FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

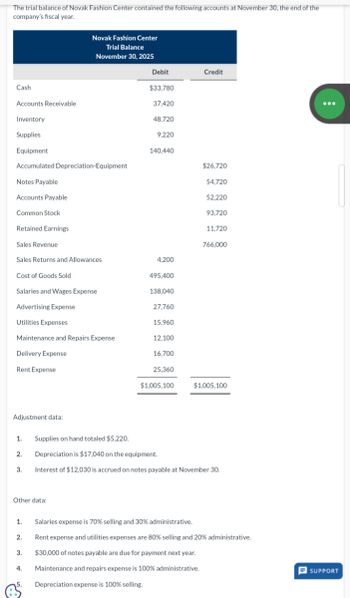

Transcribed Image Text:**Novak Fashion Center Trial Balance Overview**

**Date:** November 30, 2025

This trial balance outlines the financial position of Novak Fashion Center as of November 30, 2025, marking the end of the company's fiscal year. The document provides a detailed account of the organization's debits and credits, ensuring that both sides balance.

**Trial Balance Summary:**

- **Debits:**

- Cash: $33,780

- Accounts Receivable: $37,420

- Inventory: $48,720

- Supplies: $9,220

- Equipment: $140,440

- Sales Returns and Allowances: $4,200

- Cost of Goods Sold: $495,400

- Salaries and Wages Expense: $138,040

- Advertising Expense: $27,760

- Utilities Expenses: $15,960

- Maintenance and Repairs Expense: $12,100

- Delivery Expense: $16,700

- Rent Expense: $25,360

- **Credits:**

- Accumulated Depreciation-Equipment: $26,720

- Notes Payable: $54,720

- Accounts Payable: $52,220

- Common Stock: $93,720

- Retained Earnings: $11,720

- Sales Revenue: $766,000

- **Totals:**

- Debits: $1,005,100

- Credits: $1,005,100

**Adjustment Data:**

1. Supplies on hand totaled $5,220.

2. Depreciation is $17,040 on the equipment.

3. Interest of $12,030 is accrued on notes payable on November 30.

**Additional Information:**

1. Salaries expense is allocated as 70% selling and 30% administrative.

2. Rent expense and utilities expenses are divided into 80% selling and 20% administrative.

3. $30,000 of notes payable are due for payment next year.

4. Maintenance and repairs expense is entirely administrative.

5. Depreciation expense is exclusively selling.

Adjustments and categorizations are crucial for accurate financial reporting, affecting both the income statement and balance sheet presentations.

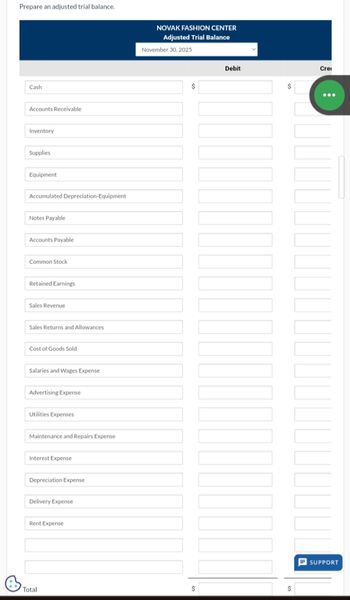

Transcribed Image Text:**Adjusted Trial Balance for Novak Fashion Center - November 30, 2025**

The adjusted trial balance for Novak Fashion Center is prepared to ensure that total debits equal total credits after adjustments. Below is a list of accounts included in the trial balance with columns for debit and credit amounts:

1. **Cash**

2. **Accounts Receivable**

3. **Inventory**

4. **Supplies**

5. **Equipment**

6. **Accumulated Depreciation - Equipment**

7. **Notes Payable**

8. **Accounts Payable**

9. **Common Stock**

10. **Retained Earnings**

11. **Sales Revenue**

12. **Sales Returns and Allowances**

13. **Cost of Goods Sold**

14. **Salaries and Wages Expense**

15. **Advertising Expense**

16. **Utilities Expenses**

17. **Maintenance and Repairs Expense**

18. **Interest Expense**

19. **Depreciation Expense**

20. **Delivery Expense**

21. **Rent Expense**

Each account has corresponding blank spaces for the debit and credit amounts. At the bottom, there are totals for both debit and credit columns, which should match once all adjustments are accurately entered.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the adjusted trial balance?arrow_forwardPrepare A Classified balance sheet, in report format, at June 30, 2020. READY HOSPITAL SUPPLIES ADJUSTED TRIAL BALANCE AS AT JUNE 30, 2020 ACCOUNT DEBIT CREDIT 1 Cash 127,000 2 A/c receivables 151,000 3 Allowance for bad debt 19,500 4 Prepaid insurance 48,000 5 Merchandise inventory 186,000 6 Store supplies 25,000 7 Prepaid rent 14,000 8 Furniture and fixtures 800,000 9 Accumulated depreciation-furniture & fixtures 320,000 10 Computer equipment 450,000 11 Accumulated depreciation-computer equipment 21,000 12 Interest payable 36,000 13 Accounts payable 133,500 14 Salaries payable 14,000 15 Unearned sales revenue 34,000 16 Portion of loan 90,000 17 Long term loan 270,000 18 Eva Ready Capital 898,500 19 Eva Ready Withdrawals 104,000 20 Sales revenue 1,091,000 21 Gain on computer equipment 14,000 22 Interest expense 36,000 23 Sales discount 7,000 24 Insurance expense 24,000 25…arrow_forwardPrepare the Adjusted Trial balance for the period ending June 30, 2020arrow_forward

- Open with Google Docs The following trial balance was extracted from the books of Fasuha Trading as at 31 December 2020. Debit RM Particulars Credit RM 12,250 9,150 3,600 Office equipment Motor vehicles Fumiture Accumulated depreciation as at 1 January 2020: Office equipment Motor vehicles Fumiture 2,450 1,373 1,060 3,632 29,608 6,860 Account receivables and account payables Сapital 6% loan to Rara Purchases and sales Discount Advertising Cash in hand Provision for doubtful debts 2,500 19,110 31,560 215 175 4,250 1,630 300 740 8,000 700 Commission received 6% loan from Afina Bank (taken from 1 May 2020) 1,200 1,900 1,260 4,005 1,000 5,270 210 250 610 915 110 Rent Drawings Maintenance and petrol Staff's wages Insurance Cash at bank Carriage inwards Carriage outwards Telephone and electricity Duties on purchases Returns 112 3.415 Inventory as at 1 January 2020 79.710 79.710 TOTAL Page 718 РОСО SHOT ON POCO F2 PROarrow_forwardCan you create a post-closing trial balance?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education