FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

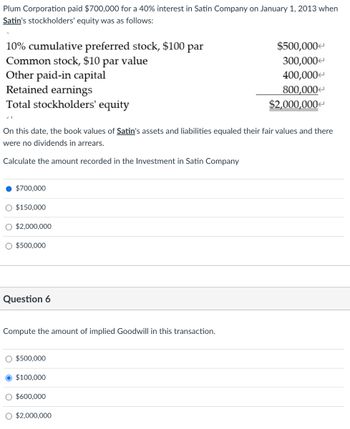

Transcribed Image Text:Plum Corporation paid $700,000 for a 40% interest in Satin Company on January 1, 2013 when

Satin's stockholders' equity was as follows:

10% cumulative preferred stock, $100 par

Common stock, $10 par value

Other paid-in capital

Retained earnings

Total stockholders' equity

On this date, the book values of Satin's assets and liabilities equaled their fair values and there

were no dividends in arrears.

Calculate the amount recorded in the Investment in Satin Company

$700,000

O $150,000

O $2,000,000

$500,000

Question 6

Compute the amount of implied Goodwill in this transaction.

$500,000

$100,000

O $600,000

$500,000

300,000

400,000

800,000

$2,000,000

O $2,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How much is the Ordinary Share Capital at year end? please kindly answerarrow_forwardAt the end of the accounting year, December 31, 2007, Emme's records reflected the following: (Compute for the total stockholders' equity) - Common stock, no par, 5,000 shares issued, issue price P12 per share - Preferred stock, par P5, 1,000 shares issued and outstanding; issue price, P15 per share - Unrealized gain, available-for-sale securities, P18,000 - Retained earnings, P20,000 (unappropriated) - Preferred stock, par P5, subscribed (not yet issued), 400 shares; subscription price P20 per share -Subscriptions receivable on the preferred stock P5,000 to be collected on January 1, 2008 -Reserve for bond sinking fun, P15,000 -Treasury stock, common stock, 1,000 shares, cost P10 per sharearrow_forwardThe outstanding share capital of KTI Corporation consists of 2,950 preferred shares and 7,000 common shayes for which $280,000 was received. The preferred shares carry a dividend of $7 per share and have $100 stated value. Instructions: Assuming that the company has retained earnings of $95,000 that is to be entirely paid out in dividends and that preferred dividends were not paid during the two years preceding the current year, state how much each class of shares should receive under each of the following conditions. a. The preferred shares are cumulative and non-participating. b. The preferred shares are cumulative and participating. Do not round intermediate calculations but round answer to nearest dollar.arrow_forward

- In January 2014, ABC Corporation, a new corporation, issued 10,000 shares of common stock with a par value of $10 for $15 per share. On July 1, 2014, ABC Corporation repurchased 1,000 shares of stock that were outstanding for $12 per share. This repurchase transaction has the effect of: a. it does not affect the total shareholders' equity. b. reduce the total equity of the shareholders. c. decrease the number of shares issued.arrow_forwardOn January 1, 2021, Anna Inc. owned 75% of the common stock of Jill Co. On that date, Jill's stockholders' equity accounts had the following balances: Common stock ($6 par value) $ 300,000 Additional paid-in capital 120,000 Retained earnings Total stockholders' equity The balance in Anna's Investment in Jill Co. account was $570,000, and the noncontrolling interest was $190,000. On January 1, 2021, Jill Co. sold 10,000 shares of previously unissued common stock for $12 per share. Anna did not acquire any of these shares. What is the balance in Anna Inc's Investment in Jill Co. account following the sale of the 10,000 shares of common stock? O $403,000. 340,000 $760,000 O $550,000. O $570,000. O $660,000. @ $880,000.arrow_forwardOn January 1, 2010, the accounts of Mac Corporation showed the following: Common stock, par SI, authorized 100.000 shares Capital in excess of par value ($2 per share) Retained carnings 60,000 140,000 During 2010, the following transactions occurred affecting stockholders' equity (in the order given) A B. C. D. Issued a 100° stock dividend when the market price was at $5 per share. Purchased treasury stock, 1.000 shares at a total cost of $8.000. Declared and paid cash dividends. SI5.000. Net income for 2010. S25.000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education