FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Using High-Low to Calculate Fixed Cost, Calculate the Variable Rate, and

Construct a Cost Function

Refer to the information for Pizza Vesuvio on the previous page. Pizza

Vesuvio's controller wants to calculate the fixed and variable costs

associated with labor used in the restaurant.

Required:

Using the high-low method, calculate the fixed cost of labor, calculate

the variable rate per employee hour, and construct the cost formula for

total labor cost.

Use the following information for Brief Exercises 3-17 through 3-20:

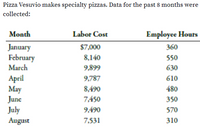

Transcribed Image Text:Pizza Vesuvio makes specialty pizzas. Data for the past 8 months were

collected:

Month

Labor Cost

Employee Hours

January

February

March

$7,000

360

8,140

550

9,899

630

April

May

June

July

August

9,787

610

8,490

480

7,450

350

9,490

570

7,531

310

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The JAG Company has assembled the following data pertaining to certain costs that cannot be easily identified as either fixed or variable. JAG Company has heard about a method of measuring cost functions called the high-low method and has decided to use it in this situation. The following are data from the most recent periods: Cost Hours $25,000 5,025 25,100 4,000 34,000 7,515 60,370 15,500 38,000 9.500 Required: (a) Using the high-low method, estimate the cost function. Round to two decimal places. Show work to receive partial credit!! (b) Calculate the estimated total costs at an operating level of 6,000 hours. Show work to receive partial credit!!!arrow_forwardLockTite Company produces two products, Pretty Safe (PS) and Virtually Impenetrable (VI). The following two tables give pertinent information about these products. Solve, a. What is the cost per unit of Pretty Safe if LockTite uses traditional overhead allocation based on number of units produced? b. What is the cost per unit of Pretty Safe if LockTite uses activity-based costing to allocate overhead?arrow_forwardwhat is the labor-related activity cost pool per DLH what is the machine-related activity cost pool per MH what is the machine setups activity cost pool per seteup what is the production orders activity cost per order what is the product testing activity cost per test what is the packaging activity cost per package what is the general factory activity cost per DLHarrow_forward

- Activity-based costing can be used to allocate period costs to various products that the company sells. False Truearrow_forwardHansabenarrow_forwardOverhead application to costs is a critical issue for the costing of your products. We are studying several ways to handle this situation. What would cause an overhead to be overapplied, or underapplied. Discuss the results to your decision making and the financial statements for each of those two situations.arrow_forward

- Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate compl 2. Compute the contribution margin per unit. [assume direct labor is a fixed cost] 3. Compute the contribution margin per welding hour. [assume direct labor is a fixed cost] 4. Assuming direct labor is a fixed cost: a. Determine the number of WVD drums (if any) that should be purchased and the number of WVD drums and/or bike frames (if any) that should be manufactured. b. What is the increase (decrease) in net operating income that would result from this plan over current operations? 5. Compute the contribution margin per unit. [assume direct labor is a variable cost] 6. Compute the contribution margin per welding hour. [assume direct labor is a variable cost] 7. Assuming direct labor is a variable cost: a. Determine the number of WVD drums (if any) that should be purchased and the number of WVD drums and/or bike frames (if any) that should be manufactured. b.…arrow_forwardHow does activity-based costing differ from traditional costing systems? Can you please create a brief outline by identifying 1 or 2 examples of a restaurant using an ABC system at a customer level, group level, service level, and facility level? PLEASE BE ORIGINAL IN YOUR ANSWER.arrow_forwardActivity-based costing can be beneficial in allocating selling and administrative expenses to various products for managerial decision making. Which of the following would be the best allocation base for help desk costs? a. number of sales employees Ob. number of products sold c. number of calls Od. square footage of the help desk officearrow_forward

- Please help me with Req 4. If someone can help I will give a thumbs up. If you zoom in I believe the image should beome clearer. Thanks!arrow_forwardPlease explain the statement below thoroughly with examples. (Ture or False) "In activity-based costing, the manufacturing overhead cost per unit will depend partially on the number of units in a batch."arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education