ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Please see the attached 98

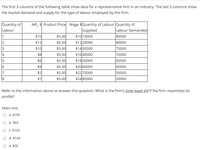

Transcribed Image Text:The first 3 columns of the following table show data for a representative firm in an industry. The last 3 columns show

the market demand and supply for the type of labour employed by this firm.

Quantity of

Labour

MPL $ Product Price Wage $Quantity of Labour Quantity of

Supplied

$1010000

$12 20000

Labour Demanded

85000

1

$10

$5.00

$5.00

$12

80000

75000

2

$10

$5.00

$5.00

$5.00

$1430000

4

$8

$16 40000

70000

$6

$18 50000

65000

16

$4

$5.00

$20 60000

60000

7

$2

$5.00

$22 70000

55000

$1

$5.00

$24 80000

50000

Refer to the information above to answer this question. What is the firm's_total wage bill if the firm maximizes its

profits?

Select one:

O a. $192

O b. $64

O c. $120

O d. $154

e. $30

Expert Solution

arrow_forward

Step 1

Answer to the question is as follows :

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Someone decides to purchase a vehicle. They will finance the entire purchase and can afford to pay $400 per month. The loan is for 36 months and there is a 7% annual interest rate. What is the maximum purchase price they can afford?arrow_forwardYou are in the market to buy a used car. Your monthly budget allows for a $300 per month car payment and you want to finance for 4 years. The current APR for a used car is 3%. a) Calculate the amount of loan you can afford. b) Complete the table below. Year 0 After 1 month After 2 months After 6 months After 1 year Loan Balance Interest Paidarrow_forwardProtection costs $338 and returns $507 after 6 years. What is the interest rate?arrow_forward

- Calculate the simple interest due on a 58-day loan of $1300 if the interest rate is 5%. (Round your answer to the nearest cent.)$arrow_forwardEd opened a savings account 5 years ago with $600. The account earns 3% simple interest per year, and Ed has not added or withdrawn from the account. How much interest has Ed earned?arrow_forwardJim Duggan made an investment of $10,000 in a savings account 10 years ago. This account paid interest of 5 1/2% for the first 4 years and 6 1/2% interest for the remaining 6 years. The interest charges were compounded quarterly. How much is this investment worth now?arrow_forward

- You deposit $ 9,030 in an account that pays 3 % simple interest. How much do you have after 4 years? If needed, round your answer to zero decimal places.arrow_forwardPlease see attachment and type out step by step the correct answer within 40 minutes , n give explanation of each option given below . Will give thumbs up only for the correct answer. Thank youarrow_forwardSo what really happens if we don't raise the debit limit? Hmmmm? Good question we have never not done that before... Verbatum question formulated by Eric Kortenhoven. Comment on the question then reply to a fellow student this will be an extra credit and points can be used wherever you would like just let me know where to apply themarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education