FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Please don't provide answer in image format thank you.

Required 1. Record the transactions in the general journal. 2. Prepare the statement of shareholders' equity for the year ended December 31, 2023.

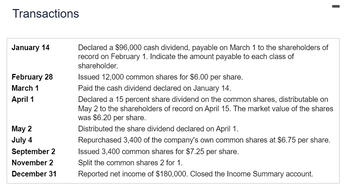

Transcribed Image Text:Transactions

January 14

February 28

March 1

April 1

May 2

July 4

September 2

November 2

December 31

Declared a $96,000 cash dividend, payable on March 1 to the shareholders of

record on February 1. Indicate the amount payable to each class of

shareholder.

Issued 12,000 common shares for $6.00 per share.

Paid the cash dividend declared on January 14.

Declared a 15 percent share dividend on the common shares, distributable on

May 2 to the shareholders of record on April 15. The market value of the shares

was $6.20 per share.

Distributed the share dividend declared on April 1.

Repurchased 3,400 of the company's own common shares at $6.75 per share.

Issued 3,400 common shares for $7.25 per share.

Split the common shares 2 for 1.

Reported net income of $180,000. Closed the Income Summary account.

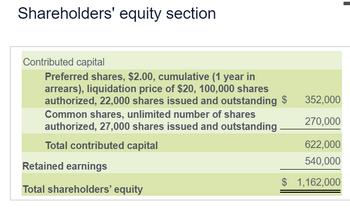

Transcribed Image Text:Shareholders' equity section

Contributed capital

Preferred shares, $2.00, cumulative (1 year in

arrears), liquidation price of $20, 100,000 shares

authorized, 22,000 shares issued and outstanding $

Common shares, unlimited number of shares

authorized, 27,000 shares issued and outstanding

Total contributed capital

Retained earnings

Total shareholders' equity

352,000

270,000

622,000

540,000

$ 1,162,000

|

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need answer for d) part only please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardplease do not provide solution in image format thank you!arrow_forwardIn light of the full disclosure principle, investors and creditors need to know the balances for assets, liabilities, and equity as well as the accounting policies adopted by management to measure the items reported in the balance sheet. Instructions If your school has a subscription to the FASB Codification, go to http://aaahq.org/asclogin.cfm to log in and prepare responses to the following. Provide Codification references for your responses. (a) Identify the literature that addresses the disclosure of accounting policies. (b) How are accounting policies defined in the literature? (c) What are the three scenarios that would result in detailed disclosure of the accounting methods used? (d) What are some examples of common disclosures that are required under this statement?arrow_forward

- converted into preferred stock. Assuming that the book value method was used, what entry would be made? (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account title and enter 0 for the amounts.) Account Titles and Explanation Debit Credit eTextbook and Mediaarrow_forwardanswer in text form please (without image)arrow_forwardDo not give answer in imagearrow_forward

- Step one of the closing entries for a corporation requires a debit to revenue account(s) for its balance, credit each expense account for its balance and credit what account for the amount of net income? Group of answer choices common stock retained earnings treasury stock dividendsarrow_forwardSaved Help Save & Exit Submi- Which of the following does not accurately describe a requirement that a company must fulfill when adopting IFRS for the first time? Multiple Choice The company must provide a reconciliation of net income and stockholders' equity under previous GAAP to net income and stockholders' equity under IFRS in its first set of IFRS financial statements. The company must prepare an opening IFRS balance sheet at the beginning of the year for which the company is preparing its first set of IFRS financial statements. At the IFRS transition date, the company must select IFRS accounting policies based on those that will be in effect for the accounting period that will be covered by the first set of IFRS financial statements. At the IFRS transition date, the company must derecognize assets and liabilities that were recognizedarrow_forwardThese financial statement items are for Sunland Corporation at year end, July 31, 2021: Operating expenses Salaries expense Deferred revenue Utilities expense Equipment Accounts payable Service revenue Rent revenue Common shares Cash Accounts receivable D Accumulated depreciation-equipment $32,500 46,700 12,000 2,600 70,200 5,020 116,100 19,000 27,500 5,560 16,100 5,800 Interest payable Supplies expense Dividends declared Depreciation expense Retained earnings, August 1, 2020 Rent expense Income tax expense Supplies Trading investments Bank loan payable (due December 31, 2021) Interest expense O $900 777891 700 14,500 3,500 22,940 11,500 5,700 2,100 20,500 24,800 Additional information: Sunland started the year with $14,000 of common shares and issued additional shares for $13,500 during the year. 1,900 O Warrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education