FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

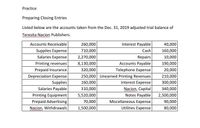

Transcribed Image Text:Practice

Preparing Closing Entries

Listed below are the accounts taken from the Dec. 31, 2019 adjusted trial balance of

Teresita Nacion Publishers.

Accounts Receivable

Supplies Expense

260,000

Interest Payable

40,000

710,000

Cash

160,000

Salaries Expense

2,270,000

Repairs

10,000

Accounts Payable

Telephone Expense

250,000 Unearned Printing Revenues

Printing revenues

8,130,000

190,000

Prepaid Insurance

320,000

20,000

Depreciation Expense

210,000

Supplies

160,000

Interest Expense

300,000

Salaries Payable

Nacion, Capital

Notes Payable

Miscellaneous Expense

Utilities Expense

310,000

340,000

Printing Equipment

5,520,000

2,500,000

Prepaid Advertising

70,000

90,000

Nacion, Withdrawals

1,500,000

80,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Prepare an aging schedule to determine the total estimated uncollectibles at March 31,2018arrow_forwardprepare these entries for Sarah's plant services. prepare general journal entries for the needed balance dy adjustments for the year ending 30/6/21: A stocktake of the inventory on hand was completed on 30/6/21. The value of the stocktake was $17,000. The inventory asset account as at 30/6/21 before adjustments was $18,000 The allowance for Doubtful debts should be 5% of the balance of Accounts Receivable. The accounts receivable balance at 30/6/21 is $76,120 and the balance of the Allowance for Doubtful Debts was $3,450arrow_forwardFollowing are transactions of The Barnett Company: 2023 Dec. 16 Accepted a $22,900, 60-day, 5% note dated this day in granting Carmel Karuthers a time extension on her past-due account. Made an adjusting entry to record the accrued interest on the Karuthers note. Closed the Interest income account. Dec. 31 Dec. 31 2024 Feb. 14 Mar. 2 Mar. 17 May 31 Received Karuthers' payment for the principal and interest on the note dated December 16. Accepted an $8,800, 4%, 90-day note dated this day in granting a time extension on the past-due account of ATW Company. Accepted a $4,000, 30-day, 4.5% note dated this day in granting Leroy Johnson a time extension on past-due account. Received ATW's payment for the principal and interest on the note dated March 2. Prepare journal entries to record The Barnett Company's transactions. (Assume 365 days in a year. Round your answers to 2 decimal places.) View transaction listarrow_forward

- ces Required information [The following information applies to the questions displayed below.] Following are transactions of Danica Company. December 13 Accepted a $20,000, 45-day, 4% note in granting Miranda Lee a time extension on her past-due account receivable. December 31 Prepared an adjusting entry to record the accrued interest on the Lee note. Complete the table to calculate the interest amounts at December 31st and use the calculated value to prepare your journal entries. Note: Do not round your intermediate calculations. Use 360 days a year. Complete this question by entering your answers in the tabs below. Interest Amounts General Journal Complete the table to calculate the interest amounts at December 31st, Interest Recognized December 31 20,000 4% 18/360 Principal Rate (%) Time Total interest Total Through Maturity $ 20,000 $ 4% 45/360 Check my workarrow_forwardDhapaarrow_forwardPedroni Enterprises issues a $260,000, 45 day 5 % note to Zorzi Industries for merchandise inventory Journalize Pedroni Enterprises entries to record: The issuance of the note The payment of the note at maturity Journalize Zorzi Industries entries to record: The receipt of the note Receipt of the payment of the note at maturity On July 31, 2019 the balances of the accounts appearing in the ledger of Pedroni Interiors company a furniture wholesales, are as follows. Accumulated Depreciation – Building $365,000 Ray Zorzi – Capital $530,000 Administrative Expenses 440,000 Ray Zorzi – Drawing 15,000 Building 810,000 Sales 1,437,000 Cash 78,000 Sales tax Payable 4,500 Cost of Merchandise Sold…arrow_forward

- Do a journal entry based on this transections, round interest amounts to the nearest dollar,arrow_forwardRequired: (a) Prepare journal entries to record the impairment loss of receivable in 2021 under Statement of Financial Position approach. (b) Prepare partial Statement of Financial Positions to show the accounts receivables at 31 December 2021.arrow_forwardReporting Uncollectible Accounts and Accounts Receivable (FSET) LaFond Company analyzes its accounts receivable at December 31 and arrives at the aged categories below along with the percentages that are estimated as uncollectible. \table [[Age Group, Accounts Receivable, \table [[Estimated], [Loss %]]], [Current (not past due), $375,000, 0.50%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education