FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

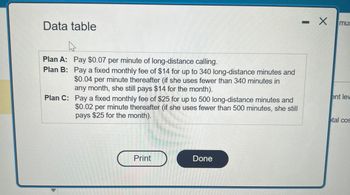

Transcribed Image Text:Data table

Plan A: Pay $0.07 per minute of long-distance calling.

Plan B:

Pay a fixed monthly fee of $14 for up to 340 long-distance minutes and

$0.04 per minute thereafter (if she uses fewer than 340 minutes in

any month, she still pays $14 for the month).

Plan C: Pay a fixed monthly fee of $25 for up to 500 long-distance minutes and

$0.02 per minute thereafter (if she uses fewer than 500 minutes, she still

pays $25 for the month).

Print

Done

- X

mus

ent lev

tal cos

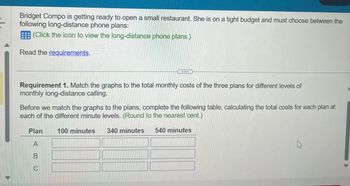

Transcribed Image Text:Bridget Compo is getting ready to open a small restaurant. She is on a tight budget and must choose between the

following long-distance phone plans:

(Click the icon to view the long-distance phone plans.)

Read the requirements.

Requirement 1. Match the graphs to the total monthly costs of the three plans for different levels of

monthly long-distance calling.

Before we match the graphs to the plans, complete the following table, calculating the total costs for each plan at

each of the different minute levels. (Round to the nearest cent.)

100 minutes 340 minutes 540 minutes

Plan

A

B

C

B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- AMG Services offers to lend Scott Tucker $5,250 which he needs to repair his sports car. AMG’s loan offer is subject to an APR of 14.6 % interest rate with monthly compounding. How long will it take Scott Tucker to pay off the loan if he makes $95 monthly payments?arrow_forwardns Lacy has a $41,500.00 student loan when she graduates on May 4, and the prime rate is set at 5.5%. She has decided at the end of the grace period to convert the interest to principal, and she sets her fixed monthly payment at $900.00. She opts for the variable rate on her student loan. Create the first four repayments of her repayment schedule. Calculate the total interest charged for both the grace period and the four payments combined. Assume February does not involve a leap year. (Round all monetary values to the nearest penny.) (Use a minus sign before the dollar sign to denote a negative monetary value. For example, "-$149.63") (Give all "Number of Days" quantities as fractions with denominator 365.) Date June 11 Nov 30 (inclusive) Dec 31 Jan 31 Feb 28 Mar 31 Balance before Transaction Annual Interest Rate 8% 8% 8% 8% 8% Number Interest Accrued of Days Charged Interest U D n Total combined interest charged for grace period and first four months: Payment (+) or Principal Balance…arrow_forwardAble Long buys a new desk for $2,400. Able will pay back $250 per month. Monthly interest is 3% on the unpaid balance. Calculate the balance outstanding after the second payment. (Use the U.S. Rule.) (Round your answer to the nearest cent.)arrow_forward

- Jenna bought a new car for $39,000. She paid a 10% down payment and financed the remaining balance for 48 months with an APR of 4.5%. Determine the monthly payment that Jenna pays. Round your answer to the nearest cent, if necessary.arrow_forwardSuppose that you charged $8430 on a credit card to relocate for your first job. When you realized that the interest rate for the unpaid balance was 27% compounded monthly, he decided not to charge any more on that account. You want to have this account paid off by the end of 3 years, so you arrange to have automatic payments of equal amount sent at the end of each month.(a) What monthly payment must you make to have the account paid off by the end of 3 years? (b) How much total interest will you have paid?arrow_forwardMarilyn was supposed to pay $1.620 to Bernice on March 18. Some time later Marilyn paid Bernice an equivalent payment of $1,67263. allowing fora time value of money of 24% compounded monthly. When did Marilyn make the payment? (Do not round your Irntermediate calculatlons and round your anewer to the neorest month.) Marylin mode the payment months later.arrow_forward

- A career counselor decides to make monthly payments of $150 on credit card debt of $3,496.46 and discontinue using that credit card. Assuming the monthly interest rate is 1.85%, it will take the counselor approximately 31 months to repay the debt. How many fewer months would it take to repay the debt if the counselor makes monthly payments of $200? (Round your answer to the nearest month.)arrow_forwardArminte is expanding her massage therapy business and needs to purchase equipment totaling $7,918.55 including sales tax. The supplier offered in-house financing of 30 monthly payments at $281.93 per month, with a 10% down payment. Answer parts 1 through 6. 1. Find the amount financed, installment price, and the finance charge presuming Arminte goes with the supplier. The amount financed is $nothingarrow_forwardA woman, with her employer's matching program, contributes $300 at the end of each month to her retirement account, which earns 7% interest, compounded monthly. When she retires after 43 years, she plans to make monthly withdrawals for 25 years. If her account eams 6% interest, compounded monthly, then when she retires, what is her maximum possible monthly withdrawal (without running out of money)? The maximum possible monthly withdrawal is approximately $ (Simplify your answer. Round to the nearest cent as needed) CD-arrow_forward

- Your grandma pays upfront for you to go on the overnight trip with the school, which cost $340. You make a deal that you'll give her $25 per month until you pay all back. How will you pay grandma?arrow_forwardTheresa borrowed $7258.00 compounded monthly to help finance her education. She contracted to repay the loan in monthly payments of $265.00 each. If the payments are due at the end of each month and interest is 4% coumpunded monthly, how long will Theresa have to make monthly payments? State your answer in years and months (from 0 to 11 months). theresa will have to make payments for _____ year(s) and ______ month(s)arrow_forwardCondominiums usually require a monthly fee for various services. At $280 a month, how much would a homeowner pay over a period of 12 years for living in this housing facility? Total Feearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education