ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

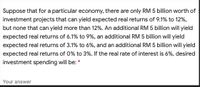

Transcribed Image Text:Suppose that for a particular economy, there are only RM 5 billion worth of

investment projects that can yield expected real returns of 9.1% to 12%,

but none that can yield more than 12%. An additional RM 5 billion will yield

expected real returns of 6.1% to 9%, an additional RM 5 billion will yield

expected real returns of 3.1% to 6%, and an additional RM 5 billion will yield

expected real returns of 0% to 3%. If the real rate of interest is 6%, desired

investment spending will be: *

Your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 12. Consider an economy without technological progress and population growth. The production function is given as Y = K²/³N\/3. Both the saving rate and the capital depreciation rate are assumed to be 0.1. Which of the following saving rate delivers the highest consumption per worker in the steady-state: (a) 1/3 (Ь) 1/2 (c) 2/3 (d) none of above is correctarrow_forwardA project that will provde annual cash flows of $2,350 for nine years costs $9,700 today. a. At a required return of 12 percent, what is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. At a required return of 28 percent, what is the NPV of the project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. At what discount rate would you be indifferent between accepting the project and rejecting it? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) а. NPV b. NPV C. Discount rate %arrow_forward2. C = 50 + .8YD = 50 + .8(Y – T) %3D | = 150 %3D G = 200 T = 200 a) Calculate AY if AG = 100 (assuming that G could change all by itself). b) Calculate AY if AT = 100 (assuming that T could change all by itself). c) Calculate AY for AG = AT = 100.arrow_forward

- Solve it correctly please. I will rate accordingly with 4votes.arrow_forwardY=W.Kr.L1-r W=technology and r is standard share parameter of Cobb-Douglas production. b. Draw a graph and show output function, actual investment and breakeven investment lines. c. Assume that in this economy, people start spending more and therefore marginal propensity to save decline permanently. What will happen to variables in the model (steady-state level capital per effective labor; output growth etc.). d. Instead of reduction in saving assume this time that we face lower fertility rate in the country. What will happen to variables in the model (steady-state level capital per effective labor; output growth etc.).arrow_forwardIf your investment earns 6% each year for two years and will be worth $540.80 after two years, its present value is Select one: a. $481.31. b. $450. C. $501.25. d. $510.33.arrow_forward

- Assume that at the end of year 0 you invested $100,000 in an investment fund. Since then the annual returns earned by this fund have been as follows: End of Year 1 2 3 Observed Return A. $87,319. B. $90,973. C. $109,683. D. $114,015. 15.00% -40.00% 35.00% It is now the end of year 3 and you expect to earn the same average annual return that you earned over the three-year period above. Based on this expectation, the value of your original $100,000 investment at the end of year 4 will be closest to:arrow_forwardWhich type of project is called a pure investment project?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education