FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

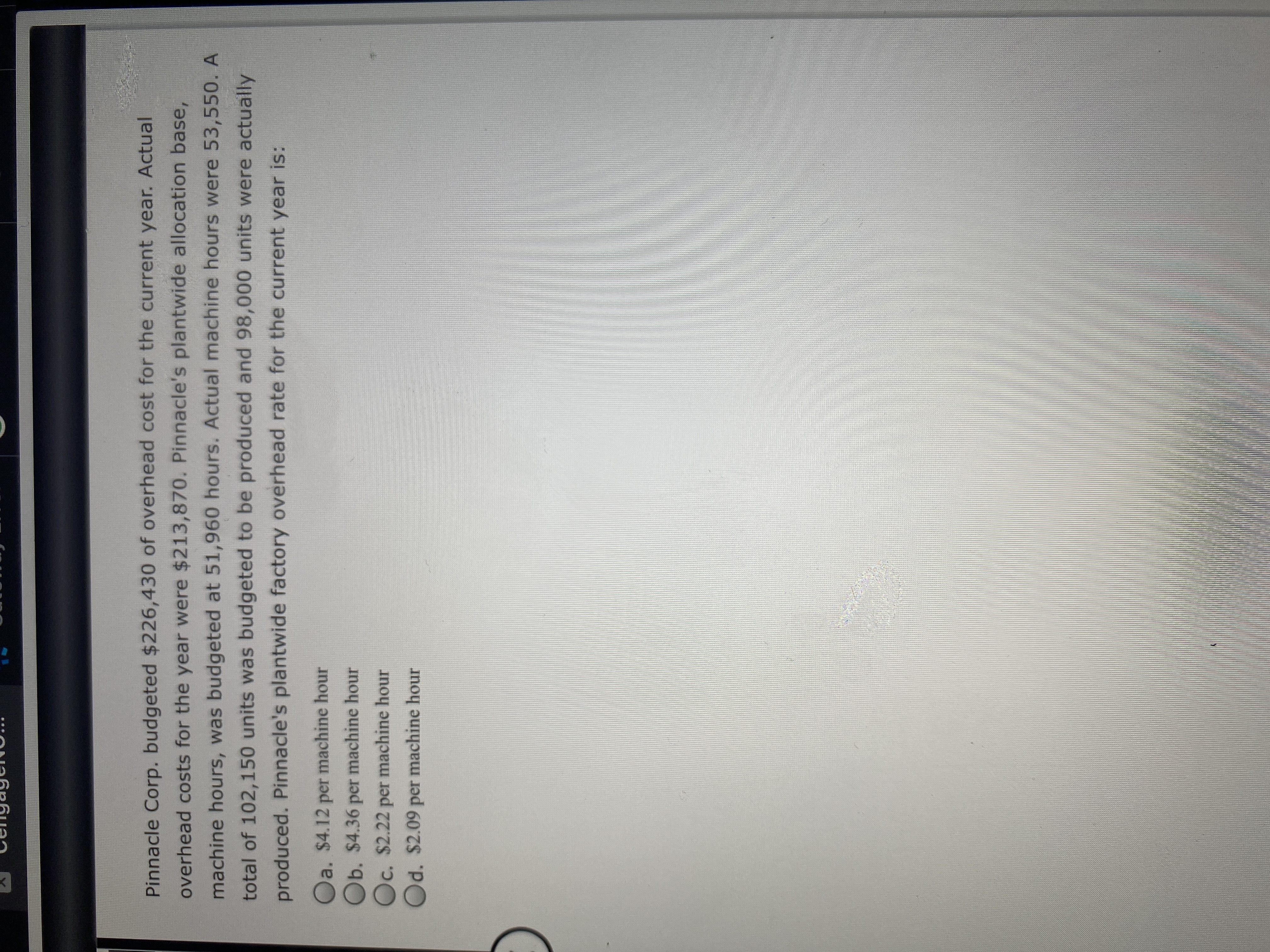

Transcribed Image Text:Pinnacle Corp. budgeted $226,430 of overhead cost for the current year. Actual

overhead costs for the year were $213,870. Pinnacle's plantwide allocation base,

machine hours, was budgeted at 51,960 hours. Actual machine hours were 53,550. A

total of 102,150 units was budgeted to be produced and 98,000 units were actually

produced. Pinnacle's plantwide factory overhead rate for the current year is:

Oa. $4.12 per machine hour

Ob. $4.36 per machine hour

Oc. $2.22 per machine hour

Od. $2.09 per machine hour

Expert Solution

arrow_forward

Step 1

Given,

Budgeted overhead cost = $226,340

Actual overhead cost = $213,870

Budgeted machine hours = 51,960 hours

Actual machine hours = 53,550 hours

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Patel and Sons Inc. uses a standard cost system to apply factory overhead costs to units produced. Practical capacity for the plant is defined as 51,600 machine hours per year, which represents 25,800 units of output. Annual budgeted fixed factory overhead costs are $258,000 and the budgeted variable factory overhead cost rate is $2.50 per unit. Factory overhead costs are applied on the basis of standard machine hours allowed for units produced. Budgeted and actual output for the year was 19,500 units, which took 40,600 machine hours. Actual fixed factory overhead costs for the year amounted to $251,600 while the actual variable overhead cost per unit was $2.40. Assume that at the end of the year, management of Patel and Sons decides that the overhead cost variances should be allocated to WIP Inventory, Finished Goods Inventory, and Cost of Goods Sold (CGS) using the following percentages: 10%, 20%, and 70%, respectively. Provide the proper journal entry to close out the…arrow_forwardTiger Equipment Inc., a manufacturer of construction equipment, prepared the following factory overhead cost budget for the Welding Department for May of the current year. The company expected to operate the department at 100% of normal capacity of 6,200 hours. Variable costs: Indirect factory wages $20,460 Power and light 13,826 Indirect materials 11,346 Total variable cost $45,632 Fixed costs: Supervisory salaries $10,410 Depreciation of plant and equipment 26,700 Insurance and property taxes 8,150 Total fixed cost 45,260 Total factory overhead cost $90,892 During May, the department operated at 6,600 standard hours. The factory overhead costs incurred were indirect factory wages, $22,000; power and light, $14,450; indirect materials, $12,300; supervisory salaries, $10,410; depreciation of plant and equipment, $26,700; and insurance and property taxes, $8,150. Required: Prepare a factory overhead cost…arrow_forwardA company's budgeted varlable manufacturing overhead cost Is $1.05 per machine-hour and Its budgeted fixed manufacturing overhead Is $27,094 per month. The following information is avallable for a recent month: a. The denominator activity of 8,740 machine-hours is used to compute the predetermined overhead rate. b. At a denominator activity of 8.740 machine-hours, the company should produce 3,800 unlts of product. C. The company's actual operating results were: Number of units produced Actual machine-hours Actual variable manufacturing overhead cost Actual fixed manufacturing overhead cost 4,220 10,050 $12,060.00 $26,400.00 Required: 1. Compute the predetermined overhead rate and break It down Into varlable and fixed cost elements. (Round your answers to 2 declmal places.) 2. Compute the standard hours allowed for the actual production. 3. Compute the varlable overhead rate and efficlency varlances and the fixed overhead budget and volume varlances. (Indicate the effect of each…arrow_forward

- Assume the following five facts: • budgeted fixed manufacturing overhead for the coming period of $308,750 • budgeted variable manufacturing overhead of $4.00 per direct labor hour, • actual direct labor hours worked of 64,000 hours, and • budgeted direct labor-hours to be worked in the coming period of 65,000 hours. The company allocates MOH based on direct-labor hours. The predetermined plantwide overhead rate for the period is closest to:A. $8.50 per dlh B. $8.82 per dlh C. $$8.75 per dlh D. $8.63 per dlharrow_forwardKing Company estimated that it would operate its manufacturing facilities at 800,000 direct labour hours for the year, which served as the denominator activity in the predetermined overhead rate. The total budgeted manufacturing overhead for the year was $2,000,000, of which $1,600,000 was variable and $400,000 was fixed. The standard variable overhead rate was $2 per direct labour hour. The standard direct labour time was 3 direct labour hours per unit. The actual results for the year are presented below: Actual Finished Units Actual Direct Labour Hours Actual Variable Overhead Actual Fixed Overhead 250,000 764,000 $1,610,000 $ 392,000 A. What was the variable overhead spending variance for the year? B. What was the variable overhead efficiency variance for the year?arrow_forwardThe total factory overhead for Big Light Company is budgeted for the year at $2,201,190. Big Light manufactures two different products: night lights and desk lamps. Night lights are budgeted for 18,000 units. Each night light requires 2 hours of direct labor. Desk lamps are budgeted for 18,700 units. Each desk lamp requires 3 hours of direct labor. a. Determine the total number of budgeted direct labor hours for the year.fill in the blank direct labor hours b. Determine the single plantwide factory overhead rate using direct labor hours as the allocation base. Round your answer to two decimal places.fill in the blank per direct labor hour c. Determine the factory overhead allocated per unit for each product using the single plantwide factory overhead rate determined in (b). Round your answers to two decimal places.Night lights fill in the blank per unitDesk lamps fill in the blank per unitarrow_forward

- Tannin Products Inc. prepared the following factory overhead cost budget for the Trim Department for July of the current year, during which it expected to use 12,000 hours for production: Variable overhead cost: Indirect factory labor $31,200 Power and light 9,120 Indirect materials 20,400 Total variable overhead cost $ 60,720 Fixed overhead cost: Supervisory salaries $45,600 Depreciation of plant and equipment 12,000 Insurance and property taxes 22,400 Total fixed overhead cost 80,000 Total factory overhead cost $140,720 Tannin has available 16,000 hours of monthly productive capacity in the Trim Department under normal business conditions. During July, the Trim Department actually used 11,000 hours for production. The actual fixed costs were as budgeted. The actual variable overhead for July was as follows: Actual variable factory overhead cost: Indirect factory labor $27,890 Power and…arrow_forwardThe total factory overhead for Big Light Company is budgeted for the year at $448,060. Big Light manufactures two different products: night lights and desk lamps. Night lights are budgeted for 10,900 units. Each night light requires 3 hours of direct labor. Desk lamps are budgeted for 9,700 units. Each desk lamp requires 2 hours of direct labor. a. Determine the total number of budgeted direct labor hours for the year. direct labor hours b. Determine the single plantwide factory overhead rate using direct labor hours as the allocation base. Round your answer to two decimal places. per direct labor hour c. Determine the factory overhead allocated per unit for each product using the single plantwide factory overhead rate determined in (b). Round your answers to two decimal places. Night lights $ per unit Desk lamps $ per unitarrow_forwardThe total factory overhead for Big Light Company is budgeted for the year at $1,163,800. Big Light manufactures two different products: night lights and desk lamps. Night lights are budgeted for 17,900 units. Each night light requires 2 hours of direct labor. Desk lamps are budgeted for 21,800 units. Each desk lamp requires 3 hours of direct labor. a. Determine the total number of budgeted direct labor hours for the year. direct labor hours b. Determine the single plantwide factory overhead rate using direct labor hours as the allocation base. Round your answer to two decimal places. $ per direct labor hour c. Determine the factory overhead allocated per unit for each product using the single plantwide factory overhead rate determined in (b). Round your answers to two decimal places. Night lights $ Desk lamps $ per unit per unitarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education