ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Calculate the average benefit a Medicare recipient receives.

Instructions: Round your response to the nearest dollar.

Calculate the average benefit a recipient of food stamps receives.

Instructions: Round your response to the nearest dollar.

$

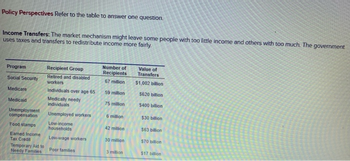

Transcribed Image Text:Policy Perspectives Refer to the table to answer one question.

Income Transfers: The market mechanism might leave some people with too little income and others with too much. The government

uses taxes and transfers to redistribute income more fairly.

Program

Recipient Group

Number of

Recipients

Value of

Transfers

Social Security

Retired and disabled

67 million

$1,002 billion

workers

Medicare

Individuals over age 65

59 million

$620 billion

Medicaid

Medically needy

75 million

$400 billion

individuals

Unemployment

compensation

Unemployed workers

6 million

$30 billion

Food stamps

Low-income

42 million

households

$63 billion

Eamed Income

Tax Credit

Low-wage workers

30 million

$70 billion

Temporary Aid to

Needy Families

Poor families

3 million

$17 billion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- List the most common nonprice rationing systems in the marketarrow_forwardWhich of the following stalements is CORRECT about Medicare? A.Il is a medical assistance program B.Il is a hospital and medical expense insurance program. C.It provides benefis o lotally disabled persons only D.Its Part A provides payment for physicians' bills.arrow_forwardMike took clothes to the cleaners three times last month. First, he brought 2 shirts and 1 pair of slacks and paid $10.97.Then he brought 7 shirts, 4 pairs of slacks, and 1 sports coat and paid $48.38. Finally, he brought 5 shirts and 2 sports coats and paid $29.93. How much was he charged for each shirt, each pair of slacks, and each sports coat?arrow_forward

- How Much Do Cigarette Taxes Reduce Smoking?arrow_forwardConsider the following information on Alfred’s demand for visits per year to his health clinic, if his health insurance does not cover (100 percent coinsurance) clinic visits. Price Quantity 5 9 10 9 15 9 20 8 25 7 30 6 35 5 40 4 a. Alfred has been paying $25 per visit. How many visits does he make per year? Find his demand curve. b. What happens to his demand curve if the insurance company institutes a 40 percent coinsurance feature (Alfred pays 40 percent of the price of each visit)? What is his new equilibrium quantity? Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardAre there ways the government can or does attempt to improve the quality of information on certain goods and services?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education