Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Need solution

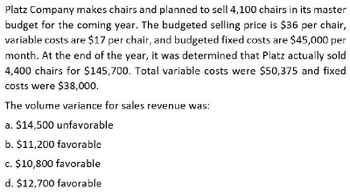

Transcribed Image Text:Platz Company makes chairs and planned to sell 4,100 chairs in its master

budget for the coming year. The budgeted selling price is $36 per chair,

variable costs are $17 per chair, and budgeted fixed costs are $45,000 per

month. At the end of the year, it was determined that Platz actually sold

4,400 chairs for $145,700. Total variable costs were $50,375 and fixed

costs were $38,000.

The volume variance for sales revenue was:

a. $14,500 unfavorable

b. $11,200 favorable

c. $10,800 favorable

d. $12,700 favorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Lowell Manufacturing Inc. has a normal selling price of 20 per unit and has been selling 125,000 units per month. In November, Lowell Manufacturing decided to lower its price to 19 per unit expecting it can increase the units sold by 16%. a. Compute the normal revenue with a 20 selling price. b. Compute the planned revenue with a 19 selling price. c. Compute the actual revenue for November, assuming 135,000 units were sold in November at 19 per unit. d. Compute the revenue price variance, assuming 135,000 units were sold in November at 19 per unit. e. Compute the revenue volume variance, assuming 135,000 units were sold in November at 19 per unit. f. Analyze and interpret the lowering of the price to 19.arrow_forwardSunrise Poles manufactures hiking poles and is planning on producing 4,000 units in March and 3,700 in April. Each pole requires a half pound of material, which costs $1.20 per pound. The companys policy is to have enough material on hand to equal 10% of the next months production needs and to maintain a finished goods inventory equal to 25% of the next months production needs. What is the budgeted cost of purchases for March?arrow_forwardLens Junction sells lenses for $45 each and is estimating sales of 15,000 units in January and 18,000 in February. Each lens consists of 2 pounds of silicon costing $2.50 per pound, 3 oz of solution costing $3 per ounce, and 30 minutes of direct labor at a labor rate of $18 per hour. Desired inventory levels are: Â Prepare a sales budget, production budget. direct materials budget for silicon and solution, and a direct labor budget.arrow_forward

- Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the follow sales: In Shalimars experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 percent are never collected. Total sales for the third quarter of the current year are 4,900,000 and for the fourth quarter of the current year are 6,850,000. Required: 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. 2. Construct a cash receipts budget for Shalimar Company for each quarter of the next year, showing the cash sales and the cash collections from credit sales. 3. What if the recession led Shalimars top management to assume that in the next year 10 percent of credit sales would never be collected? The expected payment percentages in the quarter of sale and the quarter after sale are assumed to be the same. How would that affect cash received in each quarter? Construct a revised cash budget using the new assumption.arrow_forwardAdam Corporation manufactures computer tables and has the following budgeted indirect manufacturing cost information for the next year: If Adam uses the step-down (sequential) method, beginning with the Maintenance Department, to allocate support department costs to production departments, the total overhead (rounded to the nearest dollar) for the Machining Department to allocate to its products would be: a. 407,500. b. 422,750. c. 442,053. d. 445,000.arrow_forwardCadre, Inc., sells a single product with a selling price of $120 and variable costs per unit of $90. The companys monthly fixed expenses are $180,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of October when they will sell 10,000 units. How many units will Cadre need to sell in order to realize a target profit of $300,000? What dollar sales will Cadre need to generate in order to realize a target profit of $300,000? Construct a contribution margin income statement for the month of August that reflects $2,400,000 in sales revenue for Cadre, Inc.arrow_forward

- Uchdorf Manufacturing just completed a study of its purchasing activity with the objective of improving its efficiency. The driver for the activity is number of purchase orders. The following data pertain to the activity for the most recent year: Activity supply: five purchasing agents capable of processing 2,400 orders per year (12,000 orders) Purchasing agent cost (salary): 45,600 per year Actual usage: 10,600 orders per year Value-added quantity: 7,000 orders per year Required: 1. Calculate the volume variance and explain its significance. 2. Calculate the unused capacity variance and explain its use. 3. What if the actual usage drops to 9,000 orders? What effect will this have on capacity management? What will be the level of spending reduction if the value-added standard is met?arrow_forwardTIB makes custom guitars and prepared the following sales budget for the second quarter It also has this additional information related to its expenses: Direct material per unit $55, Direct labor per hour 20, Variable manufacturing overhead per hour 3.50, Fixed manufacturing overhead per month 3,000, Sales commissions per unit 20, Sales salaries per month 5,000, Delivery expense per unit 0.50, Utilities per month 4,000. Administrative salaries per month 20,000, Marketing expenses per month 8,000, Insurance expense per month 11,000, Depreciation expense per month 9,000. Prepare a sales and administrative expense budget for each month in the quarter ended June 30. 2018.arrow_forwardKrouse Company produces two products, forged putter heads and laminated putter heads, which are sold through specialty golf shops. The company is in the process of developing itsoperating budget for the coming year. Selected data regarding the companys two products areas follows: Manufacturing overhead is applied to units using direct labor hours. Variable manufacturing overhead Ls projected to be 25,000, and fixed manufacturing overhead is expected to be15,000. The estimated cost to produce one unit of the laminated putter head is: a. 42. b. 46. c. 52. d. 62.arrow_forward

- Nashler Company has the following budgeted variable costs per unit produced: Budgeted fixed overhead costs per month include supervision of 98,000, depreciation of 76,000, and other overhead of 245,000. Required: 1. Prepare a flexible budget for all costs of production for the following levels of production: 160,000 units, 170,000 units, and 175,000 units. 2. What is the per-unit total product cost for each of the production levels from Requirement 1? (Round each unit cost to the nearest cent.) 3. What if Nashler Companys cost of maintenance rose to 0.22 per unit? How would that affect the unit product costs calculated in Requirement 2?arrow_forwardPlatz Company makes chairs and planned to sell 4,100 chairs in its master budget for the coming year. The budgeted selling price is $36 per chair, variable costs are $17 per chair, and budgeted fixed costs are $45,000 per month. At the end of the year, it was determined that Platz actually sold 4,400 chairs for $145,700. Total variable costs were $50,375 and fixed costs were $38,000. The volume variance for sales revenue was: a. $14,500 unfavorable b. $11,200 favorable c. $10,800 favorable d. $12,700 favorablearrow_forwardPlatz Company makes chairs and planned to sell 4,100 chairs in its master budget for the coming year. The budgeted selling price is $36 per chair, variable costs are $17 per chair, and budgeted fixed costs are $45,000 per month. At the end of the year, it was determined that Platz actually sold 4,400 chairs for $145,700. Total variable costs were $50,375 and fixed costs were $38,000. The volume variance for sales revenue was: a. $14,500 unfavorable b. $11,200 favorable c. $10,800 favorable d. $12,700 favorable want solution of this questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning