FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

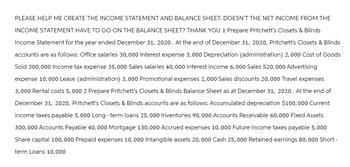

Transcribed Image Text:PLEASE HELP ME CREATE THE INCOME STATEMENT AND BALANCE SHEET. DOESN'T THE NET INCOME FROM THE

INCOME STATEMENT HAVE TO GO ON THE BALANCE SHEET? THANK YOU 1 Prepare Pritchett's Closets & Blinds

Income Statement for the year ended December 31, 2020. At the end of December 31, 2020, Pritchett's Closets & Blinds

accounts are as follows: Office salaries 30,000 Interest expense 3,000 Depreciation (administration) 2,000 Cost of Goods

Sold 300,000 Income tax expense 35,000 Sales salaries 40,000 Interest income 6,000 Sales 520,000 Advertising

expense 10,000 Lease (administration) 3,000 Promotional expenses 2,000 Sales discounts 20,000 Travel expenses

3,000 Rental costs 5,000 2 Prepare Pritchett's Closets & Blinds Balance Sheet as at December 31, 2020. At the end of

December 31, 2020, Pritchett's Closets & Blinds accounts are as follows: Accumulated depreciation $100,000 Current

income taxes payable 5,000 Long - term loans 25, 000 Inventories 90, 000 Accounts Receivable 60,000 Fixed Assets

300,000 Accounts Payable 40,000 Mortgage 130,000 Accrued expenses 10,000 Future income taxes payable 5,000

Share capital 100, 000 Prepaid expenses 10,000 Intangible assets 20, 000 Cash 25,000 Retained earnings 80,000 Short -

term Loans 10,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please show your work.arrow_forwardUse the information for Purrfect Pets below to calculate each of the required numbers. Assume that expenses include taxes and the company has no other sources of revenue. December 31, 2019 December 31, 2020 Current Assets $186,600 Current Assets $237,300 Current Liabilities 95,300 Current Liabilities 91,400 Contributed Capital 69,100 Contributed Capital 80,200 Retained Earnings 27,700 Retained Earnings 81,900 During the period 1/1/019 to 12/31/19 During the period 1/1/20 to 12/31/20 Sales Revenue 178,400 Sales Revenue 202,500 Expenses 145,200 Expenses 134,200 Required: a. Determine the current ratio for the company for 2019 and 2020. Provide your answer in the space given below. 2019 2020 Current Ratio $ $ Based on your calculated result, answer the following question: Has Purrfect Pets' liquidity been increased or decreased in 2020? In the space provided below, enter "1" for increase, enter "-1" for decrease, enter "0" for no change. Your answer: b. Determine the net income for the…arrow_forwardanswer the following questions based on the information provided please!arrow_forward

- Prepare an income statement for the year ending December 31, 2021arrow_forwardHomework: Part 1 of 7 Luxe Mobile Homes reported the following in its financial statements for the year ended December 31, 2024: (Click the icon to view the financial statements) Read the requirements. 4 Data table Requirement 1. Compute the collections from customers. Collections from customers are ||| Help me solve this SEPUPPER Demodocs example Income Statement Net Sales Revenue Cost of Goods Sold Depreciation Expense Other Operating Expenses Income Tax Expense Net Income Balance Sheet Cash $ Accounts Receivable Merchandise Inventory Property, Plant, and Equipment, net Accounts Payable Accrued Liabilities Long-term Liabilities Common Stock, no par Retained Earnings Get more help - Print $ Done $ 2024 24,623 S 18,097 269 4,411 535 1,311 $ 22 $ 2023 795 3,487 4,341 1,546 935 483 676 5,005 21,674 15,458 4,283 488 1,212 19 616 2,840 3,424 1,362 848 467 444 3,778 CHL Earrow_forwardI only need the 5b photo question. #2 prepare a single income statement and the analysis component. Thanks!arrow_forward

- Required: Use the financial statements of Heifer Sports Incorporated to find the information below for Heifer. Note: Use 365 days a year. Do not round intermediate calculations. Round all answers to 2 decimal places except $ amounts and Round Average collection period to 1 decimal place. Income Statement Sales Cost of goods sold Depreciation Selling and administrative expenses EBIT Interest expense Taxable income Taxes Net income 2023 $5,750,000 3,036,000 301,400 1,614,000 $ 798,600 173,000 $ 625,600 284,500 $ 341,100 Balance Sheet, Year-End Assets Cash Accounts receivable Inventory Total current assets Fixed assets Total assets Liabilities and shareholders' equity Accounts payable Short-term debt Total current liabilities Long-term bonds Total liabilities Common stock Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 2023 $ 41,600 592,000 439,600 $ 1,073,200 2,827,000 $ 3,900,200 $ 313,300 501,000 $ 814,300 1,783,800 $2,598,100 $ 312,500 989,600 $…arrow_forwardThe Unearned Revenue account of Melrose Incorporated began 2021 with a normal balance of $5,500 and ended 2021 with a normal balance of $16,000. During 2021, the Unearned Revenue account was credited for $19,000 that Melrose will earn later. Based on these facts, how much revenue did Melrose eam in 2021? OA. $8,500 OB. $19,000 OC. $29,500 OD. $0 OUarrow_forwardneed help preparing an statement table The following information relates to Oriole Co. for the year 2020. Owner’s capital, January 1, 2020 $53,827 Advertising expense $ 2,019 Owner’s drawings during 2020 6,728 Rent expense 11,663 Service revenue 71,321 Utilities expense 3,476 Salaries and wages expense 33,081arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education