FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please do not give solution in image format ? And Fast answering please and explain proper steps by Step.

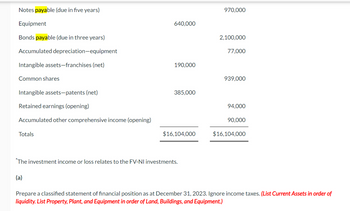

Transcribed Image Text:Notes payable (due in five years)

Equipment

Bonds payable (due in three years)

Accumulated depreciation-equipment

Intangible assets-franchises (net)

Common shares

Intangible assets-patents (net)

Retained earnings (opening)

Accumulated other comprehensive income (opening)

Totals

640,000

(a)

190,000

385,000

$16,104,000

The investment income or loss relates to the FV-NI investments.

970,000

2,100,000

77,000

939,000

94,000

90,000

$16,104,000

Prepare a classified statement of financial position as at December 31, 2023. Ignore income taxes. (List Current Assets in order of

liquidity. List Property, Plant, and Equipment in order of Land, Buildings, and Equipment.)

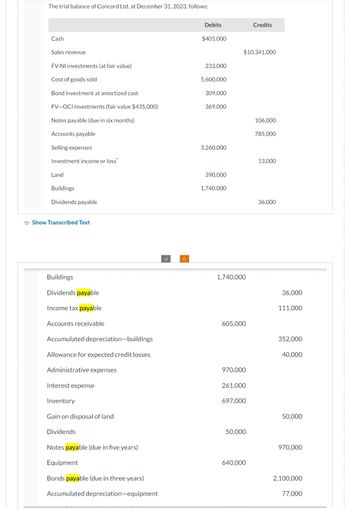

Transcribed Image Text:The trial balance of Concord Ltd. at December 31, 2023, follows:

Cash

Sales revenue

FV-NI investments (at fair value)

Cost of goods sold

Bond investment at amortized cost

FV-OCI investments (fair value $435,000)

Notes payable (due in six months)

Accounts payable

Selling expenses

Investment income or loss

Land

Buildings

Dividends payable

Show Transcribed Text

Buildings

Dividends payable

Income tax payable

Accounts receivable

Accumulated depreciation-buildings

Allowance for expected credit losses

Administrative expenses

Interest expense

Inventory

Gain on disposal of land

Dividends

Notes payable (due in five years)

Equipment

Bonds payable (due in three years)

Accumulated depreciation-equipment

Debits

$405,000

233,000

5,600,000

309,000

369,000

3,260,000

390,000

1,740,000

$10,341,000

1,740,000

605,000

970,000

261,000

697,000

50,000

Credits

640,000

106,000

785,000

13,000

36,000

36,000

111,000

352,000

40,000

50,000

970,000

2,100,000

77,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education