Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

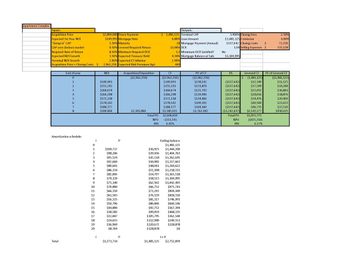

Please clearly and thoroughly explain the steps on how you determine the expected levered-before-tax-annual

Transcribed Image Text:Apartment Complex

Inputs:

Acquisition Price

Expected 1st Year NOI

"Going in" CAP

CAP over (below) market

Required Rate of Return

Expected NOI Growth

Terminal NOI Growth

Acquisition Price + Closing Costs $

End of year

0

1

Total

2

3

4

5

6

7

8

Amortization schedule:

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

I

$2,890,000 Down Payment

$149,991 Mortgage Rate

5.19% Maturity

0.50% Levered Required Return

8.50% Minimum Required DCR

3.50% Expected Treasury Yield

2.90% Expected LT Inflation.

2,962,250 Expected Risk Premium (bp)

NOI

$149,991

$155,241

$160,674

$166,298

$172,118

$178,142

$184,377

$190,830

$100,717

$98,206

$95,524

$92,660

$89,601

$86,334

$82,845

$79,119

$75,140

$70,890

$66,350

$61,503

$56,325

$50,796

$44,890

$38,583

$31,847

$24,653

$16,969

$8,764

$1,271,714

P

P

Acquisition/Disposition

($2,962,250)

$3,195,084

Total PV:

NPV:

IRR:

Outputs:

$ 1,481,125 Terminal CAP

6.80% Loan Amount

20 Mortgage Payment (Annual)

11.00% DCR

$62,502

$66,752

$71,292

$76,139

$81,317

$86,846

$92,752

$99,059

$105,795

$112,989

$120,672

$128,878

1.2 Mimimum DCR Satisfied?

4.30% Mortgage Balance at Sale

2.90%

400

CF

($2,962,250)

$149,991

$155,241

$160,674

$166,298

$172,118

$178,142

$184,377

$3,385,915

Ending balance

$1,481,125

$36,925 $1,444,200

$39,436

$1,404,763

$42,118

$1,362,645

$44,982

$1,317,663

$48,041 $1,269,622

$2,606,659

-$355,591

6.45%

$51,308 $1,218,315

$54,797

$1,163,518

$58,523

$1,104,995

$1,042,493

$975,741

$904,449

I + P

$828,310

$746,993

$660,146

$567,394

$468,335

$362,540

$249,551

$128,878

$0

$1,481,125 $2,752,839

PV of CF

($2,962,250)

$138,241

$131,870

$125,793

$119,996

$114,466

$109,191

$104,160

$1,762,942

5.900% Closing Fees

$1,481,125 Comission

$137,642 Closing Costs $

1.09 Selling Expenses $

No

$1,104,995

DS

($137,642)

($137,642)

($137,642)

($137,642)

($137,642)

($137,642)

($137,642)

($1,242,637)

Total PV:

NPV:

IRR:

Levered CF

$ (1,481,125)

$12,349

$17,599

$23,032

$28,656

$34,476

$40,500

$46,735

$2,143,277

$1,055,775

($425,350)

6.17%

2.50%

4.00%

72,250

133,128

PV of Levered CF

($1,481,125)

$11,125

$14,284

$16,841

$18,876

$20,460

$21,653

$22,510

$930,025

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please show detailed steps and correctarrow_forwardSuppose a wealthy individual approaches you and says, “Because of your outstanding ability to manage money, I am prepared to present you with a tax-free gift of $1,000. If you prefer, however, I will postpone the presentation for a year, at which time I will guarantee that you will receive a tax-free gift of $X.” (For purposes of this example, assume that the guarantee is risk-free.) In other words, you can choose to receive $1,000 today or receive $X 1 year from today. Which would you choose if X equals (1) $1,000, (2) $1,050, (3) $1,100, (4) $1,500, (5) $2,000, (6) $5,000, (7) $10,000, (8) $100,000? Suppose the student is guaranteed to receive $1,100 one year from today, and nothing thereafter, if $1,000 is invested today in a particular venture. What is the return on the student’s investment?arrow_forwardYou are creating a pro forma balance sheet for the upcoming year. You have already prepared a pro forma income statement, and are predicting total assets will increase by $185,000 due to the increase in sales you are anticipating. How will you choose to finance this new growth in order to make sure the balance sheet balances?arrow_forward

- Sophia Martinez wants to travel after she retires as well as pay off the balance of the loan she has on the home she owns. whi planning process does this situation demonstrate? Multiple Choice Determining her current financial situation Developing her financial goals Identifying alternative courses of action Evaluating her alternatives Implementing her financial planarrow_forwardPLEASE ASSIST ME WITH PARTS A (Number 4) B & C Waterways put much emphasis on cash flow when it plans for capital investments. The company chose its discount rate of 8% based on the rate of return that it must pay its owners and creditors. Using that rate, Waterways then uses different methods to determine the best decisions for making capital outlays. This year, Waterways is considering buying five new backhoes to replace the backhoes it now has. The new backhoes are faster, cost less to run, provide for more accurate trench digging, have comfort features for the operators, and have 1-year maintenance agreements to go with them. The old backhoes are working just fine, but they do require considerable maintenance. The backhoe operators are very familiar with the old backhoes and would need to learn some new skills to use the new backhoes. The following information is available to use in deciding whether to purchase the new backhoes. Information Old Backhoes New Backhoes…arrow_forwardHow to solve a problem when they give you the liability amount $120000 and the equity $232k and they ask to fund the total assets?arrow_forward

- 9. Go to the Earnings Projections worksheet. Pranjali has entered most of the income and expense data on the worksheet. She knows the income from municipal grants will be $25,000 in 2022, and estimates it will be $40,000 in 2026. She needs to calculate the income from municipal grants in the years 2023-2025. The grants should increase at a constant amount from year to year. Project the income from Municipal grants for 2023-2025 (cells D5:F5) using a Linear Trend interpolation. 10. Pranjali also needs to calculate the income from insurance reimbursements in the years 2023-2025. She knows the starting amount and has estimated the amount in 2026. She thinks this income will increase by a constant percentage. Project the income from Insurance reimbursements for 2023-2025 (cells D7:F7) using a Growth Trend interpolation. 11. Pranjali needs to calculate the payroll expenses in the years 2023-2026. She knows the payroll will be $140,000 in 2022 and will increase by at least five percent per…arrow_forwardo Describe in detail how you are financing your college education. Include sources like scholarships, loans, family contributions, part- time jobs, savings, grants, etc. o How did you secure these financial resources? What challenges did you face in the process?arrow_forwardYou need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital: Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation Pretax profit Tax at 30% Investment 1 $ 73 33 40 12 19 a. Total value b. Laputa's equity Year 2 $93 43 50 15 22 3 $ 108 48 60 18 25 4 $ 113 53 60 18 27 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 60% by equity and 40% by debt. Its cost of equity is 18%, its debt yields 9%, and it pays corporate tax at 30%. a. Estimate the company's total value. Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount.arrow_forward

- Instructions Consider an organization that has Earnings Before Tax of $100,000. Assume amortization expense for this organization is zero, and it is in the 30% tax bracket. Answer the following questions: 1. What is the cash flow? 2. Now assume amortization is $50,000. Does the cash flow change? If so, why and by how much? Requirements Your submission should include a single Microsoft Word document or pdf containing your response to the discussion question. Sarrow_forwardcalculate the annual payment and complete the following capital recovery schedule.arrow_forwardRefer to the investment opportunity for 2025 and calculate the Internal Rate of Return, ignoring taxes (expressed to two decimal places). Your answer must reflect two NPV calculations (using consecutive rates/percentages) and interpolation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education