Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

(answer in text form please (without image), Note: .Every entry should have narration please)

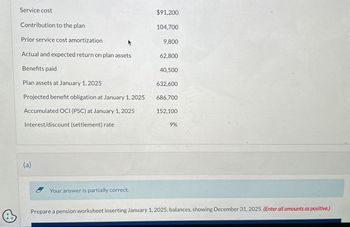

Transcribed Image Text:Service cost

Contribution to the plan

$91,200

104,700

Prior service cost amortization

9,800

Actual and expected return on plan assets

62,800

Benefits paid

40,500

Plan assets at January 1, 2025

632,600

Projected benefit obligation at January 1, 2025

686,700

Accumulated OCI (PSC) at January 1, 2025

152,100

Interest/discount (settlement) rate

9%

(a)

Your answer is partially correct.

Prepare a pension worksheet inserting January 1, 2025, balances, showing December 31, 2025. (Enter all amounts as positive.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please Introduction and show work no plagiarism pleasearrow_forward2 ($ in thousands) Discount rate, 7% Expected return on plan assets, 8% Actual return on plan assets, 7% Service cost, current year January 1, current year: Projected benefit obligation Accumulated benefit obligation Plan assets (fair value)" Prior service cost- AOCI (current year amortization, $30) Net gain- AOCI (current year amortization, $12) There were no changes in actuarial assumptions. December 31, current year: Cash contributions to pension fund, December 31, current year Benefit payments to retirees, December 31, current year Required: 1. Determine pension expense for the current year. $ 500 3,250 2,950 3,350 420 520 435 460 2. Prepare the journal entries to record (a) pension expense, (b) gains and losses (if any), (c) funding, and (d) retiree benefits for the current year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine pension expense for the current year. Note: Amounts to be deducted should be indicated with a minus sign.…arrow_forwardII IIUTIOLIUITFIUVIUEU Dy reision FIGII ACLUGI y. a. Projected benefit obligation as of December 31, 2020 = $3,200. b. Prior service cost from plan amendment on January 2, 2021 = $600 (straight-line amortization for 10-year average remaining service period). c. Service cost for 2021 = $640. d. Service cost for 2022 = $690. e. Discount rate used by actuary on projected benefit obligation for 2021 and 2022 = 10%. Payments g. Payments to retirees in 2022 = $570. h. No changes in actuarial assumptions or estimates. i. Net gain-AOCI on January 1, 2021 = $370. j. Net gains and losses are amortized for 10 years in 2021 and 2022. to retirees in 2021 = $500. Information Provided by Pension Fund Trustee: a. Plan asset balance at fair value on January 1, 2021 = $2,300. b. 2021 contributions = $660. c. 2022 contributions = $710. d. Expected long-term rate of return on plan assets = 12%. e. 2021 actual return on plan assets = $210. f. 2022 actual return on plan assets = $260. Required: 1. Calculate…arrow_forward

- Projected Benefit Obligation Balance, January 1, 2024 Service cost Interest cost, discount rate, 5% Gain due to changes in actuarial assumptions in 2024 Pension benefits paid Balance, December 31, 2024 Plan Assets Balance, January 1, 2024 Actual return on plan assets (Expected return on plan assets, $49) Cash contributions Pension benefits paid Balance, December 31, 2024 January 1, 2024, balances: Pension asset ($ in millions) $ 680 70 34 (18) (34) $ 732 ($ in millions) $ 740 44 85 (34) $ 835 ($ in millions) $ 60 30 124 Prior service cost-AOCI (amortization $6 per year) Net gain-AOCI (any amortization over 10 years) Required: Prepare a pension spreadsheet to show the relationship among the PBO, plan assets, prior service cost, the net gain, pension expense, and the net pension asset.arrow_forwardHh1.arrow_forward1. Information on an entity's defined benefit obligation is as follows Present value of defined benefit obligation, lan 1 130,000 Present value of defined obligation, Dec. 31 110,600 Discount rate 12% Benefits paid to retirees 110,000 Actuarial loss 50,000 How much is the current service cost? O r000 O s000 O B0,000 O 25,000arrow_forward

- Helping tags: Accounting, Intermediate Accounting . . . WILL UPVOTE, just pls help me answer it and show complete solutions. Thank you!arrow_forwardKindly answer the 10 11 and 12 question thank youarrow_forwardions) Saved Help Save & Exit Submit Bissell Company recelved the following reports of its defined benefit penslon plan for the current calendar year: PBO Plan assets $400,000 195,000 32,000 (80,000) $250,000 30,000 110,000 (80,000) Balance, January 1 Balance, January 1 Service cost Actual return Interest cost Annual contribution Benefits paid Benefits paid Balance, December 31 $547,000 Balance, December 31 $310,000 The long-term expected rate of return on plan assets is 10%. Assuming no other data are relevant, what is the pension expense for the year? Multiple Choice $202,000. $197,000. $227,000. Prev 9 of 15 Next > Show 7 Question no....pages ..pdf Question no....pages MacBook Air 身arrow_forward

- More Into st and annuity table for discrete con project is S (Round to the neare the project V acceptable. 1.0000 2.1800 3.5724 5.2154 71542 1800 1800 1.3924 1.6430 1.9388 2.2873 2.6996 3.1855 C 8475 1.5656 0000 0.4587 0.2799 0.1917 0.1398 0.1059 0.0824 0.0652 0.0524 0.8475 0.7182 0.6086 0.6387 0.4599 R1743 26901 0.5158 0.4371 03704 о3139 0 2660 0.2255 0.1911 0.3717 0.3198 0.2859 0.2624 4 9.4420 12.1415 15 3270 19 0859 23 5213 3.1272 34976 38115 4 0776 4.3030 4.4941 8 3.7589 0.2452 4.4355 0.2324 10 5.2338 0,0425 0.2225 Print Donearrow_forwardGupta Industries received a $380,000 prepayment from Packard Associates for the sale of new equipment. Gupta will bill Packard an additional $108,000 upon delivery of the equipment. Upon receipt of the $380,000 prepayment, how much should Gupta recognize for a contract asset, a contract liability, and accounts receivable? Muitiple Choice Contract asset: $0; contract liability: $380.000, accounts receivable, $108.000. Contract asset: $0; contract liability: $380.000, accounts receivable, $0. Contract asset: $380,000; contract liability: $0. accounts receivable. SO:arrow_forwardDetermine the NPV, IRR, and MIRR for project Y.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning