FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

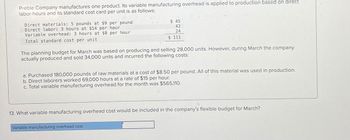

Transcribed Image Text:Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct

labor-hours and its standard cost card per unit is as follows:

Direct materials: 5 pounds at $9 per pound

Direct labor: 3 hours at $14 per hour

Variable overhead: 3 hours at $8 per hour

Total standard cost per unit

$ 45

42

24

$ 111

The planning budget for March was based on producing and selling 28,000 units. However, during March the company

actually produced and sold 34,000 units and incurred the following costs:

a. Purchased 180,000 pounds of raw materials at a cost of $8.50 per pound. All of this material was used in production.

b. Direct laborers worked 69,000 hours at a rate of $15 per hour.

c. Total variable manufacturing overhead for the month was $565,110.

13. What variable manufacturing overhead cost would be included in the company's flexible budget for March?

Variable manufacturing overhead cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Augusta Sports manufactures baseball caps. The company uses standards to control costs. The labor standards for one baseball cap are as follows: Standard Hours 15 minutes Standard Rate per Hour $15 per hour The budgeted variable overhead rate is $5 per direct labor hour. During the current month, the company incurred $21,987 in variable manufacturing overhead costs. During the current month, 4,923 direct labor hours were needed to manufacture 19,475 baseball caps. Direct labor costs totaled $102,000 for the month. Compute the variable overhead efficiency variance. Enter a favorable variance as a positive number. Enter an unfavorable variance as a negative number.arrow_forwardThe Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 10,200 9,200 12,200 Units to be produced 11,200 Each unit requires 0.25 direct labor-hours and direct laborers are paid $11.00 per hour. In addition, the variable manufacturing overhead rate is $1.60 per direct labor-hour. The fixed manufacturing overhead is $82,000 per quarter. The only noncash element of manufacturing overhead is depreciation, which is $22,000 per quarter. Required: 1. Calculate the company's total estimated direct labor cost for each quarter of the upcoming fiscal year and for the year as a whole. 2. and 3. Calculate the company's total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole. Complete this question by entering your answers in the tabs below. Req 1…arrow_forwardQueen Industries uses a standard costing system in the manufacturing of its single product. It requires 2 hours of labor to produce 1 unit of final product. In February, Queen Industries produced 12,000 units. The standard cost for labor allowed for the output was $90,000, and there was an unfavorable direct labor time variance of $5,520. NOTE: All dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). For the variance conditions, your answer is either "F” (for Favorable) or "U” (for Unfavorable) - capital letter and no quotes. What was the standard rate per hour? standard rate per hour. (with "$" round answer to two decimal places with commas as needed) How many actual hours were worked? actual hours. (round answer to whole number with commas as needed) Complete the following table of variances and their conditions: Variance Variance Amount Favorable (F) or Unfavorable (U) Labor Rate Labor Time Total DL Cost…arrow_forward

- ABC Ltd manufactures two products: Basic and Deluxe. The company expects to produce andsell 1,100 units of Basic and 1,600 units of Deluxe during the current year.Currently in the traditional costing system, the company has been using direct labour hours asthe single cost driver for allocation of manufacturing overheads to products. The budgetedmanufacturing overheads for the next period are $35,000.The company is considering to implement the activity-based costing (ABC) system. Theaccountant has analysed the budgeted production overheads and identified various costs inactivity centres with appropriate cost drivers:Activity Centre Costs Cost DriverMaintenance costs $7,000 Direct labour hoursSet up costs $12,000 Number of production runQuality inspections $7,020 Number of inspectionsStores receiving $3,480 Number of component deliveriesStores issues $5,500 Number of issues$35,000The analysis also revealed the following information:Basic DeluxeDirect materials cost per unitDirect labour…arrow_forwardPreble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct materials: 6 pounds at $8 per pound $ 48 Direct labor: 4 hours at $17 per hour 68 Variable overhead: 4 hours at $4 per hour 16 Total standard cost per unit $ 132 The planning budget for March was based on producing and selling 19,000 units. However, during March the company actually produced and sold 24,000 units and incurred the following costs: Purchased 160,000 pounds of raw materials at a cost of $7.20 per pound. All of this material was used in production. Direct laborers worked 72,000 hours at a rate of $18 per hour. Total variable manufacturing overhead for the month was $336,960. 1. What is the materials quantity variance for March? indicate whether F or U 2. If Preble had purchased 187,000 pounds of materials at $7.20 per pound and used 160,000 pounds in production, what…arrow_forwardPreble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct materials: 5 pounds at $11 per pound $ 55 Direct labor: 3 hours at $12 per hour 36 Variable overhead: 3 hours at $7 per hour 21 Total standard cost per unit $ 112 The planning budget for March was based on producing and selling 21,000 units. However, during March the company actually produced and sold 26,600 units and incurred the following costs: Purchased 154,000 pounds of raw materials at a cost of $9.50 per pound. All of this material was used in production. Direct laborers worked 63,000 hours at a rate of $13 per hour. Total variable manufacturing overhead for the month was $510,930. Questions: A) 3. What is the materials price variance for March? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no…arrow_forward

- Valera Corporation makes a product with the following standards for labor and variable overhead: Direct labor Variable overhead Standard Quantity Standard Price or Standard Cost Per or Hours 0.4 hours 0.4 hours Rate $21.00 per hour. $ 6.00 per hour Unit $8.40 $2.40 The company budgeted for production of 5,300 units in July, but actual production was 5,400 units. The company used 2,130 direct labor-hours to produce this output. The actual variable overhead rate was $6.10 per hour. The company applies variable overhead on the basis of direct labor-hours. The variable overhead rate variance for July is:arrow_forwardLemon Company manufactures a single product. The company manufactured 5,000 units in March, using 6,150 pounds of material and 2,420 labor hours. During the same month, they purchased 6,200 pounds of material for $151,590. The actual labor cost for March was $39,930. There were no beginning or ending work-in-process inventories. The company has the following unit standard costs for direct materials and labor. Budgeted quantity Per unit Direct materials 1.20 pounds Budgeted price $25 per pound $15 per hour Direct labor 0.50 hoursarrow_forwardKrump Corporation's cost formula for its manufacturing overhead is $30,600 per month plus $64 per machine-hour. For the month of March, the company planned for activity of 7,900 machine-hours, but the actual level of activity was 7,880 machine- hours. The actual manufacturing overhead for the month was $558,610. The spending variance for manufacturing overhead in March would be closest to: O $22,410 U O $22,410 F O $23,690 F O $23,690 Uarrow_forward

- The Production Department of Hruska Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year: 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Units to be produced 10,800 9,800 11,800 12,800 Each unit requires 0.25 direct labor-hours and direct laborers are paid $13.00 per hour. In addition, the variable manufacturing overhead rate is $1.90 per direct labor-hour. The fixed manufacturing overhead is $88,000 per quarter. The only noncash element of manufacturing overhead is depreciation, which is $28,000 per quarter. Required: 1. Calculate the company’s total estimated direct labor cost for each quarter of the upcoming fiscal year and for the year as a whole. 2. and 3. Calculate the company’s total estimated manufacturing overhead cost and the cash disbursements for manufacturing overhead for each quarter of the upcoming fiscal year and for the year as a whole.arrow_forwardDineshbhaiarrow_forwardMiguez Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate Standard Cost Per Unit Direct materials 2.3 liters $ 7.00 per liter $ 16.10 Direct labor 0.7 hours $ 22.00 per hour $ 15.40 Variable overhead 0.7 hours $ 2.00 per hour $ 1.40 The company budgeted for production of 2,600 units in September, but actual production was 2,500 units. The company used 5,440 liters of direct material and 1,680 direct labor-hours to produce this output. The company purchased 5,800 liters of the direct material at $7.20 per liter. The actual direct labor rate was $24.10 per hour and the actual variable overhead rate was $1.90 per hour. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The labor rate variance for September is: Multiple Choice $3,675 F $3,528 U $3,528 F $3,675 Uarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education