FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Post-Closing

An accountant prepared the following post-closing trial balance:

| Security Services Co. Post-Closing Trial Balance July 31, 2018 |

||||

| Debit Balances | Credit Balances | |||

| Cash | 12,600 | |||

| 27,970 | ||||

| Supplies | 1,760 | |||

| Equipment | 124,610 | |||

| 41,580 | ||||

| Accounts Payable | 15,120 | |||

| Salaries Payable | 1,390 | |||

| Unearned Rent | 5,670 | |||

| Common Stock | 13,500 | |||

| 89,680 | ||||

| 206,120 | 127,760 |

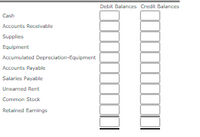

Prepare a corrected post-closing trial balance. Assume that all accounts have normal balances and that the amounts shown are correct. If an amount box does not require an entry, leave it blank.

| Security Services Co. |

| Post-Closing Trial Balance |

| July 31, 2018 |

Transcribed Image Text:Debit Balances Credit Balances

Cash

Accounts Receivable

Supplies

Equipment

Accumulated Depreciation-Equipment

Accounts Payable

Salaries Payable

Unearned Rent

Common Stock

Retained Earnings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Records show that $750 of cash receipts originally recorced as unearned admissions revenue had been earned as of December 31. Show calculations where necessary. Calculations: Date Debit Credit Db Crarrow_forwardAccounts Receivable Free Company gathered the following information from its accounting records for the year ended December 31, 2019: • Net Credit Sales for the year - P680,000 • Accounts Receivable at December 31 - 92,000 • Allowance for doubtful accounts at December 31 - 1,850arrow_forwardSubject: accountingarrow_forward

- Prepaid rent Accounts receivable Cash Comon stock Retained earnings Current assets Prepare a classified balance sheet. Note: Allowance for doubtful accounts is subtracted from accounts receivable on the company's balance sheet. Total assets otal current assets Long-term Investments Current labies BENNETT COMPANY Balance Sheet Long term is Total abilities December 31 Assets Liabilities $ 2,700 Accounts payable 18,500 Allowance for doubtful accounts 29,098 Notes payable (due in 10 years) 13,500 Notes receivable (due in 4 years) 24,200 Equity Total quity Total abilities and equity 5 S 0 0 $ 4,200 1,000 11,400 0arrow_forwardThe following selected transactions were taken from the records of Shipway Company for the first year of its operations ending December 31: apr13 Wrote off account of Dean Sheppard, $8,450 may15 Received $500 as partial payment on the $7,100 account of Dan Pyle. Wrote off the remaining balance as uncollectible july27 Received $8,450 from Dean Sheppard, whose account had been written off on April 13. Reinstated the account and recorded the cash receipt. dec31 Wrote off the following accounts as uncollectible (record as one journal entry): 31. If necessary, record the year-end adjusting entry for uncollectible accounts.a. Journalize the transactions under the direct write-off method.b. Journalize the transactions under the allowance method. Shipway Company usesthe percent of credit sales method of estimating uncollectible accounts expense.Based on past history and industry averages, ¾% of credit sales are expected to beuncollectible. Shipway Company recorded $3,778,000 of…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education