Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please solve the problem max in 30-60 minutes max. I'm waiting please. Thank u

1. A company partially financed by long-term debt has issued bonds with a characteristic nominal value of IDR 10000, an interest rate of 10% and a maturity of 5 years. If the bond is estimated to have a market price of IDR 9500. Determine the required rate of return (kd) and cost of capital after tax (ki) for the bond if the tax rate is 30%.

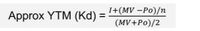

Notes; to make it easier to find kd you can use the following formula:

Transcribed Image Text:1+ (MV — Ро)/n

Approx YTM (Kd) =

%3D

(MV+Po)/2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A firm has obtained a 3-year floating rate loan paying a premium of 2%. Given the prime rate is 5%. Immediately after the loan is taken, the prime rate increases to 6%. Which of the following is TRUE? Question 49 options: 1) The interest rate payable is 3%. 2) The interest rate payable is 5%. 3) The interest rate payable is 7%. 4) The interest rate payable is 8%.arrow_forwardNonearrow_forwardBank K is about to sign a loan agreement with a mining company.The current LIBOR rate is 8%.The risk premium for the company has been estimated as 3% and the origination fee will be 0.1875 percent.The bank will be requesting a 9% compensating balance requirement.If the reserve requirement is 6%,what is the promised gross return on the loan?arrow_forward

- don't use excel also can you show me maths solving with equation by hand please....arrow_forwardCould you also include the formula that you use when working out the calculation, for example part A asks the new bond value, could you include a formula to show how this is calculated Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset 5yr bond bought at a yield of 3.4% (lending money) $550M 4.562 12.026 12yr bond bought at a yield of 4% (lending money) $800M 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability 2yr bond sold at a yield of 2.4% (borrowing money) $300M 1.941 2.384 4yr bond sold at a yield of 2.8% (borrowing money) $500M 3.759 8.206 Required a) If the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratio; (Hint: equity to asset ratio = total equity/total asset) b) In a)’s scenario, to maintain the equity to asset…arrow_forwardK You expect to have $12,000 in one year. A bank is offering loans at 5.5% interest per year. How much can you borrow today? Today you can borrow $ (Round to the nearest cent.) Carrow_forward

- Finance Suppose that the price of 3-year zero-coupon bonds is 1000 pounds. What is the forward rate for the third year? How would you construct a synthetic 1-year forward loan that commences at t= 2 and matures at t= 3arrow_forwardPls do fast i will rate for sure.. Try to answer in typed form..arrow_forwardPlease use the information in Question 5 to answer this question. You have taken out a 1/1 ARM (the teaser rate is locked for 1 year, and after this 1-year initial period, interest rate begins to adjust per year) with the following loan terms: • Loan amount: $300,000 • Annual rate cap: 2% • Lifetime cap: 6% • Margin: 300 bps (3%) • Teaser rate (annual): 5% • Market index rate at the beginning of year 1: 5.5% • Market index rate at the beginning of year 2: 6.5% • Loan term in years: 30 years Q6: Please calculate the monthly payment for year 1 $1,703.37 O $2,306.74 O $1,264.81 $1,610.46 No answer within +/-$10.0 of the correct onearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education