ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

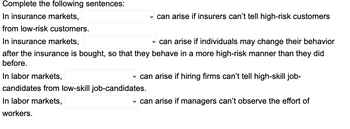

Transcribed Image Text:Complete the following sentences:

In insurance markets,

from low-risk customers.

✓ can arise if insurers can't tell high-risk customers

In insurance markets,

✓ can arise if individuals may change their behavior

after the insurance is bought, so that they behave in a more high-risk manner than they did

before.

In labor markets,

candidates from low-skill job-candidates.

In labor markets,

workers.

✓ can arise if hiring firms can't tell high-skill job-

✓ can arise if managers can't observe the effort of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Economics: Labor Economics Question: 1 Labor demand and supply of a market are given by w = 32 - 5Ed and w = 4 + 2Es. Please show work for each part. a.What is the equilibrium employment in this market? [a] b.What is the equilibrium wage in this market? [b] Question: 2 The marketplace is currently in equilibrium as indicated by the tangency condition shown below. Assume capital and labor are substitutes. Suppose technological improvements increase the productivity of capital but have no effect on the productivity of labor. In terms of its use of capital and labor what would you expect firms to do to re-establish equilibrium? (MPe/W) = (MPk/r) Thank you for your help and support Instructor Agent!arrow_forward32arrow_forwardIt is difficult to imagine a truly homogeneous market for even a commodity product like milk. In other words, since the milk market includes people who buy different types of milk (i.e., whole, 2%, skim, almond milk, etc.), you'd have to conclude that the milk market has many segments and that it's heterogeneous rather than homogeneous. A True В Falsearrow_forward

- Consider the Labor Market in New York and New Jersey. In both markets Demand is given by w = 1000-2E. Assume New York has a perfectly inelastic supply of 400 workers and New Jersey has perfectly inelastic supply of 200 workers. a. Graph the two markets and find the equilibrium wage in each market. b. With costless mobility across markets what would the long-run wage in each market. Show this in your graphs. c. Instead, assume that there are still 400 workers in New York and 200 in New Jersey but now the cost of moving is $ 100. What will be the long-run wage in each market? Explainarrow_forwarddraw a graph with this difinitions To visualize the impact of the minimum wage on the labor market, I have created an original graph (see below). This graph depicts a hypothetical labor market before and after an increase in the minimum wage. [Please insert your original graph here.] In the graph, the x-axis represents the quantity of labor, and the y-axis represents the wage rate. The blue curve (labeled "Initial Equilibrium") represents the initial labor market equilibrium, where the supply of labor (S) intersects with the demand for labor (D) at point A, determining the initial wage rate and employment level. The red curve (labeled "After Minimum Wage Increase") illustrates the impact of a minimum wage hike. When the government imposes a higher minimum wage, it acts as a price floor (represented by the horizontal line). This results in a new equilibrium at point B, where the wage rate is higher, but employment is lower compared to the initial equilibrium.arrow_forwardThe Blue-Steel Corporation supplies armored truck manufacturers with high-grade sheet metal panels that are used on the exterior of the vehicles. To make the panels, Blue-Steel uses two machines, which cost $15,000 each, and workers. These workers are available on the labor market for a salary of $55,000 each. The market price for one of Blue-Steel's metal sheet panel is $250 and the market is highly competitive. a. Based on the information provided, calculate the missing values for Table 1. a. What is the total fixed cost for Blue-Steel Corporation? Explain your calculation. b. What is the profit-maximizing number of workers Blue-Steel should hire? Explain your answer. c. What is the profit-maximizing output for Blue-Steel based on your calculations? d. Construct an X-Y Scatter chart using the Workers, Total Output, and MP-Labor column data. At what point does the diminishing returns effect set in?arrow_forward

- The war in Ukraine has driven many highly qualified IT specialists into neighboring Poland, where many chose to remain and start looking for jobs There are four graphs, depicting: (1) labor market for IT specialists in Poland, (2) the profit maximizing decision of a typical perfectly competitive Polish software firm, (3) market for Polish software products; (4) the Polish market for imported software products. Our goal is to analyze, using what you have learned, the effect of influx of foreign IT specialists on the three markets and on the typicalPolish software firm.. You have to address the questions in order, starting with the labor market for farm workers. In the labor market for IT specialists:: 1. Label clearly the supply and demand curves, S and D. 2. In the text, indicate clearly what side of the market is affected, supply or demand, by underlining or circling the relevant term. 3. Once you decided which side of the market is affected and how, show on the graph the new supply…arrow_forwardPlease give complete answer sir please and don't answer by pen paperarrow_forwardEconomics: Labor Economics Question: Native labor demand and supply are given by the following functions: w = 19 - 0.001ED and w = 10 + 0.0005ES Show your work a.What is the native employment in equilibrium? [a] b.What is the native equilibrium [b] Suppose that 2,000 immigrants that are perfectly substitutes for native workers now enter the market and their labor supply is perfectly inelastic. c.How many natives will be employed after the immigrants enter (round to the nearest whole number)? [c] d.What is the equilibrium wage for all workers in this market after the immigrants enter (round to the hundredth of a dollar)? [d] Thank you for your support and help Education Agent!arrow_forward

- Suppose a union successfully negotiates an increase in the wages of workers producing computer chips. This would lead to ___ in the supply of computers, causing the price of computers to ___ . Because computers and computer software are ___ , this change in price would cause the demand for computer software to ___ . However, computers and typewriters are ____ , so the change in the price of computers would _____ the demand for typewritersarrow_forwardExercise 2. Suppose that Government is currently evaluating a project, which is going to hire native language teachers and requires in total 5000 hours of teaching. Let's denote the hour taught by native language teacher by letter L. Thus, the project's demand for teaching hours by native language teachers is described by the demand function La project = 5000. Suppose that the following is known about the current (pre-project) market for native language teachers: - there is no involuntary unemployment among the native language teachers - the Government does not apply any taxes or subsidies in this particular labour market; - the current (pre-project) demand for teaching hours by native language teachers is described by the demand function La = 30000 – 300Wa, where La denotes the quantity of teaching hours (by native language teachers) demanded and Wa denotes the demander price per teaching hour; - the current (pre-project) supply of teaching hours by native language teachers is given…arrow_forward3:22 l LTE Question 11 Unanswered 2 attempts left Many professional sports teams operate under a salary cap. This means that teams typically have a fixed amount of money that they can spend on players' salaries - that is, a salary cap. This is true of the National Basketball Association (NBA), for example. Suppose that the NBA has a salary cap of $100 million dollars, and a team has $30 million available to sign new players. That is, $70 million has already been committed to player salaries. The team has two further possibilities: either sign a star player for $30 million, or sign two good, solid supporting players for $15 million each. What is the opportunity cost of signing the star player, assuming the team spends its full budget? A 2 supporting players 1 star player $30 million D There is no opportunity cost B.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education