Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

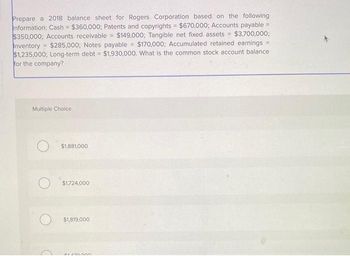

Transcribed Image Text:Prepare a 2018 balance sheet for Rogers Corporation based on the following

information: Cash = $360,000; Patents and copyrights = $670,000; Accounts payable=

$350,000; Accounts receivable $149,000; Tangible net fixed assets = $3,700,000;

Inventory $285,000; Notes payable= $170,000; Accumulated retained earnings =

$1,235,000; Long-term debt = $1,930,000. What is the common stock account balance.

for the company?

Multiple Choice

$1,881,000

$1,724,000

$1,819,000

24476000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- vv. Subject Financearrow_forwardThe Oscar Meyer Corporation earned $33 million in 2019 on sales of $450.5 million. The company's balance sheet also listed current assets of $27 million, and fixed assets of $378 million. What is the firms Return on Assets (ROA)? a. 0.211 b. 0.201 O c. -0.029 d. -0.049 e. 0.081arrow_forwardThe table below contains data on Fincorp Incorporated. The balance sheet items correspond to values at year-end 2021 and 2022, while the income statement items correspond to revenues or expenses during the year ended 2021 and 2022. All values are in thousands of dollars. Revenue Cost of goods sold Depreciation Inventories Administrative expenses Interest expense Federal and state taxes* Accounts payable Accounts receivable. Net fixed assets* Long-term debt Notes payable Dividends paid Cash and marketable securities 2021 $ 4,100 1,700 470 270 520 240 340 320 350 4,800 2,400 687 380 760 Net working capital 2022 $ 4,200 1,800 490 335 570 240 360 355 395 * Taxes are paid in their entirety in the year that the tax obligation is incurred. t Net fixed assets are fixed assets net of accumulated depreciation since the asset was installed. 5,540 2,860 540 380 480 What was the change in net working capital during the year? Note: Enter your answer in thousands of dollars. byarrow_forward

- Subject: acountingarrow_forwardYogesharrow_forwardBelow is the financial information for AXZ Corporation for fiscal year-ending June 30, 2020. (Amounts in millions $s) Cash flows from operations $2,908.3 Total revenues 14,892.2 Shareholders’ equity 4,482.3 Cash flows from financing (110.0) Total liabilities 7,034.4 Cash, ending year 2,575.7 Expenses 14,883.4 Noncash assets 8,941.0 Cash flows from investing (1,411.2) Net earnings 8.8 Cash, beginning year 1,188.6 Required: Using the information above, prepare the company’s: Balance sheet as of June 30, 2020. Income Statement for the fiscal year ended June 30, 2020. Cash Flow Statement for the fiscal year ending June 30, 2020.arrow_forward

- Here are simplified financial statements for Phone Corporation in 2020: Net sales Cost of goods sold Other expenses INCOME STATEMENT (Figures in $ millions) Depreciation Earnings before interest and taxes (EBIT) Interest expense Income before tax Taxes (at 21%) Net income Dividends Assets Cash and marketable securities Receivables Inventories Other current assets BALANCE SHEET (Figures in $ millions) Total current assets Net property, plant, and equipment Other long-term assets. Total assets Liabilities and shareholders' equity Payables Short-term debt Other current liabilities Total current liabilities Long-term debt and leases Other long-term liabilities Shareholders' equity Total liabilities and shareholders' equity $ 13,600 4,310 4,162 2,668 $2,460 718 $1,750 368 a. Return on equity (use average balance sheet figures) b. Return on assets (use average balance sheet figures) c. Return on capital (use average balance sheet figures) d. Days in inventory (use start-of-year balance sheet…arrow_forwardRamakrishnan, Incorporated, reported 2024 net income of $20 million and depreciation of $3,400,000. The top part of Ramakrishnan, Incorporated’s 2024 and 2023 balance sheets is reproduced below (in millions of dollars): 2024 2023 2024 2023 Current assets: Current liabilities: Cash and marketable securities $ 25 $ 26 Accrued wages and taxes $ 43 $ 35 Accounts receivable 98 92 Accounts payable 69 60 Inventory 170 144 Notes payable 60 55 Total $ 293 $ 262 Total $ 172 $ 150 Calculate the 2024 net cash flow from operating activities for Ramakrishnan, Incorporated. Note: Enter your answer in dollars not in millions. donearrow_forwardThe following information (in $ millions) comes from the Annual Report of Saratoga Springs Company for the year ending 12/31/2024: Year ended 12/31/2024 $ 8,139 4,957 2,099 Net sales Cost of goods sold Selling and administrative expense Interest expense Income before taxes Net income Cash and cash equivalents Receivables, net Inventories Land, buildings and equipment at cost, net Total assets Total current liabilities Long-term debt Total liabilities Total stockholders' equity 606 477 648 Profit margin on sales 12/31/2024 $ 1,165 1,200. 1,245 13,690 $ 17,300 $ 5,937 5,781 $ 11,718 $5,582 Required: Compute the profit margin on sales for 2024. Note: Round your answer to 1 decimal place, e.g., 0.1234 as 12.3%. 12/31/2023 $ 83 854 709 4,034 $ 5,680 $ 2,399 2,411 $ 4,810 $ 870arrow_forward

- According to the balance sheet of Free Inc, at the end of the 2020 fiscal year, the cash balance is $200,000, account available balance is $500,000, inventory balance is $750,000; the net fixed asset is $1,500,000. On the other side, the account payable is $250,000, the accrual $40,000, the notes payable is $300,000, long-term debt is $510,000, common stock is $1,200,000, retained earnings is $650,000. The net income is $900,000; the interest payment is $45,600; the tax rate is 25%. If the sales is $10,000,000, what is the operating margin?b. 13.26%c. 11.45%d. 10.66%arrow_forwardRamakrishnan, Incorporated, reported 2024 net income of $40 million and depreciation of $2,900,000. The top part of Ramakrishnan, Incorporated's 2024 and 2023 balance sheets is reproduced below (in millions of dollars): 2024 2023 2024 2023 Current assets: Current liabilities: Cash and marketable securities Accounts receivable $ 45 $ 16 85 Inventory 161 82 124 Accrued wages and taxes Accounts payable Notes payable $ 28 $ 25 89 85 85 80 Total $ 291 $ 222 Total $ 202 $ 190 Calculate the 2024 net cash flow from operating activities for Ramakrishnan, Incorporated. Note: Enter your answer in dollars not in millions. Net cash flowarrow_forwardThe balance sheet and income statement for J. P. RObard Manufatcuring Company are as follows: Item Cash J.P. Robard Manufacturing Company Balance Sheet as at 31 December 2021 ($ in thousands) 500 Account receivable Inventory Total current assets Net fixed assets Total assets Accounts payable Accrued expenses Short-term notes payable Total curernt liabilities Long-term debt Total common equity Total liabilities and equity 2,000 1,000 3,500 4,500 8,000 1,100 600 300 2,000 2,000 4.000 8,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education