Century 21 Accounting General Journal

11th Edition

ISBN: 9781337680059

Author: Gilbertson

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Prepare a reversing entries.

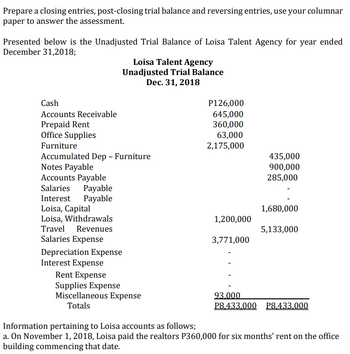

Transcribed Image Text:Prepare a closing entries, post-closing trial balance and reversing entries, use your columnar

paper to answer the assessment.

Presented below is the Unadjusted Trial Balance of Loisa Talent Agency for year ended

December 31,2018;

Loisa Talent Agency

Unadjusted Trial Balance

Dec. 31, 2018

Cash

Accounts Receivable

Prepaid Rent

Office Supplies

Furniture

Accumulated Dep - Furniture

Notes Payable

435,000

900,000

285,000

Accounts Payable

Salaries Payable

Interest Payable

Loisa, Capital

1,680,000

1,200,000

Loisa, Withdrawals

Travel Revenues

Salaries Expense

5,133,000

3,771,000

Depreciation Expense

Interest Expense

Rent Expense

Supplies Expense

Miscellaneous Expense

Totals

93.000

P8.433.000 P8,433,000

Information pertaining to Loisa accounts as follows;

a. On November 1, 2018, Loisa paid the realtors P360,000 for six months' rent on the office

building commencing that date.

P126,000

645,000

360,000

63,000

2,175,000

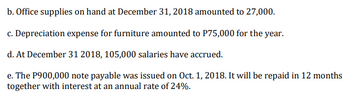

Transcribed Image Text:b. Office supplies on hand at December 31, 2018 amounted to 27,000.

c. Depreciation expense for furniture amounted to P75,000 for the year.

d. At December 31 2018, 105,000 salaries have accrued.

e. The P900,000 note payable was issued on Oct. 1, 2018. It will be repaid in 12 months

together with interest at an annual rate of 24%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Balance sheet Optimum Weight Loss Co. offers personal weight reduction consultingservices to individuals. After all the accounts have been closed on November 30, 2019, the end of the fiscal year, the balances of selectedaccounts from the ledger of Optimum Weight Loss Co. are as follows: Prepare a classified balance sheet that includes the correct balance forCasharrow_forward1. How should the $25 Referral Credit be recorded in Runway’s incomestatement?2. When would Runway record the $25 Referral Credit? What are the journalentries Runway would record when the $25 Referral Credit is earned bythe Existing Customer? What are the journal entries Runway would recordwhen the $25 Referral Credit is redeemed against a $100 purchase madeby the Existing Customer?3. Runway is planning to adopt IFRSs in the near future. What is the relevantaccounting guidance it would follow under IFRSs?arrow_forwardBelow is the adjusted trial balance which was extracted from the books of Ready Hospital Supplies on June 30, the end of the company’s financial year. You are required to apply the accrual basis of accounting in the preparation of the company’s financial statements. Ready Hospital Supplies Adjusted Trial Balance as at June 30, 2020 Dr $ Cr $ Cash 127,000.00 Accounts Receivable 151,000.00 Allowance for Bad-Debts 19,500.00 Merchandise Inventory 186,000.00 Store Supplies 25,000.00 Prepaid Insurance 48,000.00 Prepaid Rent 14,000.00 Furniture & Fixtures 800,000.00 Accumulated Depreciation: Furniture & Fixtures 320,000.00 Computer Equipment 450,000.00 Accumulated Depreciation: Computer Equipment 45,000.00 Accounts Payable 133,500.00 Salaries Payable 14,000.00 Interest Payable 36,000.00…arrow_forward

- Adams Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31, 2019: Amount 10,000 Customer Billy Adams Stan Fry 8,000 Tammy Imes Shana Wagner 5,000 1,700 Total 24,700 a. Journalize the write-offs for 2019 under the direct write-off method. b. Journalize the write-offs for 2019 under the allowance method. Also, journalize the adjusting entry for uncollectible accounts. The company recorded $2,600,000 of credit sales during 2019. Based on past history and industry averages, 1.75% of credit sales are expected to be uncollectible. c. How much higher or lower would Adams Company's 2019 net income have been under the direct write-off method than under the allowance method? %24arrow_forwardPrepare the entries for transaction below and indicate what journal it is 21 august issued a $600 credit memo to ultracity co. For an allowance on good sold on august 19, 2020arrow_forwardData for item nos. 16 and 17 The following accounts and their balances in an unadjusted trial balance of Record of Youth Company as of December 31, 2020: Cash and cash equivalents- P400,000; Trade and other receivable P2,000,000; Subscription receivable- P375,000; Inventory- P500,000; Trade and other payables- P670,000; Income tax payable- P196,500. Additional information are as follows: • Trade and other receivables include long term advances to company officers amounting to P430,000. • The subscription receivable has the following call dates: June 30, 2021, P200,000; December 31, 2021, P100,000; and June 30, 2022, P75,000. • Inventory of P500,000 was determined by physical count. At December 31, 2020, goods costing P125,000 are in transit from a supplier. Terms of purchase of said goods is FOB shipping point. The goods and the related invoice have not been received as of year-end. • Trade and other payables include dividends payable amounting to P170,000, of which P70,000 is payable…arrow_forward

- What are the adjusting entries?arrow_forwardAsset Cost: Less: Residual Value Depreciable Amount Depreciation method Depreciation p.a: Date 30/06/2018 30/06/2019 30/06/2020 Computers Depreciation Worksheet - Snow Lake Pty Ltd $66,000 $ N/A $66,000 Reducing Balance (Diminishing Balance) 30% Asset Cost $66,000 46,200 32,340 Depreciation $19,800 13,860 9,702 Accumulated Depreciation $19,800 33,660 43,362 Carrying Amount at the end $46,200 32,340 22,638 20 2014 2015 14200 1444arrow_forwardData relating to the balances of various accounts affected by adjusting or closing entries appear below . Please journalize the missing entries. Uneraned Rent at 1/1/2019 was $5,300 and at 12/31/2019 it was $8,000. The records indicate cash receipts from rental sources during 2019 amounted to $42,500, all of which was credited to Unearned Rent Account. Prepare the missing adjusting entry. Allowance for Doubtful Accounts on 1/1/2019 was $50,000. The balance in the Allowance account on 12/31/2019 after making the annual adjusting entry was $58,000 and during 2019 bad debts written-off amounted to $30,000. Journalize the missing adjusting entry. Accumulated Depreciation-Equipment at 1/1/2019 was $210,000. At 12/31/2019, the balance of the account was $260,000. During 2019, one piece of equipment was sold. The equipment had an original cost of $40,000 and was 75% depreciated when sold. Journalize the missing adjusting entry. Retained earnings at 1/1/2019 was $140,000 and at…arrow_forward

- Do a journal entry based on this transections, round interest amounts to the nearest dollar,arrow_forwardSubject - account Please help me. Thankyou.arrow_forwardRefer to RE6-8. On April 23, 2020, McKinncy Co. receives a check, from Mangold Corporation for 8,500. Prepare the journal entry for McKinncy to record the collection of the account previously written off.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College