Concept explainers

Question: Prepare a statement of financial position as at 31 December 2021 for Tonson

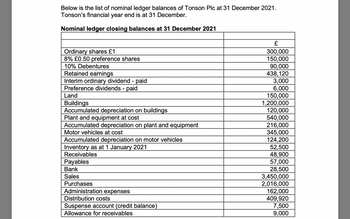

Below is the list of nominal ledger balances of Tonson Plc at 31 December 2021. Tonson’s financial year end is at 31 December.

Nominal ledger closing balances at 31 December 2021

The following information is relevant.

1. Closing inventory at 31 December 2021 is £45,000

-

On further investigation of the suspense account in the

trial balance above, it was discovered that:An expense of £8,250 for legal services had been posted to the suspense account and a cash receipt of £15,750 had been posted to the suspense account. This represented the disposal proceeds from selling equipment, which had been purchased on 1 March 2017 at a cost of £48,000.

-

Tonson depreciates non-current assets as follows:

-

buildings at 1 per cent on a straight-line basis

-

plant and equipment at 10 per cent on a straight-line basis

-

motor vehicles at 20 per cent on a reducing balance basis.

-

-

Non-current assets have no residual value. No

depreciation for the year ended 2021 has been entered into the accounting records. A full year’s depreciation is charged in the year of acquisition and none in the year of disposal. Depreciation expense for the year is included in administration expenses.At 31 December 2021, Tonson’s directors decided to revalue the buildings to £1,350,000. No entries have been made in the nominal ledger accounts.

Post-trial balance reconciliations showed that an invoice for £54,000 for insurance for the period from 1 October 2021 to 30 September 2022 had been paid and debited to the insurance account. Insurance costs are included in administration expenses.

A full year’s debenture interest is to be accrued.

At 31 December 2021, Tonson decided to write off a trade receivable of £2,400 and to make an allowance for irrecoverable receivables of 10 per cent of the outstanding receivables at that date. No entries have been made in the nominal ledger accounts.

No heat and lighting costs for the months of November and December 2021 have been recorded in the accounting records. The next quarter’s invoice for heat and lighting is expected to be £36,000. Heat and lighting costs are included in administration expenses.

For the financial year ended 31 December 2021, corporation tax is estimated to be £222,000 and the audit fee is estimated to be £180,000. These estimates have not been entered in the nominal ledger accounts.

Tonson is proposing a final dividend of 2 pence per share.

Step by stepSolved in 3 steps with 8 images

- On January 1, 2021, the general ledger of Grand Finale Fireworks includes the following account balances:Accounts Debit CreditCash $ 42,700Accounts Receivable 44,500Supplies 7,500Equipment 64,000Accumulated Depreciation $ 9,000Accounts Payable 14,600Common Stock, $1 par value 10,000Additional Paid-in Capital 80,000Retained Earnings 45,100Totals $ 158,700 $ 158,700During January 2021, the following transactions occur:January 2 Issue an additional 2,000 shares of $1 par value common stock for $40,000.January 9 Provide services to customers on account, $14,300.January 10 Purchase…arrow_forwardQuestion: Prepare a statement of profit or loss and other comprehensive income for the year ended 31 December 2021 Below is the list of nominal ledger balances of Tonson Plc at 31 December 2021. Tonson’s financial year end is at 31 December. Nominal ledger closing balances at 31 December 2021 The following information is relevant. 1. Closing inventory at 31 December 2021 is £45,000 On further investigation of the suspense account in the trial balance above, it was discovered that: An expense of £8,250 for legal services had been posted to the suspense account and a cash receipt of £15,750 had been posted to the suspense account. This represented the disposal proceeds from selling equipment, which had been purchased on 1 March 2017 at a cost of £48,000. Tonson depreciates non-current assets as follows: buildings at 1 per cent on a straight-line basis plant and equipment at 10 per cent on a straight-line basis motor vehicles at 20 per cent on a reducing balance basis.…arrow_forwardIdentifying and Computing Net Operating Assets (NOA) and Net Nonoperating Obligations (NNO)Following are the balance sheets and statement of earnings for Home Depot Inc. for fiscal year ended February 3, 2019, which the company labels fiscal year 2018. THE HOME DEPOT INC. Consolidated Balance Sheets February 3, January 28, $ millions, except par value 2019 2018 Assets Current assets Cash and cash equivalents $1,778 $3,595 Receivables, net 1,936 1,952 Merchandise inventories 13,925 12,748 Other current assets 890 638 Total current assets 18,529 18,933 Net property and equipment 22,375 22,075 Goodwill 2,252 2,275 Other assets 847 1,246 Total assets $44,003 $44,529 THE HOME DEPOT INC. Consolidated Balance Sheets February 3, January 28, $ millions, except par value 2019 2018 Liabilities and Stockholders’ Equity Current liabilities Short-term debt $1,339 $1,559 Accounts payable 7,755 7,244 Accrued salaries and…arrow_forward

- Perform a liquidity and profitability analysis on your company utilizing the ratios listed below. Quick Ratio, Receivable Turnover, Days sales uncollected, inventory turnover, Days inventory on hand, payable turnover, days payable, asset turnover, return on assets, and return on equity. statement of operations 12 Months Ended Jul. 31, 2020 Jul. 31, 2019 Revenues: Revenues $ 1,497,826,000 $ 1,684,392,000 Costs and expenses: Operating expense - personnel, vehicle, plant and other 493,055,000 468,868,000 Operating expense - equipment lease expense 33,017,000 Equipment lease expense, preadoption 33,073,000 Depreciation and amortization expense 80,481,000 78,846,000 General and administrative expense 45,752,000 59,994,000 Non-cash employee stock ownership plan compensation charge 2,871,000 5,693,000 Asset impairments 0 0 Loss on asset sales and disposals 7,924,000 10,968,000 Operating income 148,670,000 113,028,000 Interest expense…arrow_forwardVisual Inspection H Company's accounting records provided the following changes in account balances and other information for 2019: Net Changes for 2019 Debit Credit Cash $1,100 Accounts Receivable $1,100 Inventory 1,700 Buildings and Equipment 9,000 Accumulated Depreciation 2,800 Accounts Payable 600 Common Stock, no par 5,000 Retained Earnings 3,500 $12,400 $12,400 Additional information: Net income totaled $5,700. Dividends were declared and paid. Equipment was purchased for $9,000. No buildings and equipment were sold during the year. One hundred shares of common stock were sold for $50 per share. The ending cash balance was $4,000. Required: Using visual inspection, prepare a 2019 statement of cash flows for Gordon. Use a minus sign to indicate cash outflows, a decrease in cash or cash payments. H COMPANY Statement of Cash Flows For Year Ended December 31, 2019 Operating…arrow_forwardPERFORM A LIQUIDITY AND PROFITABILITY ANALYSIS ON THE FOLLOWING COMPANY UTILIZING THE RATIOS LISTED: PAYABLES TURNOVER DAYS PAYABLE statement of operations 12 Months Ended Jul. 31, 2020 Jul. 31, 2019 Revenues: Revenues $ 1,497,826,000 $ 1,684,392,000 Costs and expenses: Operating expense - personnel, vehicle, plant and other 493,055,000 468,868,000 Operating expense - equipment lease expense 33,017,000 Equipment lease expense, preadoption 33,073,000 Depreciation and amortization expense 80,481,000 78,846,000 General and administrative expense 45,752,000 59,994,000 Non-cash employee stock ownership plan compensation charge 2,871,000 5,693,000 Asset impairments 0 0 Loss on asset sales and disposals 7,924,000 10,968,000 Operating income 148,670,000 113,028,000 Interest expense (192,962,000) (177,619,000) Loss on extinguishment of debt (37,399,000) Other income (expense), net (460,000) 369,000 Loss before income taxes (82,151,000)…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education