31. Barnwell Industries acquired $90,000 of the bonds as a long-term investment. The fiscal years of both firms end December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required:1. Determine the price of the bonds issued on February 1, 2021.2-a. Prepare amortization schedules that indicate Cromley’s effective interest expense for each interest period during the term to maturity.2-b. Prepare amortization schedules that indicate Barnwell’s effective interest revenue for each interest period during the term to maturity.3. Prepare the journal entries to record the issuance of the bonds by Cromley and Barnwell’s investment on…arrow_forwardOn January 1, 2024, Rupar Retallers purchased $100,000 of Anand Company bonds at a discount of $6,000. The Anand bonds pay 6% interest but were purchased when the market interest rate was 7% for bonds of similar risk and maturity. The bonds pay interest semiannually on June 30 and December 31 of each year. Rupar accounts for the bonds as a held-to-maturity Investment, and uses the effective interest method. In Rupar's December 31, 2024, journal entry to record the second period of Interest, Rupar would record a credit to interest revenue of Multiple Choice O O $3,000 $3,500 $1.300arrow_forward

- Solve this issuearrow_forwardHello, Can you assist with questions attached, thanks much.arrow_forwardFuzzy Monkey Technologies, Incorporated purchased as a long-term investment $150 million of 6% bonds, dated January 1, on January 1, 2024. Management intends to have the investment available for sale when circumstances warrant. When the company purchased the bonds, management elected to account for them under the fair value option. For bonds of similar risk and maturity the market yield was 8%. The price paid for the bonds was $133 million. Interest is received semiannually on June 30 and December 31. Due to changing market conditions, the fair value of the bonds at December 31, 2024, was $140 million. Required: 1. to 3. Prepare the relevant journal entries on the respective dates (record the interest at the effective rate). 4-a. At what amount will Fuzzy Monkey report its investment in the December 31, 2024, balance sheet? 4-b. Prepare the journal entry necessary to achieve this reporting objective. 5. How would Fuzzy Monkey’s 2024 statement of cash flows be affected by this…arrow_forward

- Fuzzy Monkey Technologies Inc purchased as a long-term investmetn $60 million of 6% bonds, dated Jan 1, on Jan 1 2021. Management has the positive intent and ability to hold the bonds until maturity. For bonds of similar risk and maturity the market yield was 8%. The price paid for the bonds was $46 million. Interest is received semianually on June 30 and Dec 31. Due to changing market conditions the fair value of the bonds at Dec 31 2021 was $50 million. 1 to 3. Prepare the relevant journal entries on the respective dates. 4. At what amount will Fuzzy Monkey report its investment in Dec 31, 2021 balance sheet? 5. How would Fuzzy Monkey's 2021 statement of cash flows be affected by this investment?arrow_forwardJSM Ltd. sold $6,010,000 of 8% bonds, which were dated March 1, 2023, on June 1, 2023. The bonds paid interest on September 1 and March 1 of each year. The bonds' maturity date was March 1, 2033, and the bonds were issued to yield 10%. JSM's fiscal year-end was February 28, and the company followed IFRS. On June 1, 2024, JSM bought back $2,010,000 worth of bonds for $1,910,000 plus accrued interest. (a) Your Answer Correct Answer (Used) Using 1. a financial calculator, or 2. Excel function PV, calculate the issue price of the bonds and prepare the entry for the issuance of the bonds. Hint: Use the account Interest Expense in your entry). (Round answer to O decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) (b) Account Titles and Explanation Cash Interest Expense Bonds…arrow_forwardOn February 1, 2021, Cromley Motor Products issued 9% bonds, dated February 1, with a face amount of $80 million. The bonds mature on January 31, 2025 (4 years). The market yield for bonds of similar risk and maturity was 10%. Interest is paid semiannually on July 31 and January 31. Barnwell Industries acquired $80,000 of the bonds as a long-term investment. The fiscal years of both firms end December 31.Required:1. Determine the price of the bonds issued on February 1, 2021.2. Prepare amortization schedules that indicate (a) Cromley’s effective interest expense and (b) Barnwell’s effective interest revenue for each interest period during the term to maturity.3. Prepare the journal entries to record (a) the issuance of the bonds by Cromley and (b) Barnwell’s investment on February 1, 2021.4. Prepare the journal entries by both firms to record all subsequent events related to the bonds through January 31, 2023.arrow_forward

- On January 1, 2023, Teal Corporation purchased a newly issued $1,425,000 bond. The bond matured on December 31, 2025, and paid interest at 6% every June 30 and December 31. The market interest rate was 8%. Teal's fiscal year-end is October 31, and the company had the intention and ability to hold the bond until its maturity date. The bond will be accounted using the amortized cost model. Click here to view Table A.2 - PRESENT VALUE OF 1- (PRESENT VALUE OF A SINGLE SUM) Click here to view Table A.4 - PRESENT VALUE OF AN ORDINARY ANNUITY OF 1 (a) X Your answer is incorrect. Calculate the price paid for the bond using a financial calculator or Excel functions. (Round answers to 2 decimal places, e.g. 52.75.) PV $ -1062917.95 4arrow_forwardFuzzy Monkey Technologies, Incorporated purchased as a long-term investment $240 million of 6% bonds, dated January 1, on January 1, 2024. Management has the positive intent and ability to hold the bonds until maturity. For bonds of similar risk and maturity the market yield was 8%. The price paid for the bonds was $219 million. Interest is received semiannually on June 30 and December 31. Due to changing market conditions, the fair value of the bonds at December 31, 2024, was $230 million. Required: 4. At what amount will Fuzzy Monkey report its investment in the December 31, 2024 balance sheet? 5. How would Fuzzy Monkey's 2024 statement of cash flows be affected by this investment? (If more than one approach is possible, indicate the one that is most likely.)arrow_forwardTanner-UNF Corporation acquired as a long-term investment $1 million of 10-year bonds on July 1, 2023. The purchase price of the bonds was $922,054. After receiving the first interest payment on December 31, 2023, the carrying value of the bonds was $925,106. The market price of the bonds on December 31, 2023, was $927,000. Assuming that Tanner - UNF intends to sell the bonds as soon as possible, how much will be reported as investment in bonds on Tanner - unf's balance sheet on a December 31st 2023?And in which section of the balance sheet will the investment appear?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education